Trump Tariff Pause Fuels Crypto Rally Across Bitcoin and Altcoins

This article was first published on The Bit Journal.

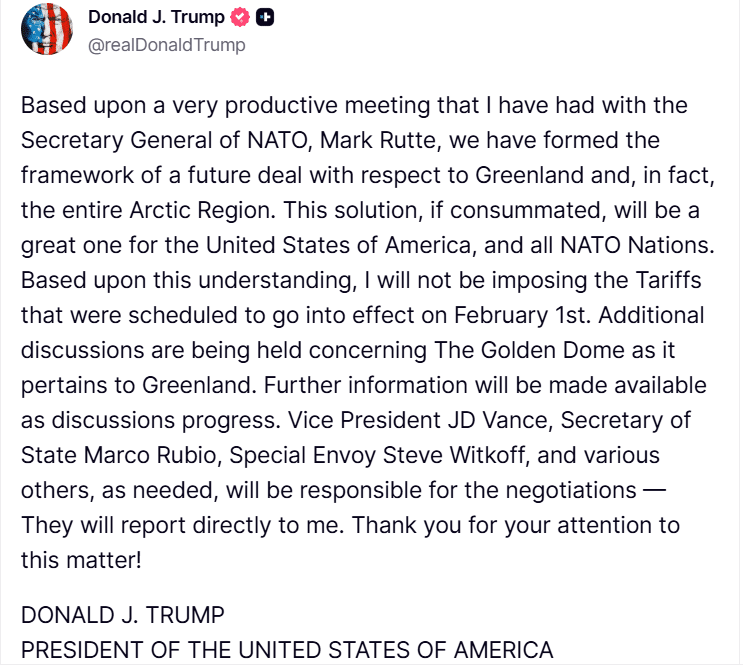

The Trump tariff pause provided a welcome boost to crypto markets after days of trade-related uncertainty. The US president announced the delay in a Truth Social post following a meeting with NATO Secretary General Mark Rutte. The statement confirmed that the planned tariffs would be postponed and outlined a framework for future discussions involving Greenland and the wider Arctic region.

What does the Trump tariff pause mean for US–EU trade relations?

The Trump tariff pause means that the US decided not to go ahead with tariffs that were planned to start on February 1. Trump described his meeting with NATO Secretary General Mark Rutte as very productive and said it led to a framework for a future agreement covering Greenland and broader Arctic cooperation.

This announcement came after a period of tension in EU–US relations. Previously, European officials had paused progress on the Turnberry trade framework because of disputes over Greenland and the threat of new tariffs. Trump confirmed that, based on this new understanding, the tariffs would not be applied for now, though further discussions are expected to continue.

Trump Tariff Pause Fuels Crypto Rally Across Bitcoin and Altcoins 4

Trump Tariff Pause Fuels Crypto Rally Across Bitcoin and Altcoins 4

Why did markets react so quickly to the Trump tariff pause?

Crypto markets rose after the Trump tariff pause eased immediate concerns about a trade conflict between the United States and its European allies. In the days before the announcement, uncertainty over geopolitical tensions had weighed heavily on risk assets.

With the confirmation that the tariffs would be postponed, short-term market stress eased. Traders adjusted their risk positions, and digital assets gained broadly, reflecting overall market sentiment rather than gains driven by any single sector.

How did Bitcoin respond after recent tariff-related struggles?

Bitcoin responded positively to the Trump tariff pause, recovering after a challenging period driven by tariff-related uncertainty. Before Trump’s announcement, Bitcoin had slipped below $88k, as worries about EU–US trade tensions weighed on the market. Following the news, this downside pressure eased.

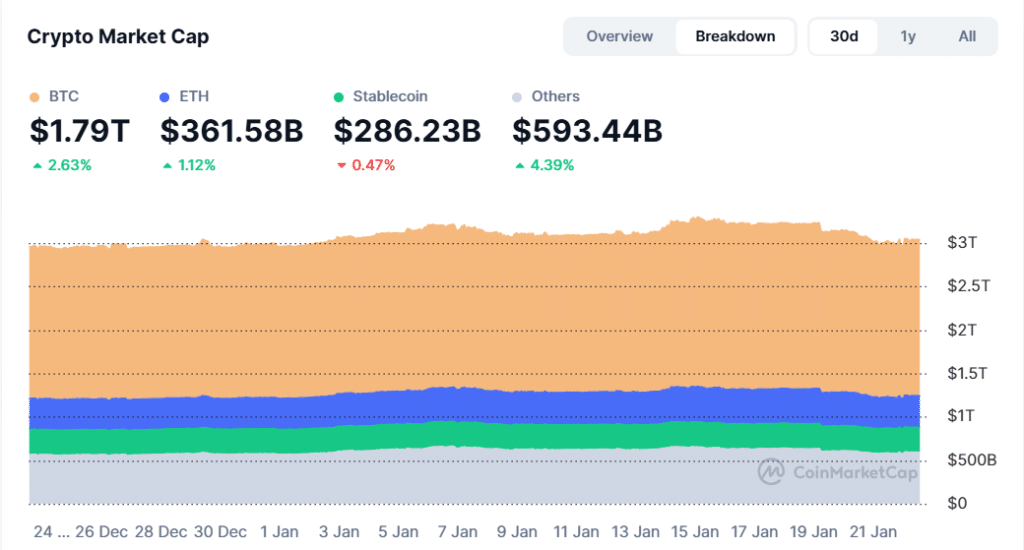

Bitcoin is currently priced at $89,715.05, with a market capitalisation of around $1.79 trillion, maintaining its lead as the largest digital asset. The rebound reflected a boost in market sentiment rather than any fundamental change in Bitcoin’s long-term outlook.

Why did altcoins see stronger gains than Bitcoin?

Altcoins outperformed Bitcoin following the Trump tariff pause, as investors shifted toward higher-risk assets amid improving market sentiment. Ethereum rose alongside the broader market, with a market capitalisation of about $361 billion.

Trump Tariff Pause Fuels Crypto Rally Across Bitcoin and Altcoins 5

Trump Tariff Pause Fuels Crypto Rally Across Bitcoin and Altcoins 5

Layer-1 tokens like Solana and XRP also gained, while several mid-cap assets recorded significant increases. Market heatmap data showed widespread strength across smart contract platforms, DeFi-related tokens, and select meme assets, indicating that the rally was broad-based rather than driven by a single sector or narrative.

How did geopolitics influence the market reaction?

Geopolitical factors played a key role in market movements. The Trump tariff pause came after several days of uncertainty in EU–US relations, including delays in the Turnberry trade framework and disputes related to Greenland.

By confirming that the tariffs would not be applied as scheduled, Trump’s announcement eased immediate macroeconomic uncertainty. The event highlighted how trade and international security developments continue to affect crypto markets, just as they influence traditional financial assets.

What should investors watch following the Trump tariff pause?

While the Trump tariff pause boosted short-term market sentiment, it does not signal a finalized agreement. Trump stated that further discussions are still underway and that more details will be provided as negotiations move forward.

Trump Tariff Pause Fuels Crypto Rally Across Bitcoin and Altcoins 6

Trump Tariff Pause Fuels Crypto Rally Across Bitcoin and Altcoins 6

Vice President JD Vance, Secretary of State Marco Rubio, and Special Envoy Steve Witkoff have been assigned to lead the talks. For investors and markets, this means focus will remain on confirmed policy actions and official announcements rather than speculation, especially as trade and security negotiations continue.

Conclusion

The Trump tariff pause sparked a broad crypto rally, led by altcoins, while Bitcoin regained stability after recent losses caused by tariff-related concerns. More broadly, the development highlighted how sensitive crypto markets remain to macroeconomic news and geopolitical events beyond any single announcement.

As long as trade negotiations and international discussions are ongoing, the Trump tariff pause serves as a reminder that digital assets continue to react strongly to changes in global risk sentiment rather than moving independently.

Glossary

Trump Tariff Pause: The US delays tariffs to ease trade tensions with Europe.

Market Capitalisation: The total value of a cryptocurrency based on price and supply.

Layer-1 Tokens: Cryptocurrencies that run on their own blockchain, like Bitcoin.

Crypto Market: The place where digital currencies are bought and sold.

DeFi (Decentralized Finance): Financial services on blockchain that work without banks.

Frequently Asked Questions About Trump Tariff Pause

Why did Trump announce the tariff pause?

Trump announced pause after a productive meeting with NATO Secretary General Mark Rutte and to ease tensions with Europe.

How does the tariff pause affect US–EU trade relations?

It reduces immediate trade tensions. And allows more time for talks on agreements involving Greenland and the Arctic region.

How did Bitcoin respond to tariff pause?

Bitcoin went up after the announcement. Recovering from previous losses caused by trade worries.

Which altcoins benefited the most?

Ethereum, Solana, XRP, and some mid-cap tokens gained strongly after the news.

Why did altcoins gain more than Bitcoin?

Altcoins rose faster as investors moved into higher-risk assets as market confidence improved.

Sources

Truth Social

AMBCrypto

CoinMarketCap

Lemonade

Read More: Trump Tariff Pause Fuels Crypto Rally Across Bitcoin and Altcoins">Trump Tariff Pause Fuels Crypto Rally Across Bitcoin and Altcoins

You May Also Like

Water150 Unveils Historical Satra Brunn Well: The Original Source of 150 Years of Premium Quality Spring Water Hydration

Amazon signs AI and cloud partnership to accelerate growth