Short-Term Bounce in Shiba Inu Crypto (SHIBUSDT) Inside a Daily Bearish Regime

Market structure shows a clear tension: despite a broader risk-on backdrop, Shiba inu crypto (SHIBUSDT) is attempting a countertrend bounce within a still-bearish daily framework.

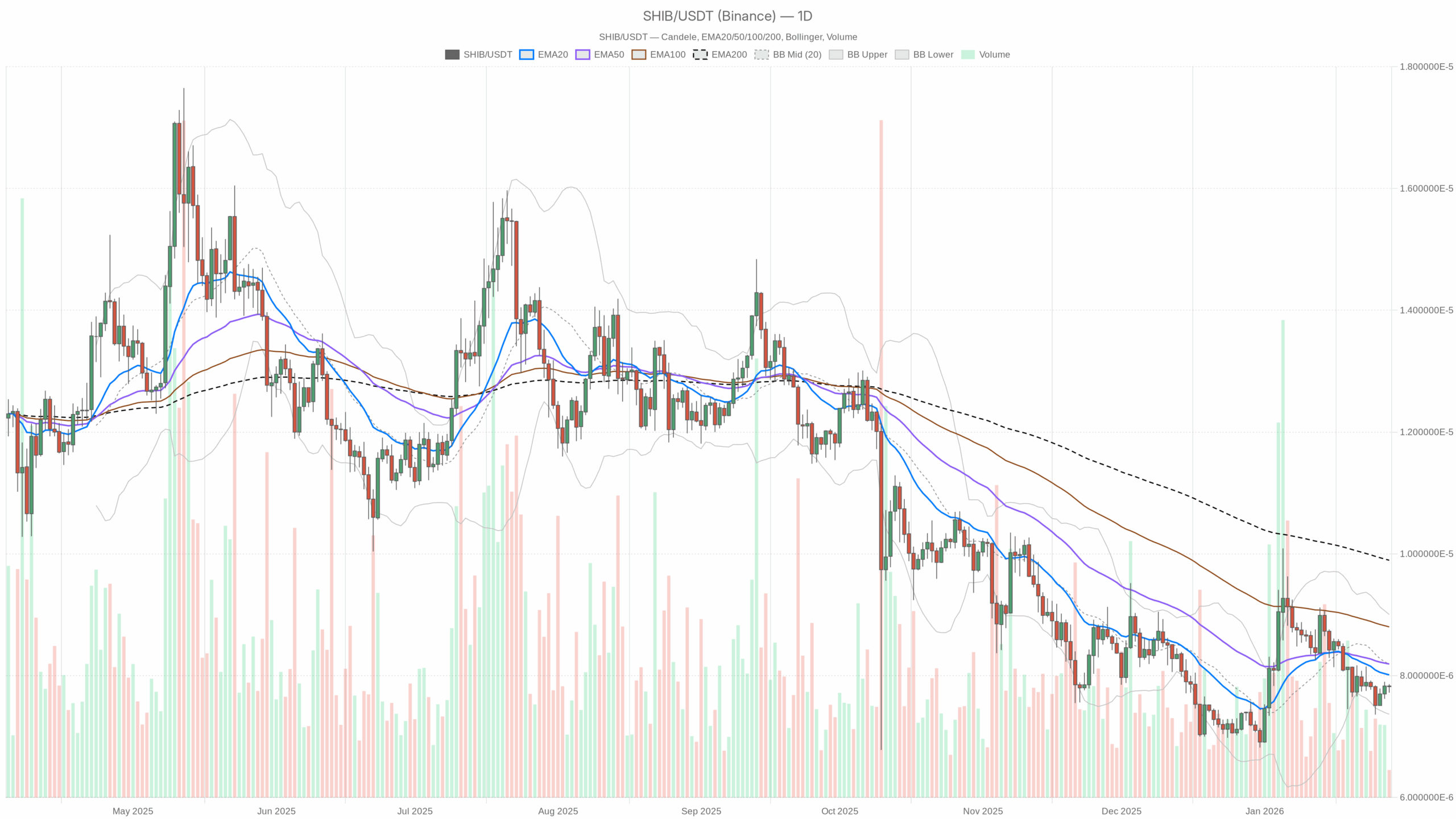

SHIB/USDT — daily chart with candlesticks, EMA20/EMA50 and volume.

SHIB/USDT — daily chart with candlesticks, EMA20/EMA50 and volume.

Main Scenario from the Daily Chart: Bearish Bias, But Not Washed Out

The daily timeframe (D1) is our anchor, and the regime flag there is bearish. That sets the base case: any upside for SHIBUSDT is, for now, a countertrend move until proven otherwise.

Daily RSI (14)

The daily RSI sits at 45.48, just below the 50 line.

That is classic late-downtrend / early-consolidation territory: sellers are still in control structurally, but momentum is not aggressive. It tells you SHIB is closer to sideways-to-soft than to capitulation or a real trend reversal yet.

Daily MACD

The MACD values in the dataset are effectively flat (0 for line, signal, and histogram), which in practice means we do not have a clean MACD signal to lean on for the daily chart this run.

When MACD is inconclusive while the regime model is bearish, it usually means the trend lower has either slowed considerably or the pair is in a choppy range where trend tools lose edge. You trade the structure and levels, not the oscillator, in this kind of tape.

Daily EMAs (20 / 50 / 200)

The numerical EMA levels are not provided, but the system has classified the daily regime as bearish while RSI is sub-50.

For that combination to show up, SHIBUSDT almost certainly trades below at least the 20-day EMA, and very likely below the 50-day as well. The 200-day EMA is, by definition, the big structural line in the sand, and until price reclaims it and holds, any rally is technically a bounce within a broader downtrend. In practice, those EMAs will act as dynamic resistance on the way up.

Daily Bollinger Bands

Bollinger values are not populated in the dataset, but we can still read them conceptually alongside RSI near 45.

Given the non-extreme RSI and the lack of a clear trend momentum signal, SHIB is likely trading somewhere between the mid-band and lower band, not hugging extremes. That fits a controlled bearish-to-neutral phase, where volatility compresses before a larger move. In this phase you often get sharp fakeouts around the mid-band as traders try to front-run breakouts.

Daily ATR (14)

ATR is reported as zero, which simply tells us the volatility data for this extraction is not usable.

From a tactical point of view, you cannot size or place stops based on this ATR reading; you have to respect SHIB’s historical tendency to overshoot and assume realized volatility can expand quickly, especially when sentiment is fearful.

Daily Pivot Levels

Pivot point (PP), R1 and S1 are all reported as zero in this feed.

That means we do not have reliable numerical intraday pivot levels from this run, so horizontal levels from recent swing highs and lows and EMAs matter more than this pivot snapshot for real trading decisions.

Macro Context and Intraday Timeframes: Bulls Fighting Back Against the Daily Trend

This moment matters because broader crypto is in risk-on mode: total market cap is above $3.1T with a near 2% daily increase, yet sentiment is stuck in Fear (index 29). That mix usually benefits high-beta names like SHIB on short squeezes and sharp rallies, but the same volatility cuts both ways if the bounce runs into heavy overhead supply.

1H Chart: Neutral Regime with Bullish Lean

The 1-hour timeframe carries a neutral regime label, but the 1H RSI is at 57.57.

That combination usually appears when an asset is trying to transition from a local bottom into a short-term uptrend, but has not broken enough levels yet to flip the structural bias. Think of it as a rally in progress that is still on probation: buyers have short-term control, but they are pushing into an old downtrend.

With EMAs not numerically specified, the most likely configuration here is price reclaiming the 20-EMA on 1H and wrestling with the 50-EMA. Until price spends sustained time above both, the hourly trend upgrade remains incomplete.

15m Chart: Bullish Regime, Execution-Only Context

The 15-minute regime is flagged as bullish, with RSI at 63.23.

That is short-term momentum clearly in favor of the upside. On a pure execution level, this usually corresponds to buying dips against fast-moving short EMAs on this timeframe. However, you cannot forget the backdrop: this is a bullish micro-trend inside a neutral 1H and a bearish daily. Scalps can work; swing longs are still fighting the higher timeframe.

How the Timeframes Fit Together

Daily is bearish, 1H is neutral with a bullish tilt, and 15m is outright bullish. When you stack them, the story is straightforward: SHIBUSDT is attempting a relief rally inside a broader downtrend. Rotation into meme coins typically accelerates when speculative appetite climbs, and the overall crypto cap rising with a Fear index at 29 is fertile ground for sharp but fragile bounces.

The key tension is this: lower timeframes are strong enough to justify tactical long exposure, but not strong enough yet to flip the macro story. Unless daily structure improves, particularly reclaiming and holding key EMAs, rallies are vulnerable to fast givebacks.

Bullish Scenario for Shiba Inu Crypto

Core idea: Bulls turn the current intraday bounce into a proper trend reversal by dragging the daily regime from bearish to at least neutral.

For that to happen, you would look for:

- Daily RSI to push decisively above 50 and start building towards 55–60. That would mark a shift from controlled bearish to emerging bullish momentum.

- Price to reclaim and hold above the 20-day EMA first, then the 50-day. On a live chart this usually shows as a series of higher lows on the daily, with intraday pullbacks finding support near those EMAs instead of rejecting there.

- On the 1H, the regime needs to flip from neutral to bullish, with pullbacks holding the 20- and 50-EMA and RSI respecting 40–45 on dips rather than collapsing into oversold zones.

In that case, the current 15m bullish regime becomes more than just noise; it becomes the ignition phase of a trend leg where SHIB can start challenging prior daily swing highs and, in strong tape, squeeze through them as shorts unwind.

What invalidates the bullish case?

If daily RSI gets rejected around the 50 level and rolls back towards 40 while intraday RSI readings (1H and 15m) start printing lower highs, the attempted breakout turns into just another rally inside a downtrend. A failure to hold reclaimed EMAs on the daily, especially a fast rejection at the 50-day, would tell you the market is not ready to absorb supply yet.

Bearish Scenario for Shiba Inu Crypto

Core idea: The current bounce is a typical countertrend move in a fearful macro environment, and sellers use higher prices to reload.

In this scenario, the daily regime stays bearish and the intraday strength burns out without shifting structure. Here is how it would usually develop:

- On the 15m first, RSI fails to make new highs and starts diverging negatively against price. Short EMAs flatten and then roll over, flipping that timeframe back to neutral or bearish.

- On the 1H, RSI rolls back from the high 50s towards the low 40s, and price loses the 20-EMA as support. Intraday higher lows break; the structure reverts to a sequence of lower highs and lower lows.

- Daily RSI drifts down from around 45 towards 40 or below, confirming that sellers retook control before any structural breakout could occur.

Given the macro Fear reading, a bearish outcome does not need a panic; it can simply be a grind lower with occasional sharp wicks as retail tries to buy perceived dips. For SHIB, that typically means spiky, illiquid drops that can trap late buyers quickly.

What invalidates the bearish case?

If, on pullbacks, the 1H regime stays neutral-to-bullish and RSI refuses to fall below 50 for long, while the daily regime tag migrates from bearish to neutral, the idea of a dead cat bounce loses credibility. Bears get invalidated if SHIB can correct in time and range without violating new higher lows on the daily chart.

Positioning, Risk, and Uncertainty

SHIBUSDT right now is not a clean trend play; it is a transition tape. The daily chart still argues for caution, the 1H allows for tactical longs, and the 15m is dominated by short-term momentum traders. That kind of set-up rewards patience and clear invalidation levels more than blind conviction in either direction.

For directional bulls, the healthier opportunities tend to appear after the daily regime has already shifted, even if that means missing the bottom. For bears, pressing shorts aggressively into a rising crypto total market cap with improving intraday momentum is equally risky; the better entries usually come after failed breakouts and clear intraday trend breaks, not in the middle of a squeeze.

Volatility in meme tokens can expand violently, especially with a fearful sentiment backdrop and a large, speculative retail base. Position sizing, leverage, and the willingness to respect technical invalidation matter more here than being right on the story. The tape is telling you one thing above all: SHIB is trying to bounce in a downtrend, and until one of those two gives way, uncertainty stays high.

If you want to monitor markets with professional charting tools and real-time data, you can open an account on Investing using our partner link:

Open your Investing.com account

This section contains a sponsored affiliate link. We may earn a commission at no additional cost to you.

Disclaimer: This analysis is for informational and educational purposes only and is not investment, trading, or financial advice. Markets are volatile and unpredictable; always do your own research and consider your financial situation and risk tolerance before making any trading decisions.

In summary, Shiba Inu Crypto is attempting a relief bounce against a dominant daily downtrend, with intraday flows supportive but not yet strong enough to resolve the broader bearish structure.

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

United States Building Permits Change dipped from previous -2.8% to -3.7% in August