Bitcoin Perps Heat Up Again As Leveraged Longs Rise

Data shows traders have set up fresh Bitcoin positions on the perpetual futures market during the past day, and the Funding Rate suggests they are long bets.

Bitcoin Open Interest Has Witnessed An Uptick

According to data from on-chain analytics firm Glassnode, the surge Bitcoin has seen to kick off Monday has come alongside a spike in the Bitcoin perpetual futures Open Interest.

The “Open Interest” refers to an indicator that keeps track of the total amount of BTC perpetual futures positions that are currently open on all derivatives exchanges.

When the value of this metric rises, it means the investors are opening up fresh positions on the market. Since such a trend usually accompanies an increase in leverage for the sector, it can lead to more volatility for the asset.

On the other hand, the indicator going down implies investors are either pulling back on risk or getting liquidated by their platform. This kind of trend can result in the cryptocurrency’s price behaving in a more stable manner.

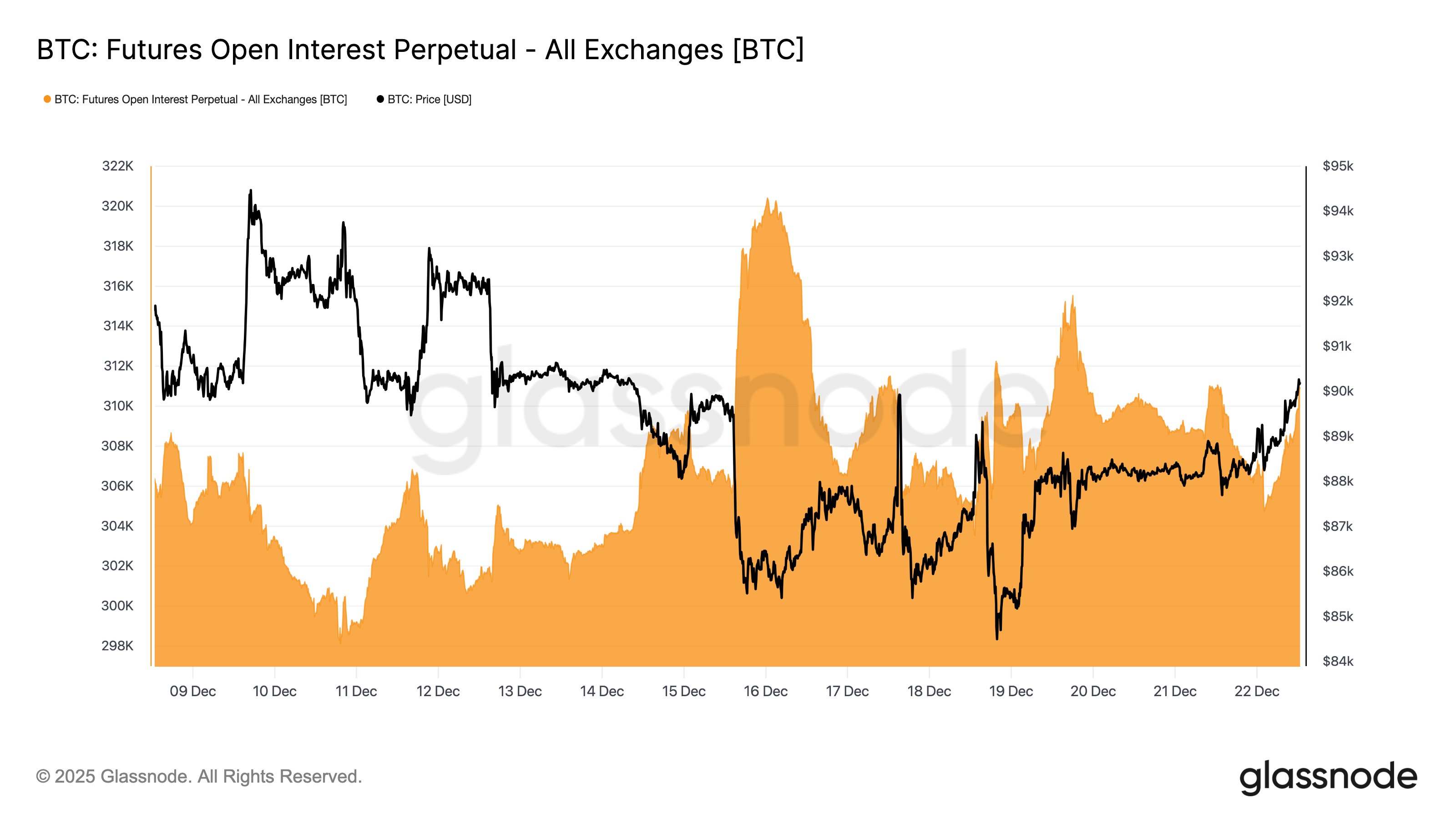

Now, here is a chart that shows the trend in the Bitcoin Open Interest over the last couple of weeks:

As displayed in the above graph, the Bitcoin Open Interest rose from 304,000 BTC to 310,000 BTC as the cryptocurrency observed a recovery surge to $90,000 during the past day.

This represents an increase of about 2%, which isn’t much, but still signals that the rally encouraged traders to open up new positions on the perpetual futures market.

The Open Interest includes both types of positions when calculating its value, so it contains no information about whether positions have a bias toward shorts or longs. Another metric called the Funding Rate can be used to determine that instead.

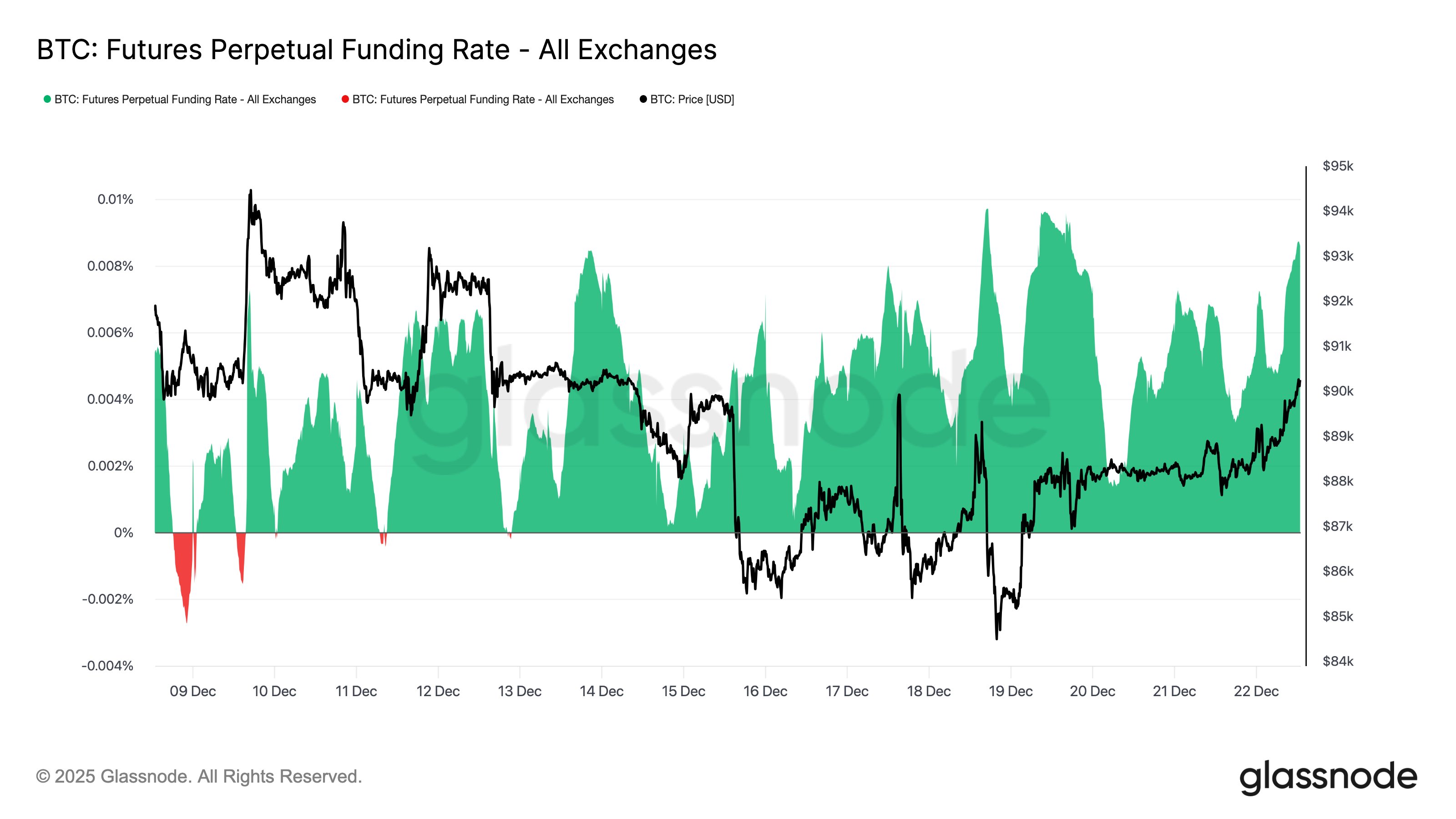

This indicator measures the amount of periodic fee that perpetual futures traders are exchanging between each other. A positive value implies long investors are paying a premium to the shorts in order to hold onto their positions, while a negative one implies bearish bets are dominant.

As the below chart shows, the Bitcoin Funding Rate has been positive for much of the last two weeks, indicating that a bullish sentiment has been shared by the majority of perpetual futures traders.

This metric also noted an uptick alongside the increase in the Open Interest, going from 0.04% to 0.09%. “This combination signals a renewed buildup in leveraged long positioning, as perpetual traders position for a potential year-end move,” noted Glassnode.

BTC Price

Bitcoin has seen a bit of a pullback since its surge above $90,000 as its price is now back at $89,500.

You May Also Like

“Oversold” Solana Mirroring Previous Bottoms

XRP Takes Hit as Whales Sell 1 Billion Coins, But Pro-Ripple Attorney Says XRP Will ‘Shock the World in 2026’