Bitcoin’s Sudden Breakdown Sparks $210M Liquidation Storm in 1 Hour

The calmness around $90,000 didn’t last long as bitcoin nosedived once again on Monday afternoon during the initial hours of US trading.

The primary cryptocurrency stood close to $90,000 as of minutes ago, but it suddenly plunged to a two-week low of $86,700.

BTCUSD Dec 15. Source: TradingView

BTCUSD Dec 15. Source: TradingView

As hinted earlier today, the week is expected to be highly volatile due to the significant economic data scheduled for release in the following days. However, no main culprit is evident for the current price drop, aside from the changes in the odds for the next Federal Reserve chair, as reported by Walter Bloomberg.

Aside from BTC, many other altcoins have followed suit on the way south. Ethereum is close to breaking below $3,000 following a 4.4% decline in the past hour alone. This comes amid notable warnings that ETH could soon plunge to $2,500.

XRP has slumped by 3% in an hour and has lost the $2.00 support. BNB is down by 4% within the same timeframe, and so is SOL.

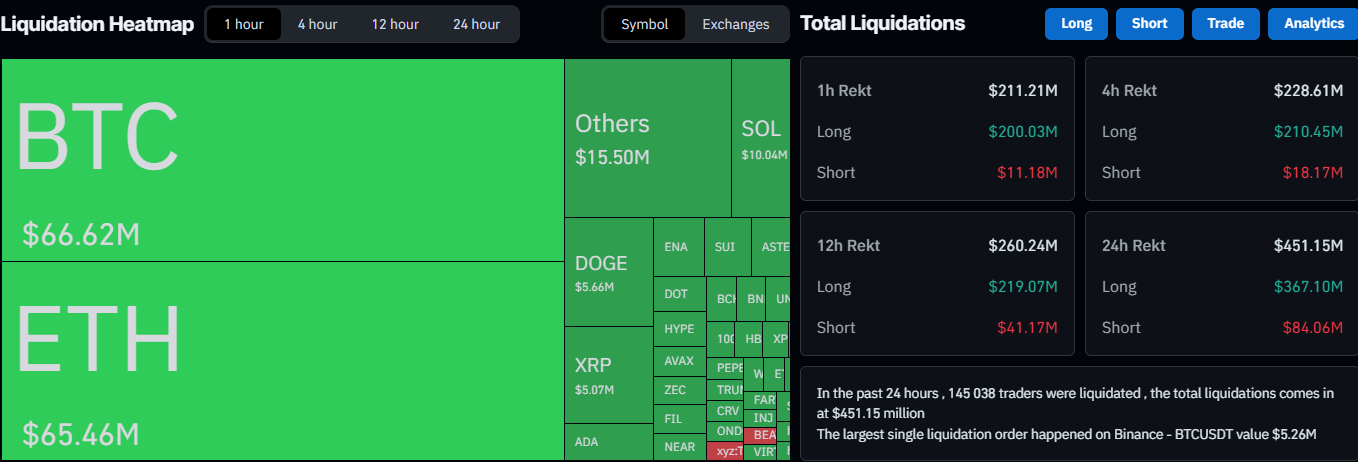

Expectedly, the total value of wrecked positions is on the rise. In the past hour alone, $210 million worth of mostly long positions have been wiped out, while the number for the last 24 hours is $450 million.

BTC and ETH are responsible for the lion’s share, with $66 million and $65 million in longs wrecked hourly. Roughly 145,000 traders have been liquidated daily.

Liquidation Data on CoinGlass

Liquidation Data on CoinGlass

The post Bitcoin’s Sudden Breakdown Sparks $210M Liquidation Storm in 1 Hour appeared first on CryptoPotato.

You May Also Like

Unlock Potential: OKX Lists LIGHT Perpetual Futures with 50x Leverage

New Gold Protocol's NGP token was exploited and attacked, resulting in a loss of approximately $2 million.