Tenbin Raises $7M Led by Galaxy Digital for Tokenized Gold, Currency Products

Galaxy Ventures, a division of Galaxy Digital, led a $7 million seed funding round for Tenbin Labs, a startup building blockchain infrastructure for tokenized gold and foreign exchange markets, with a different approach from the traditional wrapped tokens.

The funding round attracted participation from major crypto market makers, including Wintermute Ventures, GSR, and FalconX, as well as venture firms Nascent, Variant, and Bankless Ventures, according to their announcement. Tenbin differentiates itself by connecting on-chain assets directly to CME futures markets rather than using traditional custodial wrapping methods.

The company plans to launch its yield-bearing tokenized gold product in early 2026 through partnerships with Hidden Road and Ripple Prime, followed by expansion into emerging-market currencies, including the Brazilian Real and Mexican Peso.

Why Gold Appeals to Crypto Investors

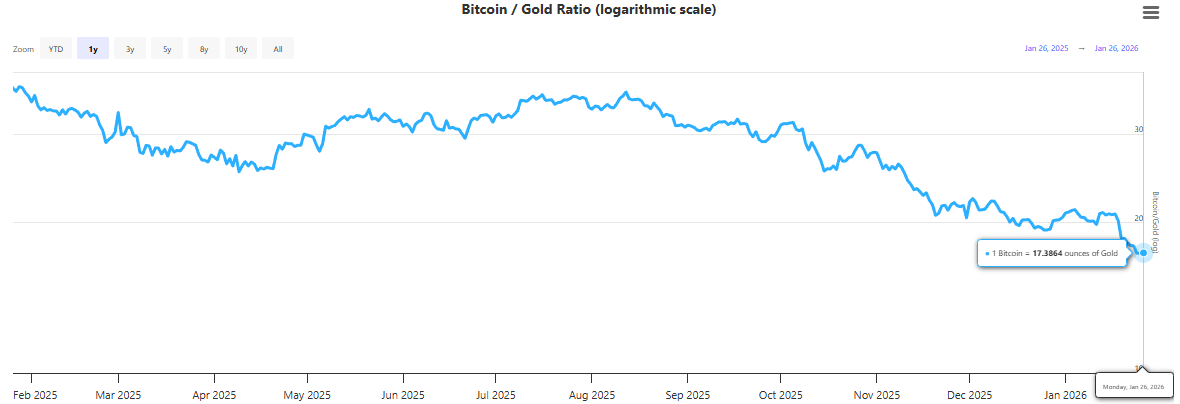

Bitcoin’s 52-week correlation with gold dropped to zero in January 2026 for the first time since 2022, breaking the pattern where both assets historically moved together during market uncertainty. We can see how Bitcoin has devalued against gold: 1 year ago, 1 BTC could buy about 37.11 ounces of gold, and now it’s only worth about 17.39 ounces.

Graph of Bitcoin / Gold ratio in 1 year | Source: LongTermTrends.com

Gold is reasserting itself as the primary safe-haven asset with prices projected to reach $4,000-$5,000 per troy ounce in 2026, driven by Federal Reserve rate cuts and geopolitical tensions. For crypto traders seeking stability without exiting crypto ecosystems, tokenized gold offers exposure to these gains while maintaining on-chain speed and composability. Even companies like Binance already allow trading gold on their platform.

The investment comes as tokenized real-world assets, excluding stablecoins, surpassed $33 billion in market value in 2025. Tenbin’s launch will test whether futures-backed tokenization can address the liquidity and utility gaps that have limited the adoption of existing tokenized commodities.

nextThe post Tenbin Raises $7M Led by Galaxy Digital for Tokenized Gold, Currency Products appeared first on Coinspeaker.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

XRPR and DOJE ETFs debut on American Cboe exchange