Rep. Torres Moves to Ban Officials From Prediction Markets After Suspicious $400K Maduro Bet

Rep. Ritchie Torres is moving to formally restrict how U.S. government officials participate in prediction markets after a highly profitable bet tied to the sudden capture of Venezuelan President Nicolás Maduro raised fresh concerns about insider trading and public trust.

The New York Democrat is preparing to introduce the Public Integrity in Financial Prediction Markets Act of 2026.

The bill would prohibit federally elected officials, political appointees, and executive branch employees from buying, selling, or trading prediction market contracts tied to government policy, actions, or political outcomes when they possess, or could reasonably access, material nonpublic information through their official roles.

Draft bill text was shared with media outlets earlier this week, and Torres’ office said the proposal has been under development for some time but gained urgency following recent events.

A $32,000 Bet, a Maduro Arrest, and Growing Insider Trading Concerns

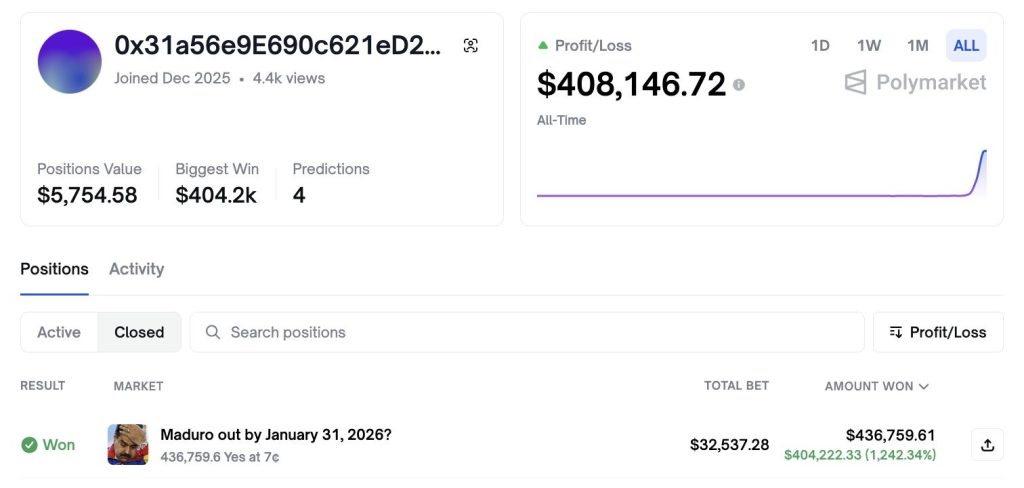

The push follows scrutiny around a Polymarket trade that turned roughly $32,000 into more than $400,000 in less than a day.

Source: Joe Pompliano

Source: Joe Pompliano

A newly created account wagered that Maduro would be removed from power by the end of January 2026, purchasing shares when the implied probability was in the low single digits.

The market began rising late Friday evening, hours before President Donald Trump announced that U.S. forces had taken Maduro and his wife, Cilia Flores, into custody during overnight operations.

Once the news became public, the contract settled near its maximum payout, generating returns exceeding 1,200%.

The account had minimal prior activity, and all of its known trades were tied to U.S. intervention in Venezuela, intensifying speculation that the wager may have been informed by nonpublic political or military information.

Maduro and Flores later pleaded not guilty on Monday to U.S. charges alleging large-scale cocaine trafficking carried out with the protection of Venezuelan security forces.

Punchbowl News founder Jake Sherman said Torres intended to clearly establish that such conduct is illegal under federal law, mirroring insider trading standards that already exist in traditional financial markets.

While the initial version of the bill does not introduce new penalties or enforcement mechanisms beyond existing statutes, it would explicitly extend those principles to prediction markets, which currently operate in a more fragmented regulatory environment.

As Prediction Markets Grow, Lawmakers Push for Clear Rule

Prediction markets have grown rapidly over the past two years, moving from a niche product to a multibillion-dollar sector. Combined trading volume across major platforms exceeded $44 billion in 2025, with weekly notional volume topping $5.3 billion in early January 2026.

Platforms like Kalshi, which operates as a regulated U.S. exchange, and Polymarket, which serves a more global user base, allow traders to speculate on a wide range of outcomes spanning politics, sports, economics, and culture.

Political markets have drawn particular attention due to their sensitivity and potential overlap with government decision-making.

While sports dominate volume on some regulated platforms, political events remain a major driver of activity on others, especially during election cycles or major geopolitical developments.

The 2024 U.S. presidential election alone generated billions of dollars in trading volume.

In response to the growing debate, Kalshi’s press relations account said the platform already prohibits insiders or decision-makers from trading on material nonpublic information under its rules.

However, Torres and other lawmakers argue that platform-level restrictions are insufficient without a clear federal standard that applies uniformly to government officials.

The proposed legislation would also build on the principles of the STOCK Act, which governs insider trading by members of Congress in traditional financial assets, extending similar expectations to newer financial instruments.

You May Also Like

XERO Price Crash: Shares Sink 16% to Three-Year Low

YwinCap View On Whether The Gold Market Is In A Bubble