Solana price prediction for July 2025 – SOL bulls targeting the $200 mark next?

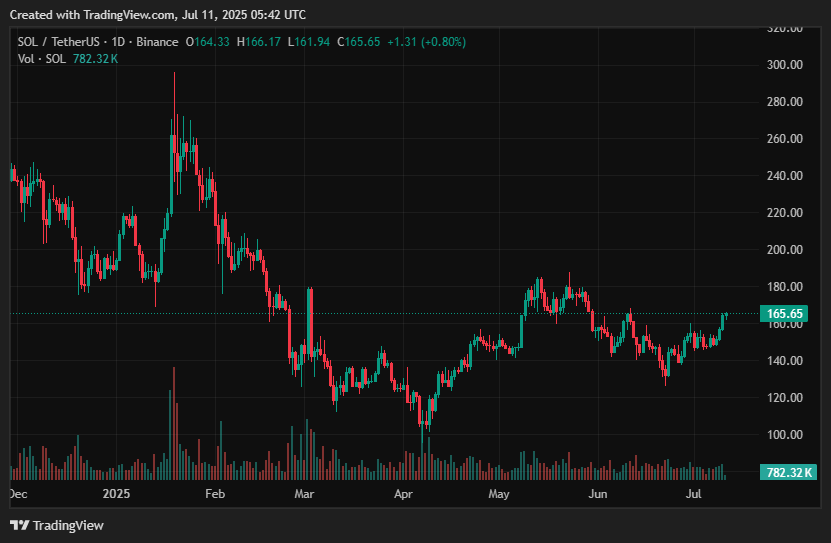

Solana continues to remain one of the leaders in this ongoing bull rally. It held the $150 support with conviction, and now bulls are eyeing the $200 resistance next. Can $200 come from the current price of $165, or will we see a pullback first? Let’s find out in this Solana price prediction for July 2025.

Currently ranked in the 6th position with a market cap of $88.74 billion, Solana (SOL) has depreciated around 43% in price since reaching an all-time high of $296 in January 2025. However, many altcoins are targeting their yearly open prices, which is why we can expect SOL to reach its yearly open and ATH at the same time.

In this article, we’ll discuss the SOL price prediction by giving you its short-term and long-term price forecasts, and specifically focus on the Solana price prediction in July 2025.

What is Solana?

The open-source, high-performance blockchain platform Solana was created with minimal transaction costs, scalability, and speed in mind. It seeks to support a variety of non-fungible token (NFT) marketplaces, decentralized finance (DeFi) platforms, and decentralized applications (dApps).

Solana uses a special hybrid consensus process that combines Proof-of-Stake (PoS) and Proof-of-History (PoH) to accomplish its high throughput and efficiency.

With a more effective option for decentralized apps and other blockchain-based initiatives, Solana has become a formidable rival to Ethereum. Both developers and users find it to be an appealing platform due to its quick transactions and affordable prices.

Now, let’s discuss the SOL price prediction for July 2025, examining both technical and fundamental factors that could impact the price.

SOL short-term price prediction

What can be a realistic projection for the SOL token? Let’s analyze this token for a short-term outlook and then discuss SOL price prediction in July 2025.

SOL coin price prediction: short-term outlook

According to CoinCodex’s SOL price prediction for the near future, the token is predicted to rise by 5.19% and reach $173.07 by Aug. 10, 2025.

Analysts on X believe SOL is getting ready for a breakout of the symmetrical triangle.

Other analysts are also looking at buy signals, with potential targets reaching up to $265.

SOL price factors for July 2025

A combination of technical strength, growing institutional demand, and general market mood fueled by Bitcoin’s new all-time highs is forming Solana’s positive momentum in July 2025.

With a consolidation period above $150 and a possible breakout pattern, SOL, which is currently trading at about $165, is aiming for the crucial $200 mark. According to analysts, the coin is developing a fractal configuration that is reminiscent of the April rally, in which it gained more than 60% in a matter of weeks. In the upcoming days, Solana might surpass $200 and approach the $208 milestone if that pattern continues.

Due to the risk-on atmosphere produced by Bitcoin’s (BTC) recent surge to new all-time highs above $112,000, cryptocurrencies are rising in value overall. BTC serves as a tailwind for high-beta assets like SOL as long as it stays above the $112,000 mark. The market has become more confident as a result of BTC’s continuous rise, and Solana has benefited greatly from this general upward trend.

The expanding ETF story is one of the main forces driving Solana. This month, Solana ETFs have grown quickly; in the first week, early U.S. staking ETFs had inflows of over $20 million. In just two days, trading volumes had surpassed $60 million, outpacing some of the first altcoin ETF offerings. After asking large issuers to resubmit, analysts anticipate that the SEC will expedite spot ETF approvals by the end of July. In addition to institutional participants like Grayscale getting ready to list a Solana Trust on NYSE Arca, which might draw even more capital, Polymarket data indicates probabilities of over 99% for a spot SOL ETF approval.

At its core, Solana’s blockchain ecosystem is still thriving. In addition to a surge in active users and application installations, its total value locked (TVL) has increased dramatically, rising from about $6 billion in April to $8.6 billion in early July. As a result, network sentiment has improved, which has strengthened its price action. Even though some traders have profited from recent increases, as long as SOL is above $150, the underlying trend is still favorable. Any confirmation about ETFs would probably rekindle considerable upward momentum, but a dip below that could result in short-term weakness.

Three main factors will probably determine Solana’s July price performance: robust ecosystem utilization, ongoing ETF advancement, and BTC’s prolonged supremacy and optimistic emotion. The $200 mark might be approached sooner rather than later if these conditions are met, and it might even be exceeded if the ETF approval leads to another round of institutional purchases.

Is SOL a good investment?

Before investing in any cryptocurrency, including SOL, please identify and understand the inherent risks that can come due to market volatility. Also, the sentiment in the cryptocurrency market changes quickly, and a price point that was once considered a very strong support or resistance may become invalid in a very short time. Hence, it is advisable to do your research on the price action before having any price expectations for the future of the SOL token.

Will SOL go up or down?

Cryptocurrencies in general experience rapid price swings that are directly driven by market sentiments, community engagement, events like token burns, and so on.

While it is hard to determine how high the SOL token will go, it is important to look out for potential buying factors that may include new partnerships, increased token holders, or viral campaigns in general.

It is also vital that you rely on financial experts and consult them for SOL price prediction, but even after all that, you should remain cautious, as no one can accurately predict how high or low SOL can go.

Should I invest in SOL?

Before investing in any cryptocurrency or trusting any SOL price forecast, please identify and understand the inherent risks that can come due to market volatility. Also, it should be noted that cryptocurrencies in general are a highly speculative investment, and their success not only relies on market volatility but also on the constant and sustainable growth of their community. Hence, it is advisable to do your research on the token’s fundamentals, which may very well decide the future of the SOL token.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

You May Also Like

Solana Hits $4B in Corporate Treasuries as Companies Boost Reserves

SHIB Price Prediction: Mixed Signals Point to $0.0000085 Target by February End