Best Crypto To Buy Now: High-Potential Token Beyond Bitcoin For 2026

Cooling inflation in the United States is reshaping global market sentiment and reigniting appetite for risk assets. The latest Consumer Price Index data came in at 2.7%, below expectations and down from the previous 3.0%, while core inflation eased to 2.6%.

This shift has strengthened expectations that the Federal Reserve will move toward lower interest rates in upcoming policy meetings.

As liquidity expectations improve, investors are reassessing exposure across equities, commodities, and digital assets. In this environment, attention is once again turning to the best crypto to buy now as macro conditions become more supportive.

Source – Cryptonews YouTube Channel

Macro Tailwinds Signal a Shift Back Toward Risk Assets

The CPI surprise triggered a broad recovery across traditional markets. US equities rebounded, with the S&P 500, Nasdaq, Dow Jones Industrial Average, and Russell 2000 moving back toward recent highs.

Gold advanced toward record levels, while oil prices continued to decline, aligning with easing inflation pressures.

Bond yields fell across the curve, reflecting changing expectations around monetary policy. Historically, this combination of falling yields and improving sentiment has supported speculative assets, including cryptocurrencies.

After months of sustained pressure, crypto markets are beginning to stabilize as confidence slowly returns.

Bitcoin Reclaims Center Stage and Sparks Bitcoin-Adjacent Opportunities

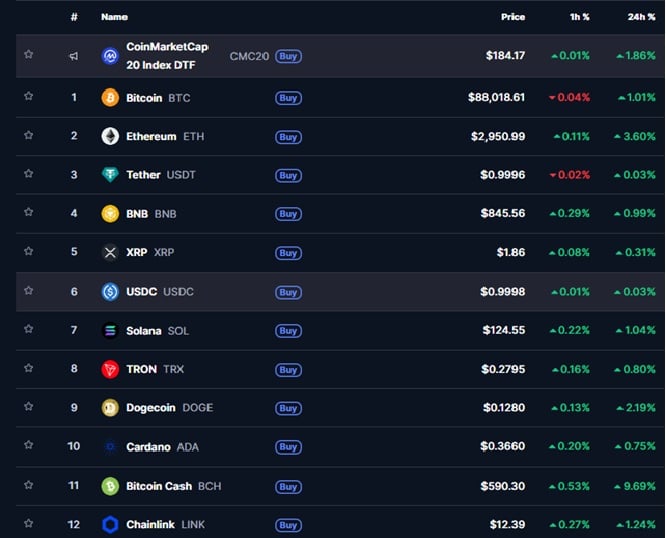

Bitcoin reacted positively to the latest CPI data, climbing around 2% and briefly nearing the $90,000 level before entering a volatile consolidation phase. Ethereum followed with gains close to 4%, while Solana, Bitcoin Cash, and other major cryptocurrencies also advanced after an extended period of weakness.

Several narrative-driven sectors showed early signs of recovery. Privacy-focused projects, AI-related tokens, and broader crypto indexes began turning green as market participation increased.

While short-term volatility remains, Bitcoin’s ability to hold recent gains reinforces its role as the primary driver of crypto market direction.

Lower inflation combined with recent softness in US labor data has strengthened expectations for easier monetary policy ahead. As rate cut expectations build, market participants are increasingly positioning for scenarios where liquidity improves and risk appetite expands.

In these conditions, Bitcoin-adjacent narratives tend to gain visibility. Bitcoin’s unmatched security and decentralization remain core strengths, but periods of heavy usage highlight limitations around transaction speed and cost.

Projects designed to complement its network rather than compete with it often attract increased interest.

Why Bitcoin Hyper Is Entering the Conversation

Bitcoin Hyper is emerging as a Bitcoin-adjacent project attracting interest amid improving market conditions. It is not an official Bitcoin upgrade and has no direct connection to Bitcoin core developers. Instead, it operates independently while complementing the Bitcoin ecosystem.

The project aims to enhance transaction efficiency by offering a faster and more cost-effective solution for Bitcoin-related activity. Rather than replacing Bitcoin, Bitcoin Hyper positions itself as a scalable and accessible option that supports the broader Bitcoin narrative during periods of high demand.

Interest in Bitcoin Hyper is growing as investors look beyond established assets to early-stage projects within the Bitcoin ecosystem. Its focus on speed, efficiency, and usability places it among ecosystem-driven opportunities that benefit from heightened visibility when Bitcoin momentum is strong and market liquidity improves.

The presale is currently active, raising over $26.6 million and offering staking rewards of up to 70% for token holders. Participation requires a Web3-compatible wallet that can connect to the presale platform.

One commonly used option is Best Wallet, a non-custodial multi-chain wallet designed for upcoming ICOs and newly launched tokens.

Best Wallet provides features such as integrated scam protection, biometric authentication, encrypted backups, and portfolio tracking, supporting a smooth and secure presale experience while allowing users to maintain full control over their assets.

For those evaluating the best crypto to buy now beyond Bitcoin, Bitcoin Hyper represents a project aligned with the expanding Bitcoin ecosystem, combining narrative relevance with potential early-stage exposure.

Final Thoughts

Cooling inflation, falling yields, and renewed Bitcoin momentum are reshaping market dynamics and investor behavior. As focus returns to the cryptocurrency space, investment discussions are increasingly guided by macro conditions and Bitcoin’s influence on market trends.

Bitcoin Hyper is positioned within this broader Bitcoin ecosystem narrative. As interest in Bitcoin-adjacent solutions grows, it continues to capture attention from investors seeking exposure to projects aligned with Bitcoin’s ongoing development and adoption.

Visit Bitcoin Hyper

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Whales keep selling XRP despite ETF success — Data signals deeper weakness

Top Solana Treasury Firm Forward Industries Unveils $4 Billion Capital Raise To Buy More SOL ⋆ ZyCrypto