XRP Price: Token Falls 7% as $70 Million in Longs Get Liquidated

TLDR

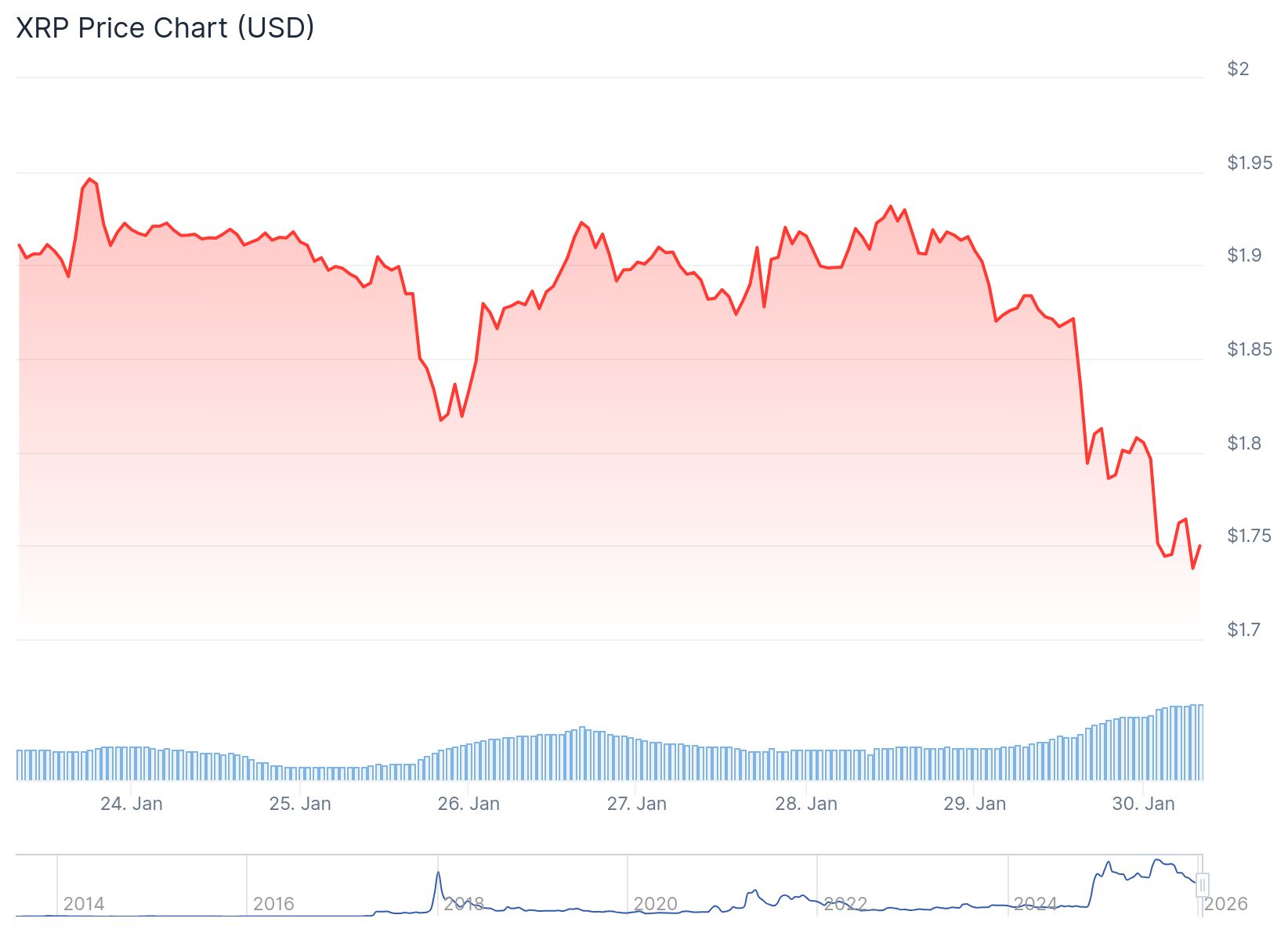

- XRP dropped approximately 6.7% to 7% in a broader crypto selloff, trading near $1.75 after falling from around $1.88

- Over $70 million in XRP futures were liquidated, with the vast majority coming from long positions

- The token broke below key support at $1.79, which has now flipped to resistance in the $1.79-$1.82 range

- Price action was driven by forced liquidations rather than XRP-specific news, following bitcoin-led market weakness

- Traders are watching $1.74-$1.75 as critical near-term support, with a break potentially opening downside to $1.70

XRP experienced a sharp decline on January 30, 2026, falling approximately 6.7% to 7% as part of a broader cryptocurrency market selloff. The token traded near $1.75 after dropping from around $1.88.

XRP Price

XRP Price

The price action triggered over $70 million in XRP futures liquidations. These liquidations overwhelmingly came from long positions, showing how crowded the bullish side of the trade had become.

The selloff was not driven by XRP-specific news. Instead, bitcoin-led weakness pressured the broader crypto market, with XRP following suit as leveraged positions unwound.

Source: Coinglass

Source: Coinglass

XRP broke below a key support level at $1.79 during the decline. The breakdown occurred on high volume, indicating institutional participation rather than just retail selling in thin markets.

After breaking support, the price reached a session low near $1.74. Some buyers stepped in at this level, leading to a brief stabilization.

Technical Breakdown Shifts Market Structure

The token fell as low as $1.710 at one point before recovering slightly. Price consolidated in a narrow range between $1.74 and $1.76 late in the session.

The former support zone between $1.79 and $1.82 has now flipped to resistance. This means XRP would need to reclaim these levels with strong volume to shift the market structure back toward neutral.

Volume surged during the breakdown but faded during the subsequent bounce. This pattern suggests stabilization rather than a true reversal in trend.

Support Levels Under Watch

Traders are now focused on the $1.74-$1.75 range as the immediate support zone. If this level holds, XRP may continue consolidating as liquidation pressure eases.

However, if $1.74 breaks, the next downside targets sit at $1.72 and $1.70. A break below these levels could trigger additional momentum to the downside as remaining support gives way.

For any meaningful recovery, bulls need to push price back above $1.79. A close above $1.80 could open the path toward $1.8250, with further resistance at $1.850.

XRP is currently trading below its 100-hourly simple moving average. A bearish trend line is forming with resistance at $1.8050 on the hourly chart.

The token remains highly correlated to bitcoin and sensitive to liquidations. Technical levels are dictating price direction rather than fundamental news.

The post XRP Price: Token Falls 7% as $70 Million in Longs Get Liquidated appeared first on CoinCentral.

You May Also Like

XRP Enters ‘Washout Zone,’ Then Targets $30, Crypto Analyst Says

Republicans are 'very concerned about Texas' turning blue: GOP senator