BIO is listed on Binance, with the public offering yield up to 58 times, and the airdrop value of some sub-DAOs exceeds its market value

Author: Weilin, PANews

At 6:00 pm on January 3rd, Beijing time, Bio Protocol's token BIO was launched on Binance, and BIO/USDT, BIO/BNB, BIO/FDUSD and BIO/TRY trading pairs were opened. After the opening, BIO briefly touched $1.477, and as of 21:15, the price was $0.89. As early as 5:00 pm on January 3rd, after BIO opened on-chain transfers, its on-chain opening price was $0.7727. It should be reminded that BIO currently only supports Ethereum mainnet operations, and will be launched on more blockchains in the coming days and weeks. There are many meme coins named "BIO" on the market that even use similar logos, all of which are scams.

Previously, the decentralized science project Bio Protocol launched three rounds of public offerings between August 9 and November 14, raising $6.2 million, $18.2 million and $3.5 million respectively, with the estimated token unit costs of the three rounds being $0.0256, $0.04277 and $0.06596. After BIO was listed on Binance this time, users who participated in the public offering, based on the first round of BIO costs and the highest price after the opening, can theoretically earn up to 58 times.

As a "Y Combinator on-chain science", Bio Protocol currently has 8 sub-DAOs, focusing on longevity research, brain health, hair loss treatment, women's health, long-term Covid treatment, rare diseases and other fields. Can DeSci, a track favored by CZ and Vitalik Buterin, continue to bring growth space and imagination to the market?

BIO is listed on Binance, and the public offering income can reach up to 58 times

Bio's popularity is inseparable from Binance's support. As early as November 8 last year, Binance Labs announced its investment in the DeSci project BIO Protocol, saying that the investment marked Binance labs' first foray into the field of decentralized science (DeSci). Less than a week after the announcement, CZ attended Binance's Desci Day event in Bangkok and discussed Desci insights with Vitalik. On December 23, Binance Launchpool announced that it would launch the 63rd project Bio Protocol (BIO).

Bio Protocol's public offering provides many users with a low-cost entry opportunity, and some auction tokens have been released directly at TGE. However, due to the high initial circulation ratio, accounting for 39.05% of the total supply, and 12.57% of the early tokens unlocked at TGE, the market previously predicted that BIO would be under certain selling pressure after the opening.

According to the monitoring of on-chain analyst Ember, the address xinanko.eth marked by Arkham as belonging to Sigil Fund CIO @Fiskantes (daddy fiskantes) transferred 6.54 million BIO (about 4.77 million US dollars) to Binance shortly after the transfer was opened. These BIOs were obtained through public offerings, with an average price of about 0.04 US dollars. The current price of BIO is 0.74 US dollars, and his income is about 18 times (4.5 million US dollars).

Back to Bio Protocol itself, the total initial supply of BIO tokens is 3,320,000,000 BIO, with a maximum supply and no upper limit. In the future, additional issuance may be decided through governance voting. The additional issuance mechanism requires the deployment of a new token contract to replace the current BIO token.

Among them, community-related allocation accounts for 56%, and the specific allocation is as follows:

In terms of token distribution, the community (56% in total):

- Community airdrop (6%): 199,200,000 BIO

- Community Auction (20%): 664,000,000 BIO

- Ecosystem Incentives (25%): 830,000,000 BIO

- Molecule Ecosystem Fund (5%): 166,000,000 BIO

Other allocations are as follows:

- Core Contributors (21.2%): 703,840,000 BIO

- Investors (13.6%): 451,520,000 BIO

- Molecule (5%): 166,000,000 BIO

- Consultants (4.2%): 139,440,000 BIO

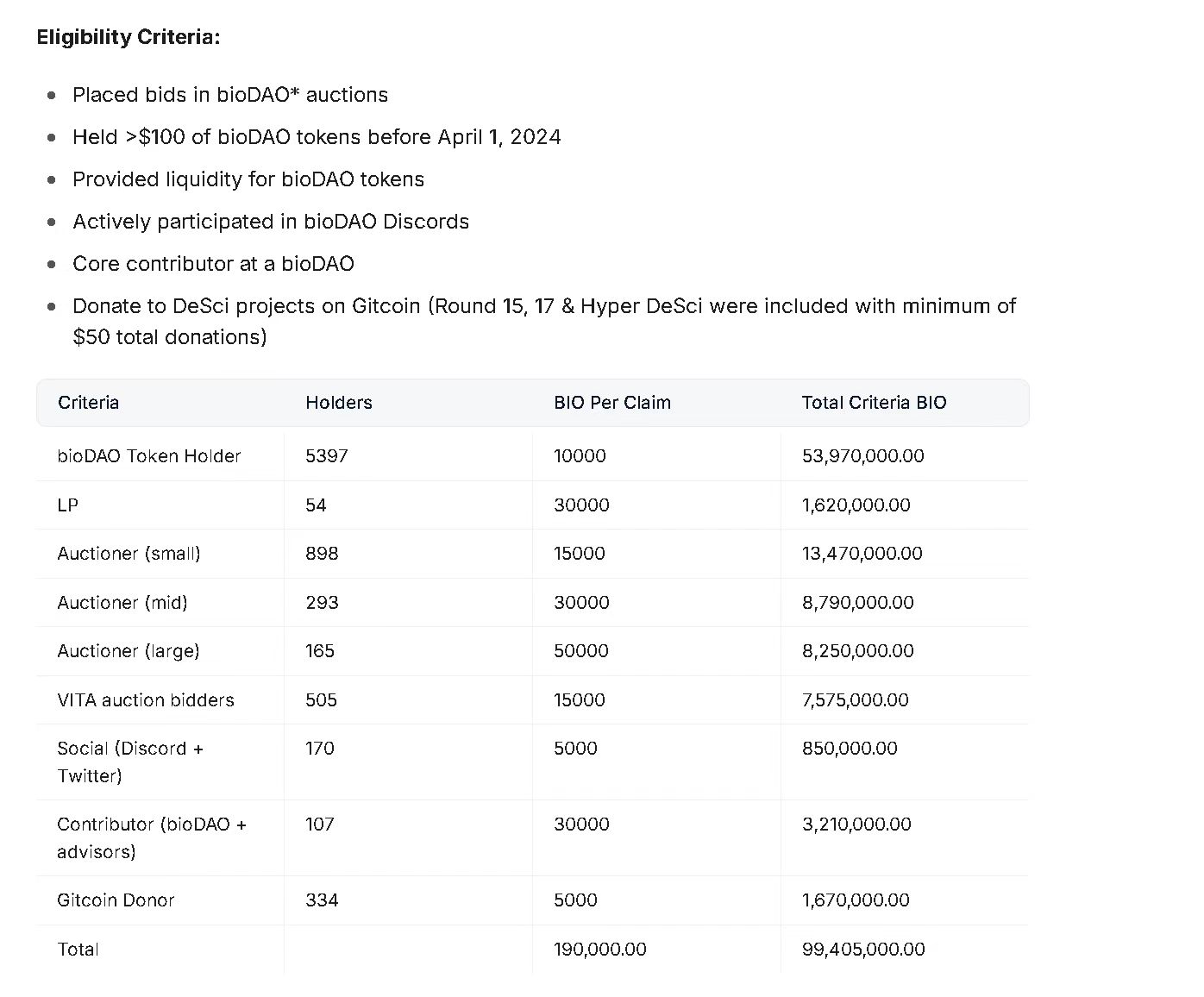

In terms of airdrops, 3% of the total supply of BIO tokens is used for airdrops, more than 8,500 addresses are eligible, and the snapshot date of the airdrop is April 1, 2024. Users can claim vBIO (locked BIO), which can be immediately redeemed for $BIO. $BIO tokens are non-transferable until unlocked by governance vote.

As the governance token of the BIO protocol, BIO is used for the following functions:

Governance and Decentralization: BIO tokens grant holders governance rights over the BIO protocol and meta-governance rights over the BioDAO within the network.

Whitelist Access: BIO tokens provide holders with whitelist access to BioDAO funding rounds and tokenized IP on the network.

Curation: BioDAOs selected by BIO holders are launched through the BIO Launchpad and receive support from the network in terms of funding and liquidity.

Connecting to BioDAO: BIO represents a basket of DeSci tokens as the BioDAO in the network contributes a percentage of its initial token supply to the protocol in exchange for funding, liquidity, and acceleration services.

Protocol Liquidity: BIO Protocol provides liquidity through BioDAO tokens and IP tokens in its treasury, earning transaction fees from the liquidity owned by its protocol

With Binance’s strong endorsement, can the DeSci narrative continue to drive growth?

As a Binance "Featured" project, BIO has received high attention from the market before its launch. The team behind BIO is a pioneer in the DeSci field. They have previously created Molecule (a tokenization platform focusing on biomedicine) and VitaDAO (the world's largest decentralized community for longevity science).

BIO is also seen as the "on-chain scientific version of Y Combinator" and currently has 8 sub-DAOs. In the white paper, BIO is called the incubator of DeSci. The most famous sub-DAO is VitaDAO, which is invested by Pfizer and specializes in longevity. There are also HairDAO for hair loss and CerebrumDAO for Alzheimer's disease.

Bio enjoys the ownership of the IP and patents produced by the sub-DAO. BIO supporters believe that its narrative ceiling is very high.

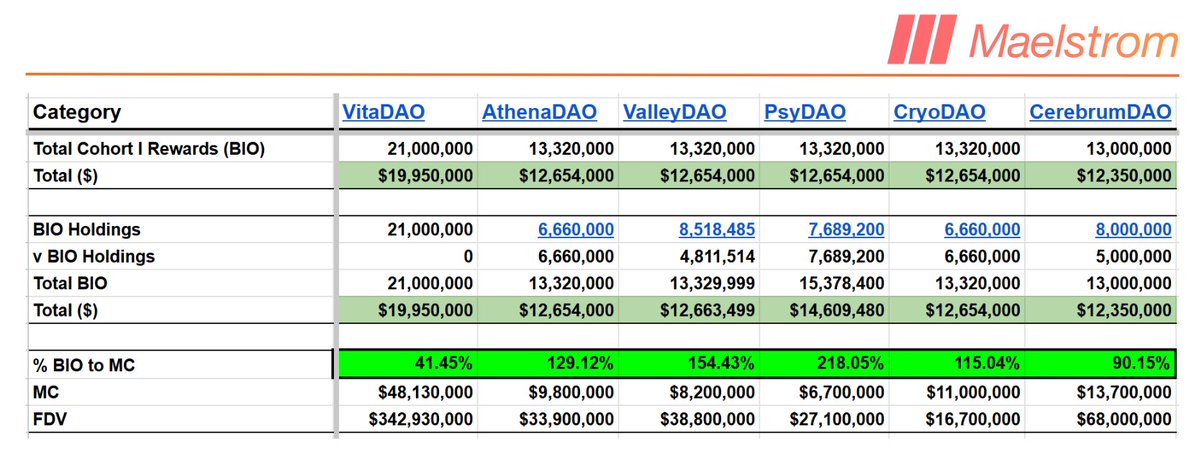

On January 3, Arthur Hayes forwarded the article "Degen DeSci", pointing out that early BioDAOs such as VitaDAO and CryoDAO will receive huge BIO rewards. For example, the 15.4 million BIO tokens obtained by PsyDAO are worth more than the market value of DAO itself (calculated at the pre-market price of BIO of $0.95).

Currently, eight BioDAO DAOs have gone through the first iteration of the BIO Accelerator Program, with a cumulative market cap of over $300 million. The most recently launched BioDAO Quantum Biology was 13 times oversubscribed, raising over $6.8 million in initial funding.

In terms of the roadmap, Bio Protocol will launch the DeSci artificial intelligence agent in January, expand $BIO on the Solana chain, $BIO on the Base chain, $BIO/BioDAOs liquidity pool, launch a long-term new coronavirus laboratory, launch a new BIODAO announcement, etc.; and carry out BIO Launchpad v1 and the management mechanism on the EVM chain in February 2025, and BIO Launchpad v1 on Solana.

In general, after listing on Binance, although BIO faces certain selling pressure and slight fluctuations in market sentiment in the short term, as a leading project in the decentralized science sector, it is still expected to achieve considerable value growth in the long run.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

While Shiba Inu and Turbo Chase Price, 63% APY Staking Puts APEMARS at the Forefront of the Best Meme Coin Presale 2026 – Stage 6 Ends in 3 Days!