Vitalik Buterin Withdraws 16,384 ETH as Ethereum Foundation Enters ‘Austerity Phase’ — What For?

Ethereum co-founder Vitalik Buterin has withdrawn 16,384 ETH, worth roughly $44.5 million at current prices, as the Ethereum Foundation enters what he described as a period of “mild austerity.”

In a post published on X, Buterin said the Ethereum Foundation is adjusting its spending approach to meet two parallel goals.

The objective involves providing a bold technical roadmap that maintains the scalability, decentralization, and resiliency of Ethereum and also enables the foundation to be self-sustaining in the long term and safeguard the core ethos of Ethereum.

He emphasized that the change is not the symptom of the financial hardships but a purposeful reaction to the market environment and needs to be more focused.

Buterin Links ETH Withdrawals to Open-Source Funding and Fiscal Discipline

Under that change, Buterin said he is taking up the role of working on it himself, where it could have been done as individual foundation projects.

He described the ETH withdrawal as being over a period of years to assist in open-source, secure, and verifiable software and hardware in financial, communication, governance, operating systems, secure hardware, and privacy-preserving technologies.

He also indicated that he was also considering decentralized staking alternatives, which may enable future staking incentives to be redirected to the identical objectives.

The pullback coincides with a broader decline in crypto markets, with Ether trading at around $2,720, significantly lower than its October high of about $4,831.

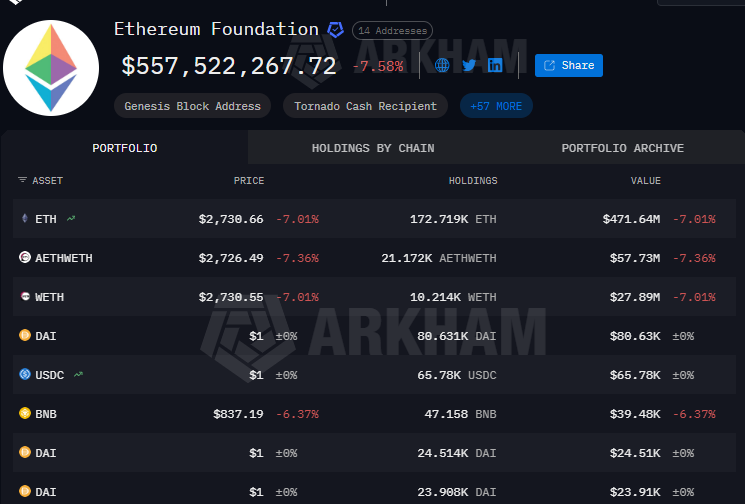

According to blockchain analytics company Arkham Intelligence, Ethereum Foundation has a crypto portfolio worth approximately $554.5 million, and about 172,719 ETH constitute the majority of the treasury at present.

Source: Arkham

Source: Arkham

Other investments are ETH that is held in Aave, wrapped ETH, and smaller investments in stablecoins like DAI and USDC.

Buterin himself is estimated to own crypto assets worth approximately $666 million.

The foundation has described its current phase as one of fiscal discipline rather than retrenchment.

Officials and researchers familiar with its finances have said the “austerity” framing refers to more conservative spending and longer planning horizons during a market downturn, not a shortage of funds.

Included in its foundation activities are core protocol development, research, and grants, with the foundation reevaluating discretionary spending.

Vitalik Buterin Sets Vision for a Leaner Ethereum in 2026

The remarks made by Butterin can be classified into a wider range of new statements explaining his vision of the future of Ethereum.

In early January, he cautioned that Ethereum would become too complicated unless developers take the active step of simplifying the protocol by removing features.

In a separate January post, Vitalik Buterin said 2026 would mark a push to restore self-sovereignty, citing easier full-node operation via zero-knowledge tools, stronger privacy, and reduced dependence on centralized infrastructure.

Those proposals emphasized Ethereum as “people-first” infrastructure, prioritizing users who rely on it for financial autonomy and secure communication over convenience-driven mainstream adoption.

The timing also coincides with signs of renewed activity on the Ethereum network.

Following the Fusaka upgrade in December, average transaction fees fell sharply, and mainnet activity has increased.

Data from Token Terminal and Etherscan show daily active addresses nearing one million in mid-January, briefly surpassing activity across major layer-2 networks.

Weekly decentralized exchange volumes on Ethereum have risen to about $13 billion, up from just over $8 billion a month earlier, while the broader Ethereum ecosystem reached nearly $27 billion in weekly DEX volume.

Despite the foundation’s tighter spending posture, Ethereum remains the largest platform for decentralized applications and smart contracts, securing tens of billions of dollars in value across DeFi and other use cases.

You May Also Like

Why It Could Outperform Pepe Coin And Tron With Over $7m Already Raised

![[Time Trowel] Zamboanga City and ‘Chief of War’](https://www.rappler.com/tachyon/2026/01/zamboanga-chief-of-war-time-trowel-01312026.jpg)

[Time Trowel] Zamboanga City and ‘Chief of War’