Trading time: Risk assets rebound after Trump "shows weakness"; Standard Chartered Bank and Arthur Hayes are optimistic about BTC hitting $200,000

1. Market observation

Keywords: Trump, ETH, BTC

Trump recently stated that he has no intention of firing Fed Chairman Powell, while admitting that tariffs on Chinese exports are too high and hinting that the tax rate will be significantly reduced. At the same time, the geopolitical situation has also shown signs of easing, and Putin has proposed to stop the offensive against Ukraine on the current front as part of efforts to reach a peace agreement with Trump. These easing signals have directly affected the performance of safe-haven assets. Spot gold has fallen by about $160 from yesterday's high of $3,500 and is now quoted at $3,339 per ounce.

Crypto assets have seen a sharp rebound. Bitcoin broke through the key resistance level of $90,000 yesterday and rose above $94,000 this morning. Its market value has surpassed silver and Amazon, rising to sixth place in the global asset market value ranking. 10x Research pointed out that the current key resistance area is between $94,000 and $95,000. Traders in the Greeks.live community believe that after Bitcoin breaks through $90,000, the next target will be $93,000/$100,000; while those who are cautious are paying attention to possible pullbacks, and it is expected that there will be a significant increase after a retracement to the $84,000 or $74,000 level. Cantor Fitzgerald, led by Brandon Lutnick, son of U.S. Commerce Secretary Howard Lutnick, is working with multiple institutions to build a multi-billion dollar Bitcoin acquisition platform, which will become another powerful buyer of Bitcoin.

In addition, Arthur Hayes is optimistic about the future of Bitcoin, believing that Bitcoin will break away from its association with technology stocks and become a safe-haven asset in the market together with gold. It is expected that Bitcoin may rise all the way to $200,000 after breaking through $110,000, triggering funds to flow from Bitcoin to altcoins. Geoff Kendrick of Standard Chartered Bank is also optimistic. He expects that if market concerns about the independence of the Federal Reserve continue, Bitcoin may hit a record high and predicts that it will reach $200,000 by the end of 2025.

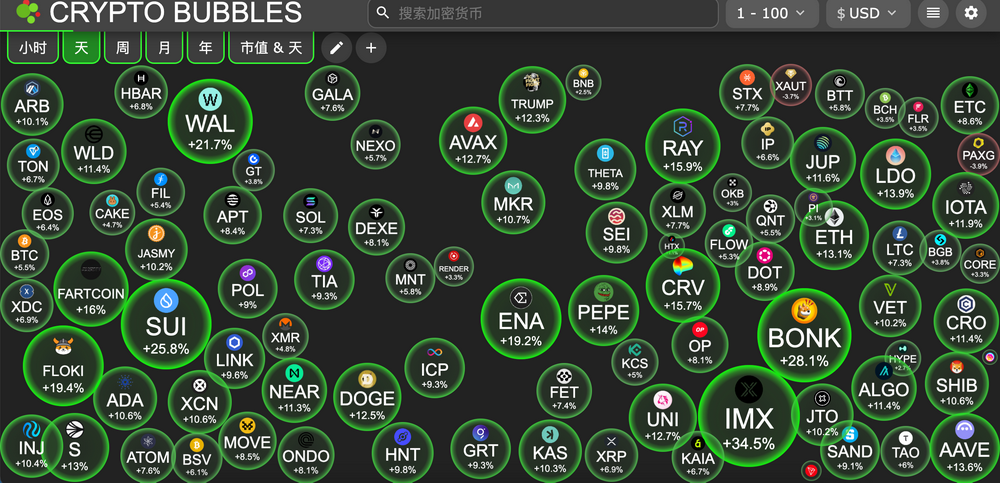

In terms of altcoins, Solana rebounded with the rise of the market, rising above $150 this morning. This rise was supported by institutional funds. Galaxy Digital exchanged $100 million of ETH for SOL, the US listed company DeFi Dev Corp increased its holdings of $11.5 million of SOL, and the blockchain payment provider Astra Fintech also set up a $100 million fund to support Solana's development in Asia. In this atmosphere, the AI Meme sector rebounded the most, ZEREBRO doubled its daily increase, and Fartcoin's market value exceeded $1 billion.

In terms of macroeconomics, U.S. Treasury Secretary Benson said the tariff stalemate is unsustainable and the situation is expected to ease. Trump's attitude towards the Federal Reserve has also eased. He said, "We think the Federal Reserve should lower interest rates, and now is a perfect time. We hope that our chairman can (cut interest rates) ahead of schedule or on time." At the same time, he also expressed satisfaction with the performance of the stock market rally. According to CME's "Fed Watch" data, the probability of the Federal Reserve keeping interest rates unchanged in May is 91.7%, and the probability of a 25 basis point rate cut is 8.3%. The probability of the Federal Reserve keeping interest rates unchanged by June is 32.8%, the probability of a cumulative 25 basis point rate cut is 61.8%, and the probability of a cumulative 50 basis point rate cut is 5.3%.

2. Key data (as of 12:00 HKT on April 23)

(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN)

-

Bitcoin: $93,203.77 (-0.45% year-to-date), daily spot volume $55.665 billion

-

Ethereum: $1,794.45 (-46.28% year-to-date), with a daily spot volume of $25.673 billion

-

Fear of Greed Index: 72 (Greed)

-

Average GAS: BTC 1.05 sat/vB, ETH 0.67 Gwei

-

Market share: BTC 63.3%, ETH 7.4%

-

Upbit 24-hour trading volume ranking: DEEP, XRP, BTC, AERGO, TT

-

24-hour BTC long-short ratio: 1.005

-

Sector gains and losses: MemeAI sector rose 14.52%, Ai sector rose 13.81%

-

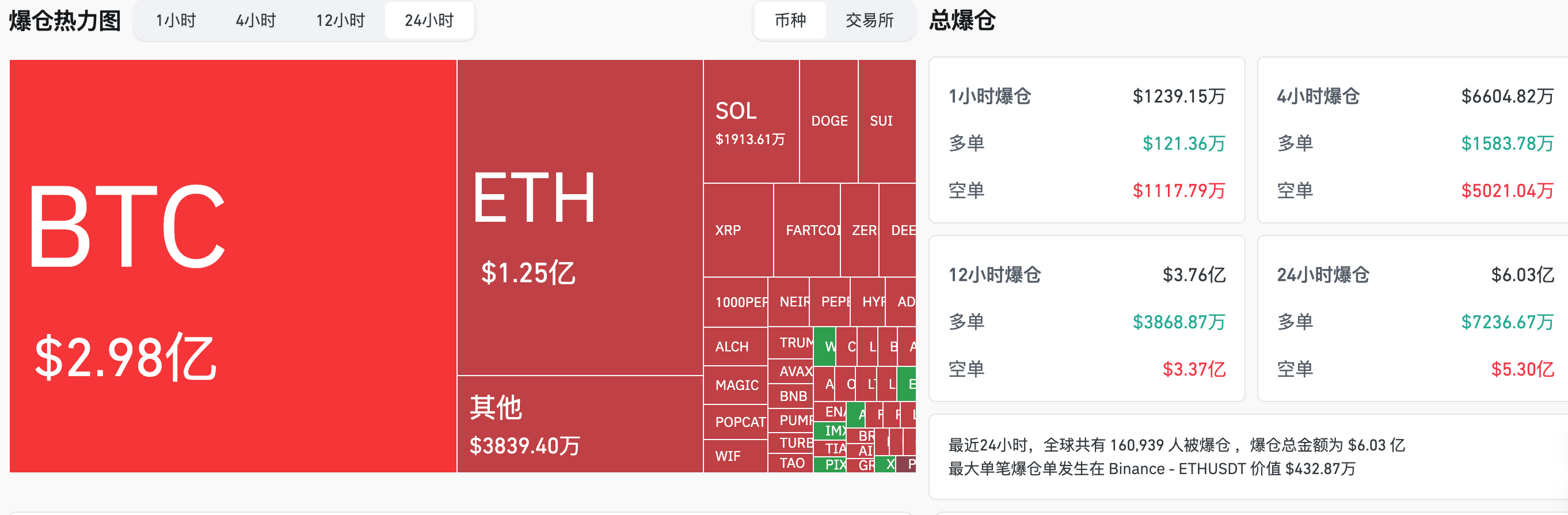

24-hour liquidation data : A total of 160,939 people were liquidated worldwide, with a total liquidation amount of US$603 million, including BTC liquidation of US$298 million, ETH liquidation of US$125 million, and SOL liquidation of US$19.13 million

-

BTC medium and long-term trend channel : upper channel line ($87457.52), lower channel line ($85725.69)

-

ETH medium and long-term trend channel : upper channel line ($1652.44), lower channel line ($1619.72)

*Note: When the price is higher than the upper and lower edges, it is a medium- to long-term bullish trend; otherwise, it is a bearish trend. When the price passes through the cost range repeatedly within the range or in the short term, it is a bottoming or topping state.

3. ETF flows (as of April 22 EST)

-

Bitcoin ETF: $936 million

-

Ethereum ETF: $38.74 million

4. Today’s Outlook

-

DTCC launches tokenized collateral management platform "AppChain" and is expected to be demonstrated on April 23rd local time

-

Zora (ZORA) Token Begins Trading on Binance Alpha

-

PancakeSwap plans to implement CAKE token economics 3.0

-

Lending protocol Dolomite will hold a TGE on April 24 and will airdrop 20% of DOLO

-

Coinbase International Station launches four perpetual contract transactions including WCT and BABY

-

Binance will terminate withdrawal services for AMB, CLV, STMX and VITE on April 24

-

Binance will launch INIT on April 24 and open INIT/USDT, INIT/USDC, INIT/BNB, INIT/FDUSD and INIT/TRY trading pairs.

-

The Federal Reserve released the Beige Book on economic conditions. (April 24, 02:00)

-

Karrat (KARRAT) unlocked approximately 21.25 million tokens, accounting for 8.79% of the current circulation, worth approximately $1.3 million

-

Murasaki (MURA) unlocked approximately 10 million tokens, which is 1.00% of the current circulation, worth approximately $4 million

-

Eigenlayer (EIGEN) unlocked approximately 1.29 million tokens, accounting for 0.53% of the current circulation, worth approximately $1.1 million

The biggest gains among the top 500 stocks by market value today: ZEREBRO up 151.13%, DEEP up 126.82%, TURBO up 50.83%, ARC up 48.62%, and ALCH up 39.56%.

5. Hot News

-

Bloomberg: U.S. strategic Bitcoin reserves may reveal details in the coming weeks

-

Bitcoin spot ETF had a net inflow of US$936 million yesterday, continuing its net inflow for three consecutive days

-

Today's Fear and Greed Index rose to 72, and market sentiment is in a greedy state

-

Bitcoin surpasses silver and Amazon to become the sixth largest asset in the world

-

Trump: No intention to fire Powell, but Fed should lower rates

-

Trump admits that US tariffs on Chinese imports are too high and are expected to be significantly reduced

-

The three major U.S. stock indexes closed sharply higher, all up more than 2%.

-

Cantor to form $3 billion crypto venture with SoftBank and Tether to invest in Bitcoin

-

Coinbase will launch tokenbot (CLANKER) on the Base network

-

US listed company DeFi Dev Corp (formerly Janover) increased its holdings of SOL worth $11.5 million

-

A whale withdrew another 1,000 BTC from Binance and currently holds 19,112 BTC

-

A whale bought 4 million worth of Fartcoin tokens and 3.5 million dollars worth of TRUMP tokens

-

Bernstein: The macro environment is favorable for Bitcoin, and "digital gold" will usher in five major catalysts

-

BTC/Nasdaq ratio reaches 4.96, close to all-time high

-

Metaplanet currently holds 4,855 BTC and plans to hold 10,000 BTC by the end of the year

-

Ouyi will delist five spot trading pairs including KISHU and MAX on April 29

-

Upbit to List DEEP in Korean Won Market

You May Also Like

SEC Approves Generic ETF Standards for Digital Assets Market

MemeCon 2025: A Gala Night for Web3 Culture & Creativity in Singapore