Bitcoin ETFs Update: Fidelity’s FBTC Leads Inflows as Total Hits $561M

TLDR

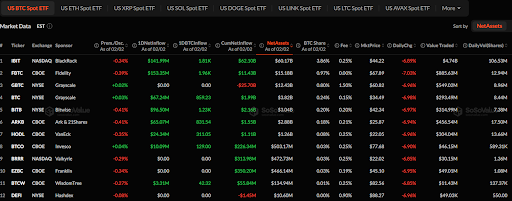

- Bitcoin ETFs recorded $561.89M in net inflows and $100.38B in total assets.

- Fidelity’s FBTC ETF led with $153M in net inflows but faced a 7.03% price drop.

- BlackRock’s IBIT remained the largest Bitcoin ETF by cumulative net inflow at $62.10B.

- Bitwise’s BITB, Ark’s ARKB, and VanEck’s HODL attracted inflows but faced price declines in the 6-7% range.

- Grayscale’s GBTC and other ETFs like BRRR, EZBC, and DEFI saw no net inflows.

As of February 2, Bitcoin ETFs recorded a total daily net inflow of $561.89 million and cumulative net inflows of $55.57 billion, with $7.68 billion traded across products. Total net assets for Bitcoin ETFs stood at $100.38 billion, representing 6.44% of the Bitcoin market cap.

Fidelity’s FBTC ETF Leads Bitcoin ETFs with $153M Net Inflow

Tracking the performance of individual Bitcoin ETFs, BlackRock’s IBIT remained the largest Bitcoin ETF by cumulative net inflow at $62.10 billion, but its price fell by 6.89% on the day. It generated $141.99 million in daily net inflows and traded $4.74 billion in value.

Source: SoSoValue (Bitcoin ETFs)

Source: SoSoValue (Bitcoin ETFs)

Fidelity’s FBTC ETF posted the largest 1‑day net inflow among Bitcoin ETFs at $153.35 million, yet its price also declined 7.03%. This Bitcoin ETF had $885.63 million in traded value and $11.43 billion in net assets, with a BTC share of 0.97%.

Grayscale BTC ETF had net assets of $3.82 billion and a 0.24% BTC share. This Bitcoin ETF recorded $67.24 million in 1‑day net inflows and traded $293.49 million in volume, but its price declined 6.98%.

BITB, ARKB, HODL, BTCO, and BTCW Attract Inflows

Bitwise’s BITB experienced a daily net inflow of $96.50 million, traded $314.99 million in value, and saw a 6.97% price drop. Its net assets totaled $3.04 billion with a 0.20% BTC share. Ark & 21Shares ARKB tallied $65.07 million in net inflows, traded $456.54 million, and fell 6.94% in price.

VanEck’s HODL ETF recorded $24.34 million in net inflows, $304.04 million in traded value, and a price decline of 6.96%. HODL’s net assets reached $1.26 billion with a BTC share of 0.08%. Invesco’s BTCO saw $10.09 million in net inflows and a 6.90% price drop while trading $46.15 million.

WisdomTree’s BTCW had $3.31 million in daily net inflows and a price drop of 6.85%, trading $11.43 million with $134.94 million in net assets.

GBTC, BRRR, EZBC, and DEFI Bitcoin ETFs Hold Stable

Grayscale’s GBTC, with $12.43 billion in net assets, recorded net outflows over time with a negative cumulative net inflow of $25.70 billion. The GBTC’s price decreased 6.96%, and it saw no reported daily net inflows or BTC inflows. Trading value reached $549.02 million, and the fund held a BTC share of 0.80%.

Valkyrie’s BRRR reported $0 in daily net inflows but held $472.73 million in net assets, trading $30.15 million. Franklin’s EZBC also showed $0 net inflows with $466.14 million in net assets and $49.01 million in traded value.

Both ETFs experienced price declines of around 6.95%. Hashdex’s DEFI Bitcoin ETF also recorded no net inflows and experienced a 6.95% price drop. Its net assets stood at $10.60 million.

The post Bitcoin ETFs Update: Fidelity’s FBTC Leads Inflows as Total Hits $561M appeared first on Blockonomi.

You May Also Like

SBI VC Trade Adds Litecoin to Japanese Lending Program

Work Dogs TGE Is Running — Is WD About to Drop in Q2 After March 30?