$3 Billion Bitcoin Short Positions Face Liquidation Risk at $112,600: CoinGlass Data Reveals Market Vulnerability

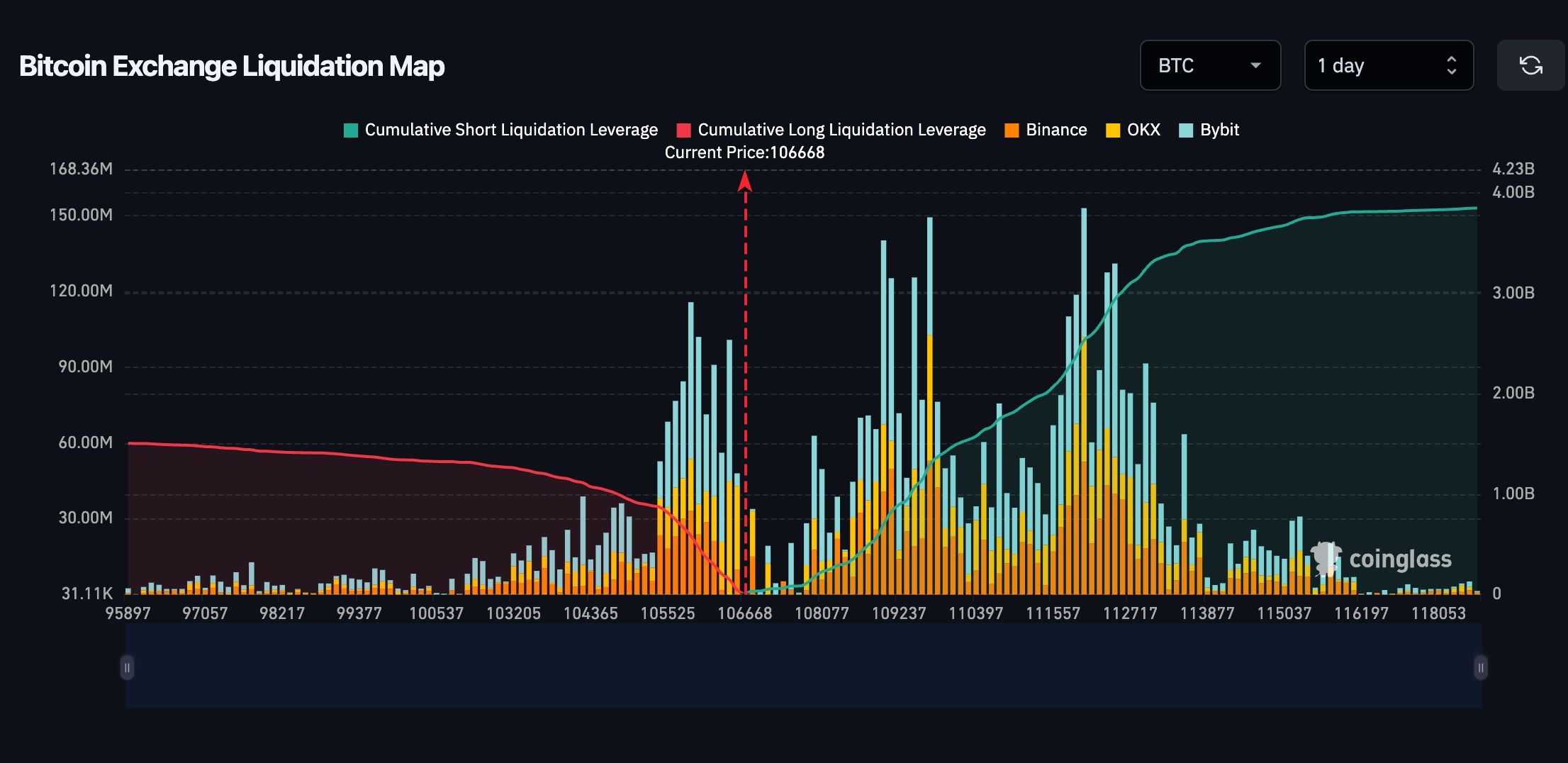

According to data from CoinGlass, a leading cryptocurrency analytics platform, approximately $3 billion worth of Bitcoin short positions stand at risk of liquidation if BTC rallies just 5% to reach $112,600. This substantial liquidation threshold highlights significant vulnerability in the derivatives market and could trigger a cascading short squeeze event.

Understanding the Liquidation Landscape

The CoinGlass data reveals a precarious situation for bearish traders who have wagered against Bitcoin's continued rise. With Bitcoin currently trading around $107,238, a modest 5% increase would push prices to $112,600, triggering automatic liquidations of short positions totaling approximately $3 billion across major cryptocurrency exchanges.

Liquidation occurs when a trader's leveraged position moves against them to the point where their margin balance becomes insufficient to maintain the position. Exchanges automatically close these positions to prevent further losses, creating forced buying pressure that can accelerate price movements.

The concentration of $3 billion in short liquidations at a relatively narrow price range indicates significant clustering of bearish positions. This clustering often results from traders employing similar leverage ratios and entry points, creating potential for rapid market movements once the liquidation threshold is breached.

Mechanics of a Short Squeeze

A short squeeze occurs when rising prices force short sellers to close their positions by buying back the asset, creating additional upward pressure. In cryptocurrency markets with high leverage availability, short squeezes can be particularly dramatic.

The liquidation process works as follows: When Bitcoin reaches $112,600, exchanges automatically market-buy Bitcoin to close short positions, creating immediate buying pressure. This buying pressure pushes prices higher, potentially triggering additional liquidations at higher price levels. The cascading effect can result in rapid price spikes as each wave of liquidations triggers the next.

Historical precedent demonstrates the power of short squeezes in cryptocurrency markets. Previous episodes have seen Bitcoin gain 10-20% within hours as liquidations cascade through leveraged positions. The larger the liquidation cluster, the more dramatic the potential price movement.

Market Implications and Trading Dynamics

The $3 billion liquidation threshold represents substantial market impact potential. For context, daily Bitcoin trading volume across major exchanges typically ranges from $20-40 billion. A sudden injection of $3 billion in forced buying could move markets significantly, particularly if it occurs during lower-liquidity periods.

Traders aware of liquidation clusters often position themselves to profit from anticipated squeezes. This "hunting" behavior can create self-fulfilling prophecies as long positions accumulate in anticipation of short liquidations, providing the initial buying pressure needed to trigger the cascade.

The current market structure shows Bitcoin in a consolidation phase following recent gains. The presence of substantial short positions suggests many traders expect either a correction or sideways movement. However, any catalyst pushing prices toward $112,600 could rapidly shift market dynamics.

Exchange Distribution and Systemic Risk

CoinGlass data typically aggregates liquidation information across major exchanges including Binance, Bybit, OKX, and others. The distribution of short positions across multiple platforms reduces systemic risk compared to concentration on a single exchange, though coordinated liquidations across exchanges can still create significant market impact.

Different exchanges employ varying liquidation mechanisms and margin requirements. Some use gradual liquidation systems designed to minimize market impact, while others employ immediate full liquidation. The specific mechanics influence how the $3 billion would actually flow into the market.

Risk management protocols at major exchanges have evolved following past liquidation events. Circuit breakers, trading halts, and other protective mechanisms may activate during extreme volatility, potentially moderating the impact of large-scale liquidations.

Leverage and Derivatives Market Health

The accumulation of $3 billion in short positions reflects the substantial leverage available in cryptocurrency derivatives markets. Many platforms offer leverage up to 100x, allowing traders to control large positions with relatively small capital. While this amplifies profit potential, it also creates liquidation vulnerability.

High leverage cuts both ways. Just as $3 billion in shorts face liquidation at $112,600, substantial long positions would face similar risk on downward price movements. The derivatives market constantly balances between these opposing forces.

Market health indicators suggest moderate leverage usage compared to peak periods. During extreme bull markets, open interest and leverage ratios often reach unsustainable levels. Current metrics indicate a more balanced market, though the $3 billion short cluster represents a notable imbalance.

Technical Analysis Context

From a technical perspective, Bitcoin's path to $112,600 faces several key resistance levels. Chart analysis shows potential barriers around $108,000, $110,000, and $111,500 before reaching the critical liquidation zone. Each resistance level could slow momentum or trigger profit-taking.

However, awareness of the $112,600 liquidation cluster may actually attract buying interest. Traders seeking to benefit from potential short squeezes might accumulate positions in anticipation, creating organic buying pressure that helps overcome resistance levels.

Volume profiles indicate significant trading activity in the $105,000-$110,000 range, suggesting this zone serves as a consolidation area. A breakout above $110,000 with strong volume could signal momentum sufficient to reach $112,600.

Historical Liquidation Events

Previous major liquidation events provide context for potential outcomes. In May 2021, cascading liquidations contributed to Bitcoin's rapid drop from $64,000 to $30,000 as long positions unwound. Conversely, short squeezes have driven dramatic rallies during bull markets.

The cryptocurrency market has experienced numerous liquidation events exceeding $1 billion. The $3 billion threshold represents a substantial but not unprecedented cluster. Market maturation and improved risk management have somewhat reduced liquidation event frequency and severity.

Learning from history, traders should recognize that liquidations often occur during periods of low liquidity when market depth is insufficient to absorb large orders. Weekend trading or Asian market hours could see more dramatic movements if liquidations trigger during these periods.

Risk Factors and Considerations

Several factors could prevent Bitcoin from reaching $112,600 despite the liquidation incentive. Macroeconomic headwinds, regulatory announcements, or technical failures could reverse momentum. Additionally, large holders may sell into strength, providing resistance that prevents reaching the liquidation zone.

Market makers and sophisticated traders with knowledge of liquidation clusters might intentionally prevent prices from reaching trigger points. By selling into rallies approaching $112,600, they could cap gains and profit from eventual reversals while preventing competitor liquidations.

The presence of $3 billion in short liquidations doesn't guarantee Bitcoin will reach $112,600. Markets require sufficient buying pressure and catalysts to drive prices higher. Without fundamental or technical drivers, prices may consolidate below liquidation thresholds indefinitely.

Strategic Implications for Traders

For long-term investors, short-term liquidation dynamics may have limited relevance. However, traders should recognize the potential for increased volatility around $112,600. Position sizing and risk management become particularly important when approaching known liquidation clusters.

Conservative traders might reduce exposure or take profits before reaching liquidation zones, anticipating increased volatility. Aggressive traders might add to long positions, betting on short squeeze momentum. Both approaches carry risks requiring careful consideration.

Stop-loss placement becomes critical in high-liquidation environments. Traders should position stops to avoid being caught in cascading liquidations while protecting against genuine reversals. This balance requires understanding market structure and liquidation dynamics.

Conclusion

The CoinGlass data revealing $3 billion in Bitcoin short liquidations at $112,600 highlights significant market structure implications. A modest 5% rally could trigger cascading liquidations, potentially accelerating price movements through forced buying pressure.

While liquidation clusters create potential for dramatic moves, they don't guarantee specific outcomes. Market dynamics involve complex interactions between leverage, liquidity, sentiment, and fundamental factors. Traders should approach the $112,600 level with awareness of heightened volatility potential.

The presence of substantial short positions during Bitcoin's current price levels reflects market uncertainty about near-term direction. Whether bulls can generate sufficient momentum to trigger liquidations remains to be seen, but the $3 billion threshold represents a clear inflection point with significant implications for market participants.

You May Also Like

BlackRock boosts AI and US equity exposure in $185 billion models

Filecoin (FIL) Rises Over 4% as Token Rebounds