Polymarket Bettors See Over 70% Chance Bitcoin Falls Below $65K — Are They Right?

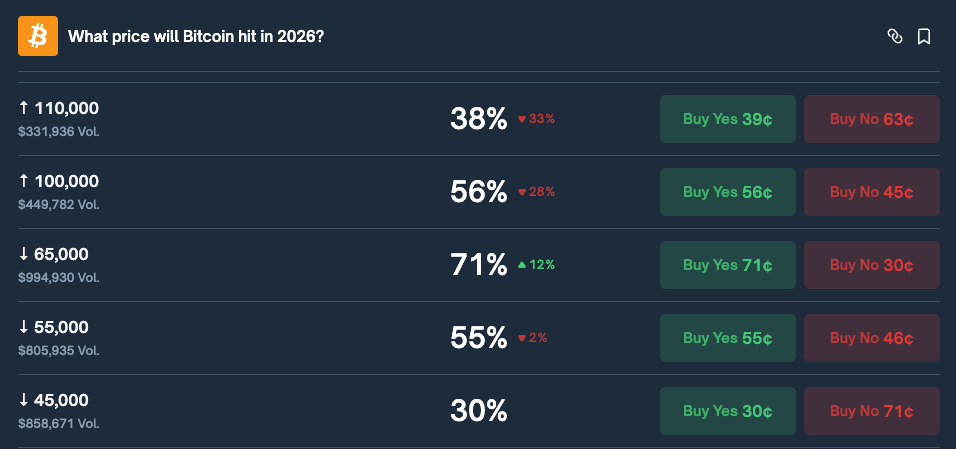

Prediction market participants on Polymarket are assigning a 71% probability that Bitcoin will drop below $65,000 in 2026, as the crypto traded around $75,000 following a weekend sell-off that pushed it to nine-month lows.

The bearish sentiment reflects a convergence of technical indicators, underwater ETF positions, and analyst warnings that the market has entered a sustained downturn rather than a temporary correction.

Multiple analysts now point to support zones between $62,000 and $65,000 as critical tests for Bitcoin’s trajectory, with some warning that a break below these levels could trigger an extended bear phase reminiscent of previous cycle downturns.

The prediction market data aligns with growing concerns from both on-chain analysts and traditional market observers who see mounting evidence of structural weakness rather than routine volatility.

Source: Polymarket

Source: Polymarket

Key Support Levels Draw Market Attention

Jurrien Timmer of Fidelity identified $65,000 as a crucial threshold in early January, noting that Bitcoin has been “following the internet S-curve a lot closer now than the power law curve.“

He warned that “$65k (previous high), and below that $45k” represent critical lines in the sand, with the power law trendline potentially converging closer to $65,000 if consolidation continues through the year.

The $62,000 level carries additional significance as Binance’s Reserve RP indicator, which tracks average acquisition costs on the exchange, now sits at that price according to a recent Cryptonews analysis.

“Bitcoin has never tested this level since Spot ETF approval,” Kesmeci said, noting the metric has risen sharply from $42,000 pre-ETF levels due to institutional participation reshaping market structure since January 2024.

CryptoQuant’s Julio Moreno projects potential lows between $56,000 and $60,000 based on Bitcoin’s realized price analysis.

“People continue to think this is a ‘bull market’ correction. It’s not,” Moreno stated, emphasizing that “we have been saying we are in a bear market since early November” when Bitcoin traded around $100,000.

He added that “bear market bottoms take months to form,” cautioning against timing entries after each decline.

ETF Investors Face Mounting Pressure

US Spot Bitcoin ETFs have turned underwater, with the average purchase price sitting at approximately $87,830 per coin while Bitcoin trades well below that level, according to Galaxy’s Alex Thorn.

The products recorded their second- and third-largest weekly outflows on record last month, with roughly $2.8 billion in net redemptions over two weeks, according to Coinglass data.

Strategy’s massive 712,647 BTC position now carries unrealized losses exceeding $900 million after Bitcoin dropped below the company’s $76,037 average cost basis, Lookonchain reported.

Strategy shares have declined about 61% over the past six months, trading near $149.71, despite the company’s continued accumulation efforts and Michael Saylor’s weekend hint of another purchase.

CryptoQuant data shows elevated volatility signals on Binance, with range z30 climbing to around +3.72, a reading that “has often preceded strong price movements, either in the form of sharp upward breakouts or rapid downward moves driven by widespread liquidation,” according to their analyst report.

Daily trading volume reached approximately 39,500 BTC, suggesting renewed speculative activity despite sideways price action.

Competing Theories on Bitcoin’s Direction

Jeff Park of Bitwise offered a contrarian perspective in his recently anaysis, suggesting that Bitcoin’s drop to $82,000 following rumors of Kevin Warsh’s Fed Chair nomination might have marked the cycle low.

“To be honest, I don’t know if $82k was indeed the bottom, and of course nobody can truly claim to know either,” Park wrote, but noted that “historically, bottoms are almost always noted by a radical shift in market regime that fundamentally resets investor behavior and expectations.“

Peter Schiff’s March 2025 prediction that Bitcoin could reach $65,000 if the NASDAQ enters a bear market now looks prescient.

“If this correction turns out to be a bear market, and the correlation where a 12% decline in the NASDAQ equates to a 24% decline in Bitcoin holds, when the NASDAQ is down 20%, Bitcoin will be about $65K,” Schiff warned at that time.

Whether Polymarket’s 71% probability proves accurate may depend on Bitcoin’s ability to hold the $75,000-$77,000 zone where the most recent liquidations cleared.

In fact, CoinSwitch Markets Desk told Cryptonews that if support holds, “selling pressure may ease and price could range or recover gradually, with $80K as the first resistance.“

You May Also Like

Eric Trump bets Fed rate cut will send crypto stocks skyrocketing

Vlna BitcoinFi boomu sa začína s HYPER