BitMine Battles $6B Unrealized Ether Loss as Crypto Sell-Off Deepens

BitMine Immersion Technologies, a publicly traded crypto treasury vehicle tied to investor Tom Lee, has faced a sharp mark-to-market unwind on its Ether holdings as recent liquidations ripple through crypto markets. The company boosted its Ether position by 40,302 tokens last week, lifting total holdings to more than 4.24 million ETH. Data from Dropstab indicate that unrealized losses now exceed $6 billion, illustrating how balance-sheet strategies can rapidly deteriorate when markets tilt lower and liquidity thins.

Valued at roughly $9.6 billion at current prices, BitMine’s Ether stack sits well below its October peak of about $13.9 billion, a reminder that the broader sector’s downturn has carved a sizable dent into treasury portfolios that once rode a wave of rising prices. The latest move comes as Ether itself has traded in a high-variance range, with valuations reflecting liquidity stress and the spillover effects of aggressive deleveraging across digital assets.

Source: DropstabThe slide in Ether’s price toward the mid-$2,000s has intensified concerns about liquidity conditions in crypto markets. Observers point to a market where liquidity has been choppy at best, and where compressed liquidity amplifies the impact of large, leveraged positions. The Kobeissi Letter summarized the dynamic, noting that “air pockets” in price emerge when risk-taking is propped up by heavy leverage and crowd-like behavior among investors, exacerbating sell-offs in downtrending environments.

Related coverage has highlighted BitMine’s broader staking footprint as a source of recurring revenue, underscoring the tension between ongoing income streams and the risk of capital drawdowns during downturns. BitMine’s staking arrangements—through which Ether can generate annual revenue—illustrate how treasury strategies seek to balance yield with drawdown risk in volatile markets. The broader market narrative remains focused on whether staking economics can cushion losses in bear phases or merely provide a partial offset to mark-to-market declines.

A difficult reset for crypto markets

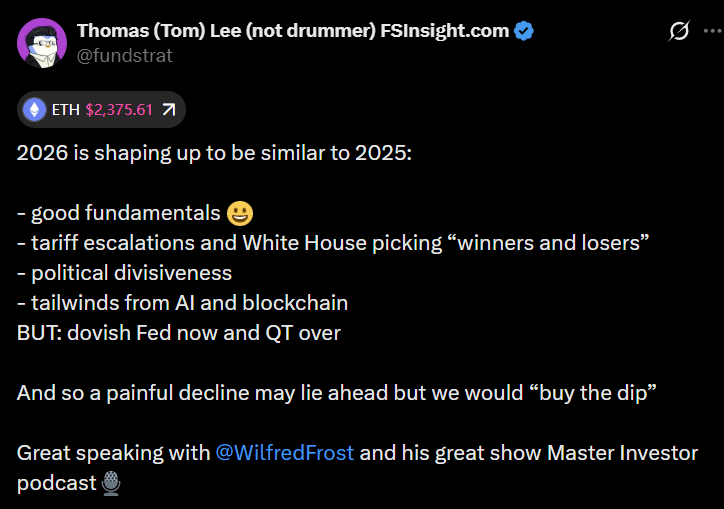

In late 2025 and into 2026, Tom Lee, founder of Fundstrat, has cautioned that conditions have shifted and that the year could begin on a painful note before any potential rebound. In recent remarks, Lee emphasized that the crypto market continues to bear the weight of deleveraging, even as some longer-term fundamentals remain intact. He pointed to the October crash as a pivotal moment that reset risk appetite across digital assets, a reference to market events that seasoned observers view as a turning point in the liquidity cycle.

Source: Tom Lee

Source: Tom Lee

A recent assessment by market maker Wintermute reinforced the view that a sustained recovery in 2026 will hinge on a handful of structural improvements: renewed momentum in Bitcoin (Bitcoin (CRYPTO: BTC)) and Ether, stronger ETF participation, expanded digital asset treasury mandates, and a revival of retail inflows. Wintermute argued these catalysts are required to restore a broader “wealth effect” across markets, noting that retail participation remains tepid as investors chase faster-growth themes such as artificial intelligence and quantum computing.

Evidence from market watchers suggests that the liquidity environment will continue to shape price action well into the year. The narrative around liquidity, leverage, and crowd dynamics has intensified as crypto assets oscillate between bouts of risk-on optimism and risk-off selling, with the implication that any meaningful revival will likely be gradual rather than immediate. The market’s experience in 2025—where liquidations reshaped the asset hierarchy and shook confidence in traditional treasury strategies—serves as a reference point for how fragile balance sheets can become when volatility spikes and liquidity tightens.

For readers tracking the broader context, additional coverage has underscored the vulnerability of digital assets to liquidity shocks, including articles that highlighted how liquidations can temporarily push Bitcoin out of the world’s top assets and how stakeholders evaluate the market impact of large-scale deleveraging. These threads help explain why BitMine’s latest moves have amplified scrutiny of crypto treasury approaches at a time when risk appetite remains subdued and institutional testing of balance sheets continues.

Why it matters

The episode around BitMine’s Ether exposure is more than a single fund’s balance-sheet setback. It spotlights how publicly traded treasury strategies, even when backed by notable investors and governance structures, can be exposed to outsized drawdowns in volatile markets. For asset managers and corporate treasuries exploring crypto holdings as a yield or diversification vehicle, the affair underscores three practical considerations: the fragility of concentrated long-only exposures during liquidity shocks, the importance of risk controls around leverage and liquidations, and the potential value—and limits—of staking revenue as a cushion during drawdowns.

From a market-wide perspective, the episode feeds into a broader question about how liquidity, ETF flows, and retail participation will shape crypto momentum in 2026. If the sector is to gain a sustained wealth effect, observers say it will require a combination of improved market liquidity, renewed retail interest, and broader adoption of treasury mandates that balance yield opportunities with prudent risk management. The path forward is unlikely to be linear, but the consensus suggests that any meaningful recovery will hinge on a combination of macro resilience, structural improvements in on-chain ecosystems, and a reaccumulation phase among investors who have been sidelined by volatility.

For builders and policymakers, the case reinforces the need for transparent risk disclosures around treasury allocations, clearer guidelines for staking-based revenue models, and robust risk management frameworks that can withstand sudden shifts in liquidity. As the market recalibrates, the ability of protocols and custodians to manage leverage, liquidity, and collateral positions will be as important as the price trajectories of the assets themselves.

What to watch next

- BitMine’s next quarterly filing and any adjustments to Ether holdings or unrealized losses.

- Ether price stability and liquidity conditions in major markets, particularly during any macro-driven risk-off episodes.

- Follower liquidity trends in crypto markets, including potential ETF flow changes and renewed retail involvement.

- Any updates to BitMine’s staking revenue expectations and related on-chain yields.

- Broader market commentary on deleveraging dynamics and the pace of recovery for BTC and ETH.

Sources & verification

- Dropstab portfolio data on BitMine’s ETH holdings and unrealized losses (bitmine-eth-strategy-portfolio lipdgyz9ho).

- The Kobeissi Letter discussion of liquidity fragility and price air pockets linked to leverage in crypto markets.

- BitMine staking revenue reference article: Bitmine’s staked Ether holdings point to $164M in annual staking revenue.

- Fundstrat notes on 2026 dynamics and Tom Lee’s commentary (Fundstrat on tough start to 2026).

- Wintermute assessment on the conditions required for a 2026 recovery (Wintermute: crypto 2026 comeback hinges three outcomes).

This article was originally published as BitMine Battles $6B Unrealized Ether Loss as Crypto Sell-Off Deepens on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

XRPR and DOJE ETFs debut on American Cboe exchange

Over 60% of crypto press releases linked to high-risk or scam projects: Report