Damaging Impact: Cardano Founder Reveals How Trump’s Crypto Moves Hurt the Market

BitcoinWorld

Damaging Impact: Cardano Founder Reveals How Trump’s Crypto Moves Hurt the Market

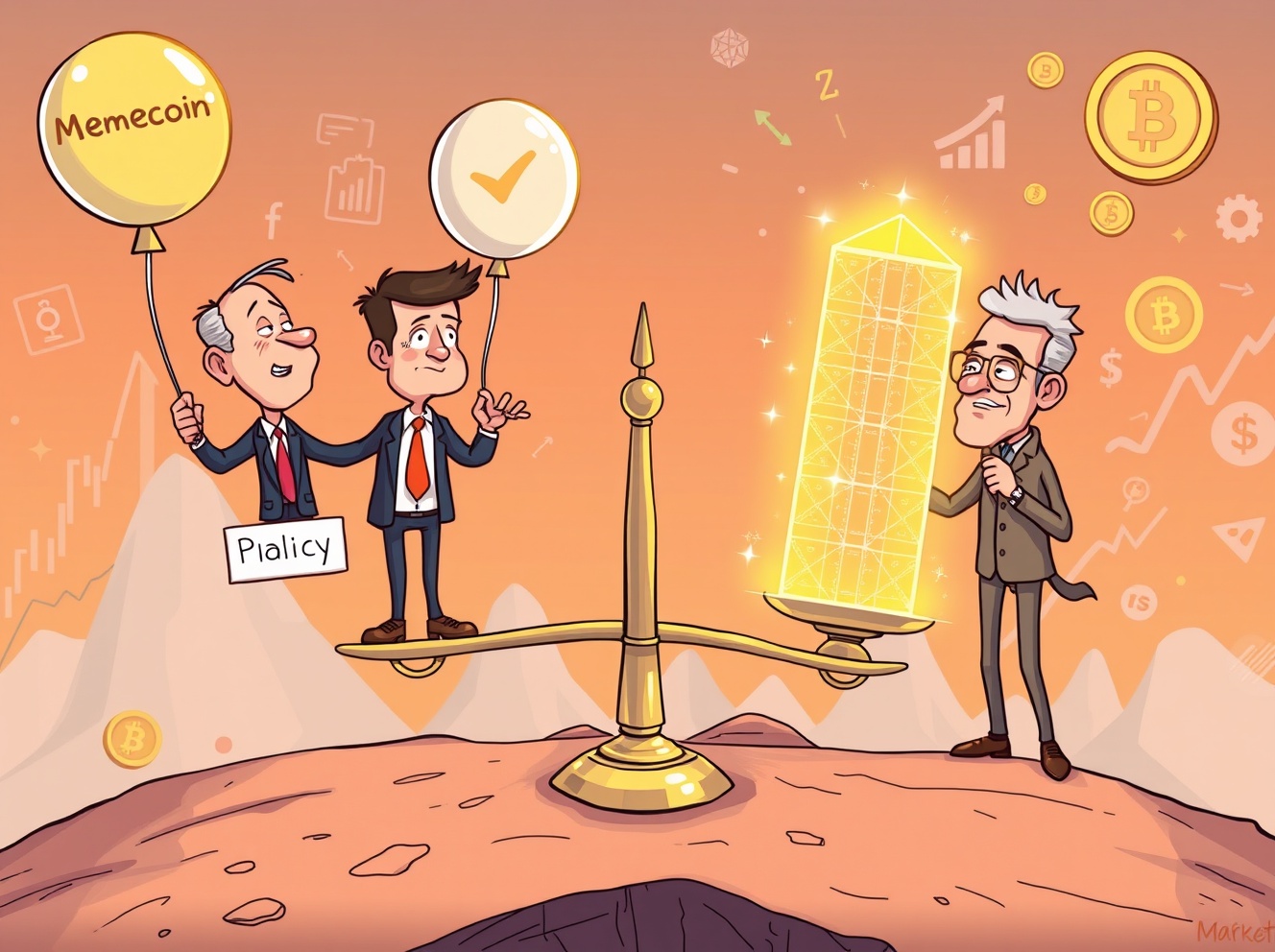

Charles Hoskinson, the founder of Cardano, has issued a stark warning about the state of the cryptocurrency industry. In a recent interview, he pointed directly at former President Donald Trump’s actions as a source of significant damage to the crypto market. Hoskinson argues that what should be a bipartisan effort for clear regulation has devolved into partisan conflict, creating uncertainty that hurts every investor and builder in the space.

How Did Trump’s Memecoin Launch Disrupt the Crypto Market?

Hoskinson identified a key moment of disruption: the launch of a Trump-branded memecoin just before the presidential inauguration. This move, according to Hoskinson, transformed cryptocurrency legislation from a technical policy discussion into a political football. The result? Vital conversations about consumer protection and innovation stalled as the focus shifted to partisan loyalty over substantive debate. This politicization injects volatility and fear into the crypto market, making it harder for serious projects to thrive.

The Controversial Plan for a Government Bitcoin Reserve

Another major point of criticism centers on Trump’s mentioned proposal for a U.S. strategic Bitcoin reserve. Hoskinson calls this “the government picking winners and losers,” a fundamental breach of the decentralized ethos of cryptocurrency. He suggests the plan is not a thoughtful economic strategy but a political tool. The inclusion of certain altcoins like Cardano (ADA) in discussions about this reserve seemed, to Hoskinson, more like an attempt to quiet critics than a genuine policy evaluation based on technology or utility.

This approach creates several problems for the crypto market:

- Market Distortion: Government favoritism can artificially inflate or suppress specific assets.

- Eroded Trust: It undermines trust in the market’s organic, merit-based dynamics.

- Regulatory Uncertainty: It signals that future regulation may be arbitrary and politically motivated.

Standing Up for Integrity in the Crypto Market

Hoskinson revealed that his outspoken criticism likely cost him an invitation to a high-profile presidential dinner. However, he emphasized that protecting the industry’s integrity is more important than access. His stance highlights a crucial conflict in the crypto market: the tension between seeking legitimacy through political engagement and maintaining the core principles of decentralization and neutrality. For founders like Hoskinson, the long-term health of the ecosystem depends on resisting short-term political games.

What Does This Mean for the Future of Crypto Regulation?

The current situation presents a clear challenge. The crypto market needs sensible, clear, and fair regulation to achieve mass adoption and protect users. However, when political figures intertwine their personal brand or agenda with the industry, it corrupts the process. The path forward requires a return to focus on the technology’s potential, its risks, and frameworks that foster innovation while ensuring security—free from the damaging influence of partisan spectacle.

In conclusion, Charles Hoskinson’s critique serves as a crucial alarm bell. The politicization of cryptocurrency, exemplified by recent actions, poses a genuine threat to market stability and ethical development. The industry’s future growth depends on navigating these political waters without compromising its foundational values. For the crypto market to mature, it must be driven by technology and community, not political maneuvering.

Frequently Asked Questions (FAQs)

What exactly did Charles Hoskinson criticize about Trump’s crypto actions?

Hoskinson criticized two main actions: the launch of a Trump memecoin, which he says turned crypto legislation into a partisan issue, and the proposal for a strategic Bitcoin reserve, which he views as inappropriate government market manipulation.

Why is a government Bitcoin reserve considered damaging to the crypto market?

It is seen as “picking winners and losers,” which goes against cryptocurrency’s decentralized nature. It can distort prices, create unfair advantages, and set a precedent for politically-driven intervention rather than rules-based regulation.

How does political partisanship hurt the cryptocurrency industry?

It creates regulatory uncertainty, scares away institutional investment, and stalls important policy discussions. When crypto becomes a partisan tool, achieving balanced, effective legislation becomes much harder.

Did Hoskinson’s comments have any personal consequence for him?

He believes they led to him not being invited to a presidential dinner, but he stated that defending the industry’s integrity was more important than that access.

What is the solution for better crypto market regulation?

The solution involves developing clear, technology-neutral rules through transparent, bipartisan collaboration that focuses on consumer protection, innovation, and market stability, without political favoritism.

Should crypto projects engage with politicians at all?

Engagement is necessary for education and sensible lawmaking, but it must be done carefully to avoid co-option and to ensure the industry’s core principles of decentralization and fairness are not compromised.

Found this analysis of political influence on the crypto market insightful? Share this article on your social media to spark a conversation about the need for integrity and sensible regulation in the cryptocurrency space. Your voice helps shape the future of this industry.

To learn more about the latest crypto market trends, explore our article on key developments shaping cryptocurrency regulatory frameworks and institutional adoption.

This post Damaging Impact: Cardano Founder Reveals How Trump’s Crypto Moves Hurt the Market first appeared on BitcoinWorld.

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

Mastercard Partners With Polygon to Enable Crypto Payments for Consumers and Merchants