TikTok is about to be banned in the United States. How much will Sonic SVM's "bringing TikTok traffic to Web3" be affected?

Author: Zen, PANews

In the Web3 world, traffic entry often determines the success or failure of a project. As a Layer-2 expansion solution on Solana, Sonic SVM has set its sights on the short video platform TikTok and successfully attracted more than two million players by launching the point-to-earn game SonicX.

In the past "Web3 Game TGE" week, Sonic SVM (SONIC) performed brilliantly, without any suspicion of fraud or continuous decline. After the SONIC token was launched on January 7, it became the 9th most valuable L2 token with a FDV of $1.94 billion the next day, and it is also the only Solana-based L2 token in the top 10. As of January 16, the price of SONIC was about $0.72. The price has been relatively stable since its launch, and it does not seem to be affected by TikTok's upcoming ban in the United States.

Solana L2 for Massive Adoption of Blockchain Games

Sonic SVM was created by Mirror World Labs, and its founding team includes CEO Chris Zhu, Chief Product Officer Alan Zhu, and Chief Technology Officer Jonathan Bakebwa. According to public information, Sonic SVM has completed a total of US$16 million in seed and A rounds of financing, with investors including BITKRAFT, Galaxy Interactive, Big Brain Holdings, Sky9 Capital, OKX Ventures, etc.

As a Layer-2 (L2) scaling solution based on Solana, Sonic SVM (SONIC) aims to improve the efficiency and interoperability of blockchain gaming platforms by providing dedicated block space and improved developer and player tools.

Sonic SVM believes that with the continuous emergence of dAPPs, Solana, which has obvious performance advantages, will also face severe challenges. Especially when there are a large number of small games or a single large game, the on-chain interactions of thousands or even millions of users will have a serious impact on the performance of the Solana L1 main chain, especially during special operational activities such as server launches, holiday events, and limited-time promotions. The instantaneous impact is worrying. This will not only affect the performance of the entire Solana L1 chain, but also the playability and user experience of each game, including the game's response speed and data availability.

In March 2024, Sonic SVM officially entered the public eye and seamlessly integrated with Solana using the innovative HyperGrid extension mechanism to provide high-performance gaming experience and efficient transaction aggregation. Its core features include atomic interoperability, the HyperGrid framework for deploying optimistic aggregation on Solana, and the Rush ECS framework for simplifying on-chain games and autonomous world construction. Sonic provides commercial tools for payment, settlement, and user acquisition for games and applications.

First application: TikTok point-earning game SonicX

In the second and third quarters of 2024, Telegram-based tap-to-earn mini games became popular in the crypto-game field. This trend started with Notcoin, which was launched at the beginning of the year, and was pushed to the top by Hamster Kombat, which claimed to have nearly 300 million player accounts. It finally "collapsed" suddenly after the airdrop in September. Mini-apps that also attracted millions or even tens of millions of users on Telegram also had similar endings.

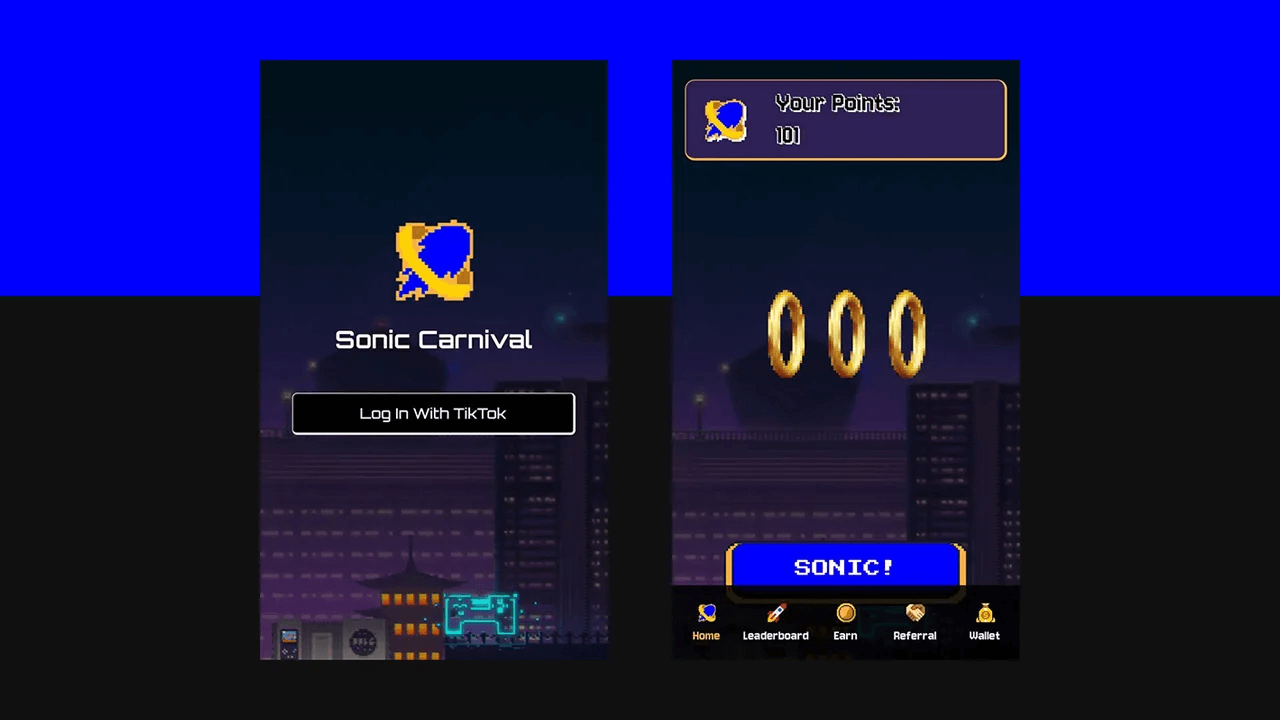

In this context, Sonic SVM chose to take a different approach and set its sights on another top traffic pool, TikTok, and launched the point-earning game SonicX on the platform in October 2024. The game's art style also draws on the classic video game Sonic The Hedgehog. Very similar to the mini-programs on Telegram, TikTok allows users to open web pages in their native browsers, and players can start playing games and collect game points after logging in with social media.

SonicX expanded its player base by launching TikTok ads to potential new users, which received millions of views within a month, some of which were converted into active users. According to Sonic SVM, the game broke the milestone of one million players a month after its launch and currently has more than two million users.

After seeing the number of Telegram mini-game users "easily" break through the millions, SonicX's one or two million users seem mediocre. However, since TikTok users need to provide phone numbers and identity verification for KYC, and Telegram does not impose restrictions on this, SonicX users may be relatively "higher quality".

TikTok's future in the US is uncertain

Sonic SVM's vision for SonicX on TikTok is not just to host games, but to cultivate a Web3 gaming layer that mainstream audiences can access and participate in. Sonic SVM provides infrastructure to developers who are willing to publish games on TikTok. They can leverage the Sonic Origin and Sonic Frontier networks and easily deploy games through its guides.

With the SONIC token generation activity smoothly landing, Sonic SVM believes that TikTok has proven itself to be an effective user acquisition channel. It hopes to open its business to third-party developers and fund them through SONIC tokens.

However, TikTok's future in the United States is also confusing. A large number of its American users have recently begun to stage a "cyber exodus" and flocked to Xiaohongshu for "refuge". Last year, the U.S. Congress passed the "Protecting Americans from Foreign Adversaries Controlling Applications Act". According to the law, TikTok's parent company ByteDance must divest its shares in TikTok by January 19, otherwise it will face a nationwide ban. TikTok has repeatedly stated that it will not sell its U.S. business. According to The Information, TikTok plans to shut down its app for U.S. users on the "deadline".

TikTok has appealed the law to the Supreme Court, stating that the ban violates the First Amendment rights of its 170 million American users. On January 10, the Supreme Court heard an emergency appeal from TikTok, but the judges seemed inclined to uphold the legislation and hope that it would meet the deadline. Unless ByteDance complies with the above law, Apple, Google, and web hosting service providers must prevent TikTok from being distributed in the United States once the ban comes into effect. According to Bloomberg, citing people familiar with the matter, Musk may become the owner of TikTok. Subsequently, TikTok responded that reports of a possible sale to Musk were "pure fiction."

Trump, who is about to officially take office as the US president, is also a supporter of TikTok. He said he had a "good impression" of TikTok and vowed to "save" the platform that brought "billions of views" to his campaign. Last month, Trump urged the Supreme Court to postpone its ruling until he returned to the White House on January 20. His lawyers submitted a legal brief to the court, saying that Trump "opposes banning TikTok" and "seeks the ability to solve current problems through political means after taking office." A week ago, Trump also met with TikTok CEO Shou Zi Chew at Mar-a-Lago, who was also invited to attend the presidential inauguration and sit in the "seat of honor."

Currently, TikTok has 1 billion monthly active users worldwide, of which more than 10% are from the U.S. Judging from the geographical distribution of users of the previously popular point-earning games, non-U.S. users of the Sonic SVM ecosystem will account for the vast majority.

In addition, according to Reuters , in theory, American users who have downloaded TikTok can still use the app, but because the law also prohibits American companies from providing distribution, maintenance or update services for the app starting Sunday, TikTok will no longer be able to update the software, and it will become more and more buggy and slower over time.

Sources said the shutdown is intended to protect TikTok's service providers from legal liability while making it easier for TikTok to resume operations if President-elect Donald Trump decides to revoke the ban.

In the uncertain future of TikTok, Sonic SVM, which acts as a bridge between Tiktok users and the Web3 world, is also forced to face certain challenges. However, judging from the recent performance of the SONIC token price, the project seems to have withstood the test of this round of external influences.

You May Also Like

Botanix launches stBTC to deliver Bitcoin-native yield

Unprecedented Surge: Gold Price Hits Astounding New Record High