BlackRock’s Partner Securitize Welcomes Former Nasdaq as Head of Issuer Growth

Securitize has appointed Giang Bui as Vice President, Head of Issuer Growth, the company announced on Jan. 27. Bui joins from Nasdaq, where she led US Equities and ETP partnerships and played a key role in the exchange’s spot Bitcoin BTC $88 768 24h volatility: 1.2% Market cap: $1.77 T Vol. 24h: $41.99 B ETF initiatives.

A thread posted on X earlier this morning mentions “a decade” spent “at the center of market structure, working with issuers, regulators, and liquidity providers to scale modern ETFs.” Giang still serves as a board member for the Security Traders Association (STA) and the ETF.com Editorial Advisory Board.

Now, her mission with Securitize will be to “focus on regulated tokenization that delivers real ownership rights, including dividends, voting, disclosures, and resilient market infrastructure,” the company wrote.

Prior to joining Nasdaq, she was a Director of Listings at Cboe Global Markets, where she was focused on ETF business development, liquidity programs, and strategic initiatives, according to Giang’s profile on Nasdaq. Before her role at Cboe, Giang played “a crucial role in developing and marketing new indexes at the New York Stock Exchange (NYSE),” the bio continues. She began her career as a business analyst for NYSE’s global index and exchange-traded products group.

Securitize: BlackRock’s Tokenization Arm

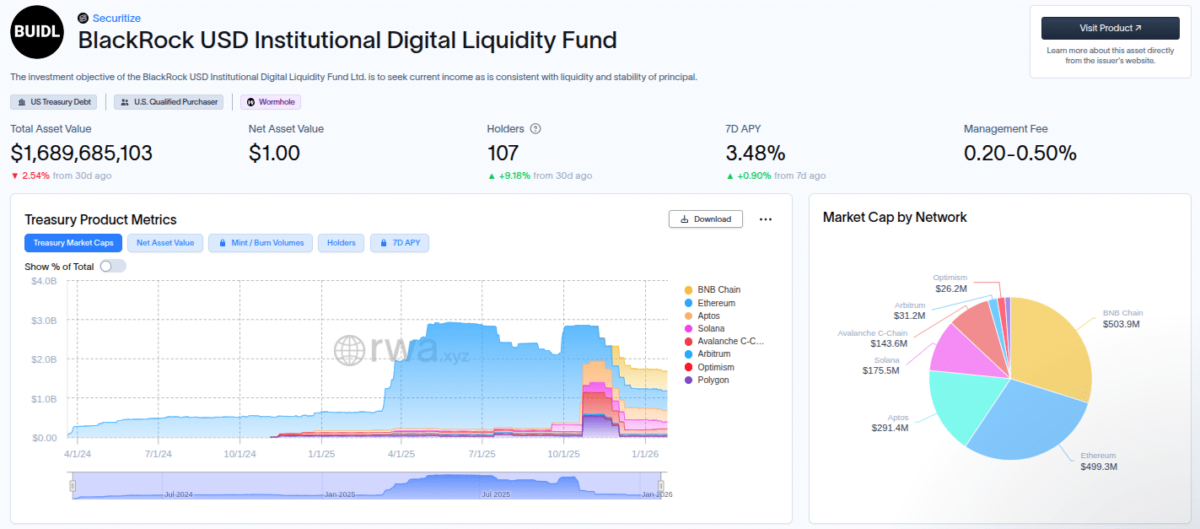

Securitize has been one of the leading industry names for connecting the blockchain-based, tokenization world with traditional finance (TradFi). The firm has become BlackRock‘s onchain arm, launching the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) in March 2024. In 2025, the fund, which had reached $2.5 billion at that time, continued expanding to other chains, as Coinspeaker reported.

By the time of this writing, data from rwa.xyz shows BUIDL with $1.69 billion, with a presence in seven blockchains.

BlackRock USD Institutional Digital Liquidity Fund (BUIDL) data as of Jan. 27, 2026 | Source: rwa.xyz

Interestingly, Nasdaq has also been looking into tokenization, starting while Giang was still on the staff. The intersection between TradFi and crypto continues to grow as relevant TradFi contributors join key tokenization players—like a former Nasdaq becoming Securitize Vice President, Head of Issuer Growth.

nextThe post BlackRock’s Partner Securitize Welcomes Former Nasdaq as Head of Issuer Growth appeared first on Coinspeaker.

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

SEI Technical Analysis Feb 6