Portugal Bans Polymarket Over €4M Insider Trading Scandal

Portugal’s gaming regulator has banned crypto prediction platform Polymarket following suspicious trading patterns during the country’s presidential election that saw over €4 million wagered in just two hours before results emerged.

The Portuguese Gaming Regulation and Inspection Service (SRIJ) ordered the platform to cease operations and face blocking after determining its activities violate national laws prohibiting political betting.

The controversy centers on suspicious shifts in betting odds that occurred precisely when exit polls began circulating privately, raising serious questions about information leakage and insider trading on prediction markets.

Suspicious Betting Patterns Trigger Investigation

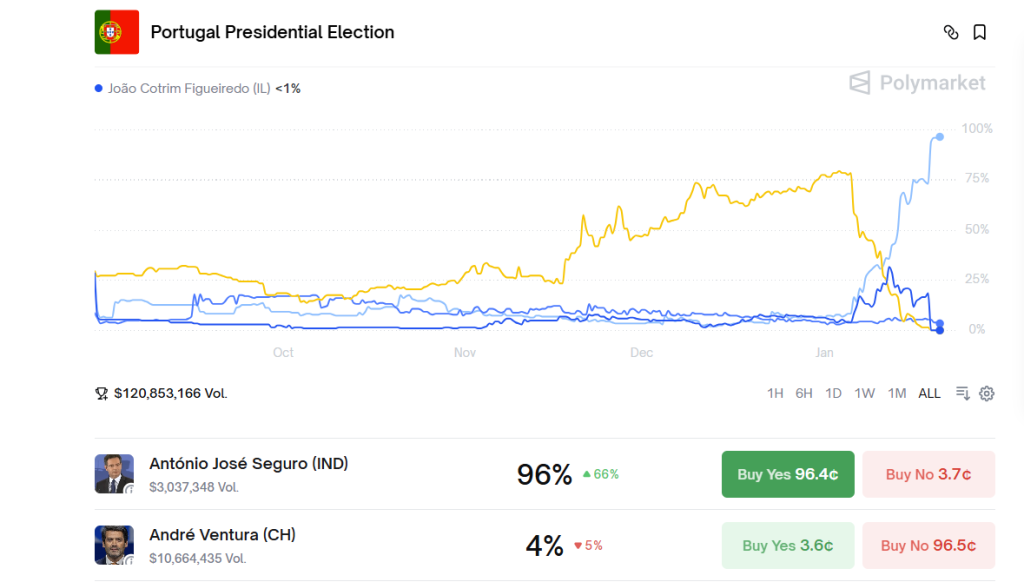

According to reports from Portuguese outlet Renascença, António José Seguro entered Sunday’s presidential election with 60% odds on Polymarket while challenger André Ventura held just 30%.

By 6 PM, one full hour before polls closed, Seguro’s probability had surged to 96%, reaching 100% when official projections confirmed his victory.

Source: Polymarket

Source: Polymarket

The timing proved even more suspicious in markets predicting the next President of the Republic.

At 6:30 PM, Seguro’s chances of reaching Belém Palace rocketed from 68.6% to 93.2% within a single hour.

During that same period, Cotrim de Figueiredo’s odds collapsed from 22% to merely 2.5%, settling at 95% for Seguro by 8 PM when Portuguese voters first learned the results.

Between 6 PM and 8 PM, the critical window between Seguro’s odds surge and public result announcements, over €5 million traded across various markets.

Total volume in the main presidential market exceeded $120 million (approximately €103 million), while alternative markets accumulated nearly $10 million (approximately €8.1 million).

The apparent mystery of how bettors correctly identified the winner two hours before official announcements dissolves upon closer examination.

Around 6 PM, preliminary exit poll projections began circulating privately, all confirming a comfortable Seguro victory with over 30% of the vote.

The two candidates will face off in a runoff ballot on February 8, though Polymarket won’t be available for Portuguese bettors this time.

Portugal Regulatory Crackdown and Compliance Measures

The SRIJ confirmed it became aware of Polymarket “very recently” and considers the company’s activity “illegal.”

According to Renascença, the regulator stated that “the website is not authorized to offer betting in Portugal, and under national law, betting on political events or happenings, whether national or international, is not permitted.”

Polymarket received notification on Friday to cease Portuguese operations within 48 hours.

As of Monday, the site remained active, prompting SRIJ to notify network services for platform blocking.

Portugal joins a growing list of countries restricting the platform.

Polymarket has been banned in Ukraine, Singapore, and France, while facing blocks in Australia, Belgium, Germany, the UK, Iran, and North Korea, amongst others.

Notably, concerns over insider trading on prediction markets have intensified following high-profile bets on geopolitical events, particularly after Polymarket nearly perfectly predicted President Trump’s 2024 victory.

Austin Weiler, a researcher at blockchain intelligence firm Messari, argued that preventing insider trading is “realistically possible only on prediction markets applying Know Your Customer (KYC) measures.”

“For KYC’d platforms, the most effective mechanism is to restrict access upfront for users to specific markets,” Weiler explained, adding that state actors could be barred from political or geopolitical markets.

Kalshi Challenges Polymarket Dominance In Prediction Market

KYC requirements vary widely across established prediction platforms.

Kalshi enforces identity verification as part of its regulated model under the US Commodity Futures Trading Commission (CFTC) authority, leading regulated exchanges like Coinbase to develop prediction market websites operating through Kalshi’s federally approved framework.

While Polymarket is also legally recognized by the CFTC, access and permitted markets differ significantly, with ongoing legal questions about whether the platform features contract trading or gambling under another name.

Amid regulatory hurdles and Kalshi lawsuits, Polymarket’s December 2025 volume breakdown showed a 28% increase in politics betting, with over $4.3 billion wagered compared to Kalshi’s $5.96 billion in the same period.

You May Also Like

Three dormant wallets, suspected to belong to the same entity, purchased 5,970 ETH eight hours ago.

BlackRock Increases U.S. Stock Exposure Amid AI Surge