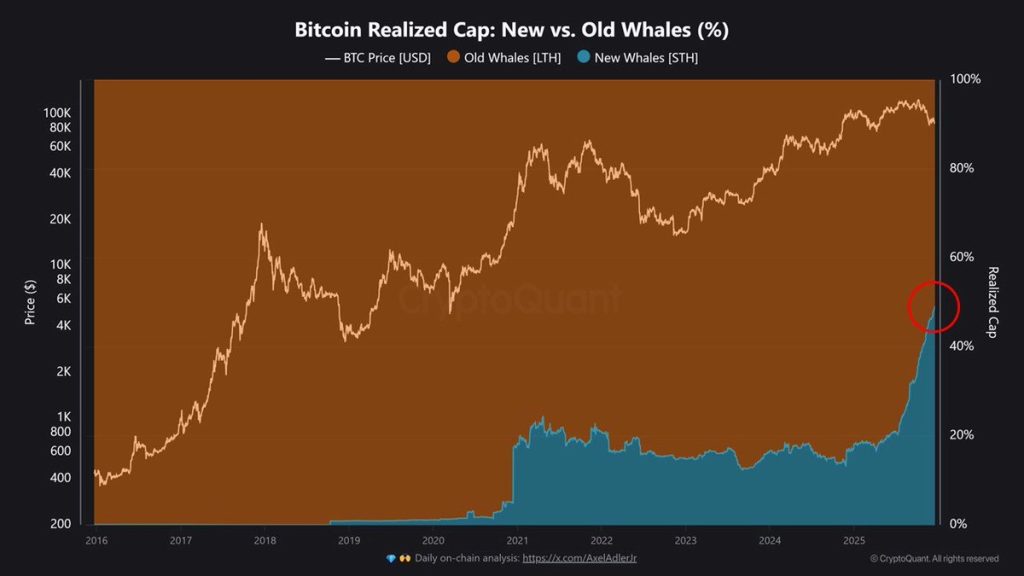

New Whale Buyers Now Drive 50% of Bitcoin’s Realized Cap – A Shift From Old Cycles?

The post New Whale Buyers Now Drive 50% of Bitcoin’s Realized Cap – A Shift From Old Cycles? appeared first on Coinpedia Fintech News

Bitcoin’s price has been volatile, but the bigger story right now isn’t the chart. It’s who’s buying and at what levels.

New on-chain data shows that nearly 50% of Bitcoin’s realized cap now comes from new whale buyers, a sharp break from how past Bitcoin cycles played out.

Realized cap tracks the value of Bitcoin at the price each coin last moved on-chain. So when new whales approach a 50% share, it means half of the capital invested in Bitcoin was formed at recent price levels, not during early low-cost accumulation phases.

New Whales Are Playing a Different Game

According to the data, these new whales are mainly institutions and ETFs buying Bitcoin at higher prices and in larger volumes. That alone sets them apart from long-term holders who accumulated cheaply and sold into strength during previous bull runs.

More importantly, their behavior during pullbacks looks different.

This should not be interpreted as a short-term bullish or bearish signal, but as evidence that the structure of the Bitcoin market itself is changing, the report adds.

Demand Is Rising, Not Rotating

Short-term holder data backs this up. Supply held by coins younger than 155 days grew by roughly 100,000 BTC in 30 days, reaching an all-time high. That suggests fresh demand is still coming in, even as prices fluctuate.

- Also Read :

- Are Banks Trying to Kill Stablecoin Rewards? 125 Crypto Groups Push Back

- ,

At the same time, long-term holders remain mostly inactive. Exchange flows show that selling pressure came largely from smaller participants, while large wallets stepped in to absorb supply.

Cumulative volume delta data reinforces this split. Whale wallets posted a positive $135 million delta, while retail and mid-sized traders showed negative flows.

What This Shift Really Signals

This data points to something deeper.

Bitcoin is entering a transition toward a more mature asset shaped by sustained institutional accumulation.

For a market long defined by boom-and-bust cycles, that change matters. And it may explain why Bitcoin’s behavior is starting to look less familiar and more structural with each passing month.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Not necessarily. While institutional buyers can stabilize liquidity and reduce extreme volatility over time, they can also introduce new risks, such as synchronized reactions to macro events, regulatory changes, or ETF inflows/outflows. Retail investors may face sharper moves tied to traditional financial markets rather than purely crypto-native cycles.

The response may differ from past cycles. Instead of panic selling, institutions may hedge, rebalance, or add exposure at predefined levels. This could lead to faster stabilization—but if forced liquidations occur (for example, due to macro stress), downside moves could still be abrupt.

Long-term participants and infrastructure providers—such as custodians, derivatives platforms, and on-chain analytics firms—stand to benefit from a more capital-heavy, institutionally driven Bitcoin market. Short-term speculators, meanwhile, may find fewer momentum-driven opportunities than in earlier cycles.

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

Forward Industries Bets Big on Solana With $4B Capital Plan