Short-term derivatives traders have maintained long positions in several altcoins as of late December. However, without strict stop-loss plans, these positions could face liquidation risks as early as January.

Which altcoins are at risk, and why could they cause major liquidation losses? The following analysis explains the details.

Sponsored

Sponsored

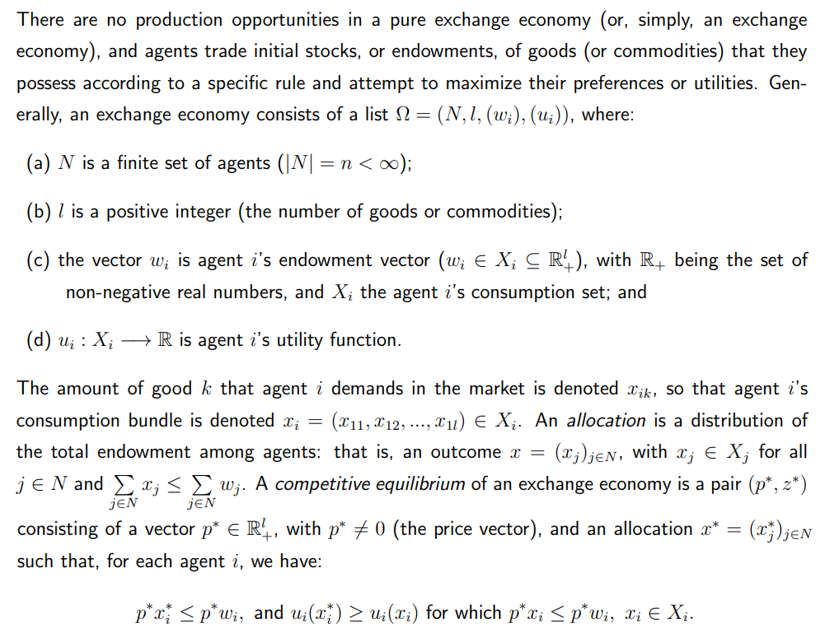

1. Solana (SOL)

Solana’s 7-day liquidation map shows a severe imbalance. Cumulative long liquidations significantly outweigh short liquidations.

Long traders have reasonable grounds to hold SOL positions at this stage.

A BeInCrypto report notes that January has historically been a strong month for SOL’s price performance. In addition, a bullish RSI divergence has confirmed expectations of a potential recovery.

SOL Exchange Liquidation Map. Source: CoinglassLong traders may achieve unrealized profits in the coming days. However, without profit-taking plans, these long positions could become vulnerable.

Data from SoSoValue shows that SOL ETFs just recorded their weakest weekly inflow since launch. Net inflows last week reached only $13.14 million. This figure dropped more than 93% from nearly $200 million during the launch week.

Total SOL Spot ETF Net Inflow. Source: SoSoValueAlthough no week has recorded negative net flows so far, this sharp decline strongly signals weakening ETF demand for SOL. This trend could pressure SOL’s price in early January.

Sponsored

Sponsored

As a result, long positions require caution. If SOL falls to $110, cumulative long liquidations could exceed $880 million.

2. Zcash (ZEC)

Similar to SOL, ZEC’s liquidation map shows traders heavily allocating capital and leverage to long positions.

ZEC locked in Shielded Pools increased again in late December. ZEC’s price also rebounded strongly during the month, rising from around $300 to above $500. These factors support the case for holding long positions.

ZEC Exchange Liquidation Map. Source: CoinglassSponsored

Sponsored

However, risks may emerge from traders acting too aggressively. After a December rally exceeding 70%, ZEC could correct from a technical perspective. A pullback to retest former resistance as support would be a normal price behavior.

Profit-taking by early December buyers could drive this correction. Such selling pressure poses a risk of liquidation for long positions.

Additionally, a recent BeInCrypto report suggests that ZEC whales are reducing their exposure. This behavior reflects growing caution after the sharp recovery.

If ZEC drops to the $466 zone in early January, long-position liquidations could surpass $78 million.

Sponsored

Sponsored

3. Chainlink (LINK)

Many traders appear confident that LINK will soon recover from the current $12 level. They have committed significant capital and leverage to long positions.

LINK Exchange Liquidation Map. Source: CoinglassOne critical signal deserves attention. LINK reserves on Binance increased throughout December.

Chainlink Binance Reserve. Source: CryptoQuantCryptoQuant data shows that Binance’s 7-day average LINK reserves ended a two-month downtrend. The trend has started to reverse upward.

This shift suggests that LINK holders may be preparing to sell whenever prices show signs of recovery. The liquidation map indicates that if LINK falls to $11, cumulative long liquidations could reach approximately $40 million.

Source: https://beincrypto.com/3-altcoins-trigger-liquidations-early-january/