The Fed Is Preparing for a Meeting: The Crypto Market Is Watching the Rate Decision

- On December 10, the Fed will hold a rate meeting.

- A 25bp cut is forecast at up to 96.6%.

- Experts believe that due to political pressure and a lack of data, the December meeting will be the most difficult this year.

- In addition, according to some analysts, there may be a pause in further rate cuts.

The Federal Open Market Committee (FOMC) will meet on December 10, 2025, to decide on the future course of monetary policy. After a 0.25% rate cut in October, investors are expecting another easing, although uncertainty is higher than usual this time.

According to CME’s FedWatch Tool, the probability of another 25 basis points (bps) rate cut is 87.6% at the time of writing, while before the recent comments by Federal Reserve officials, markets estimated the chance of such a move at less than 30%.

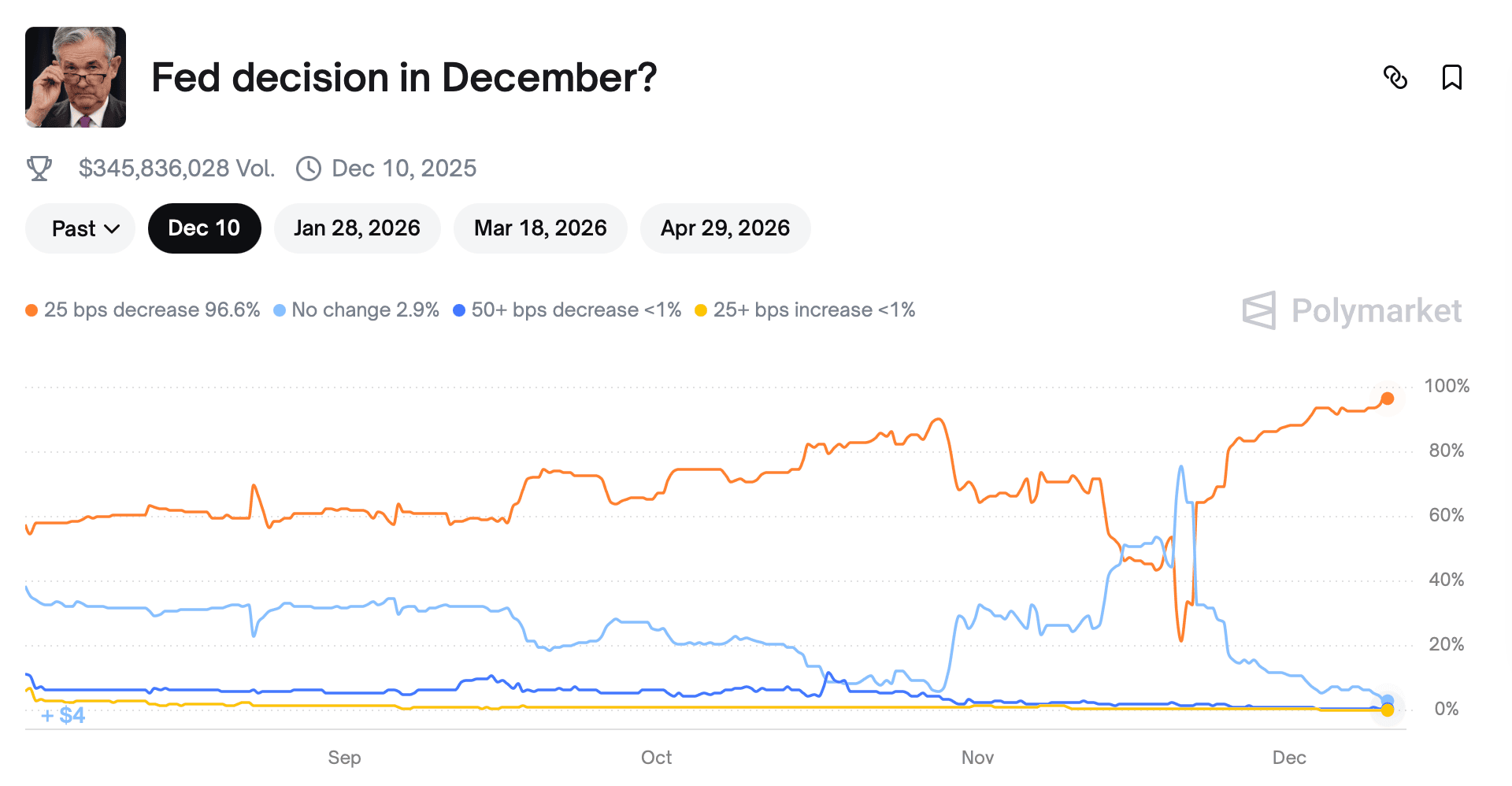

Meanwhile, Polymarket estimates the probability of a 25bps cut at 96.6%, putting <1% on a 50bps cut and 2.9% on the rate remaining at the October level.

Polymarket’s forecast for the Fed’s interest rate decision in December. Source: Polymarket.

Polymarket’s forecast for the Fed’s interest rate decision in December. Source: Polymarket.

Peter Cardillo, chief market economist at Spartan Capital Securities, told Reuters that the market may pause after the December decline:

Unlike previous meetings, this time the decision is complicated by the fact that no October statistics were collected due to the federal government shutdown. It lasted from 1 October to 12 November.

According to Forbes, the Bureau of Labor Statistics will not publish inflation and employment data for October, and the November reports will appear only after the meeting — on December 16 and 18, respectively. This means that FOMC members will be making decisions without the most up-to-date information, and, according to the publication, the lack of data will be part of their discussions.

As a reminder, on October 29, the Fed already cut the rate by 0.25%, bringing the range to 3.75-4%. This was the second consecutive easing decision after the September cut, which previously supported the stock and cryptocurrency markets.

At that time, Fed Chairman Jerome Powell said that further steps were not guaranteed, which caused a short-term negative impact on the crypto market.

Meanwhile, analysts at BofA Global Research predicted that the Fed will cut the rate again by 25 bps in December, citing weakness in the labour market and signals from Fed members about early easing. The bank also foresees two more cuts in 2026, noting:

Pressure on the Fed is also growing politically. Kevin Hassett, head of the National Economic Council, who Bloomberg called the main contender for the Fed chairmanship, said he sees “plenty of room” for a rate cut of more than 25 bps.

At the same time, US President Donald Trump, who will appoint a new Fed chairman in early 2026, was even harsher. In an interview with Politico, he confirmed that there is a clear requirement for the new Fed chairman. When asked if “immediate rate cuts” would be an expectation, Trump answered positively.

He also stated:

According to CNBC‘s analysis, a “hawkish cut” is likely, meaning that the rate will be cut, but the rhetoric will point to a possible pause.

Goldman Sachs added that Powell is likely to emphasize the opinion of committee members who opposed the cut.

Other supporters of further cuts include Federal Reserve Bank of New York President John Williams, who is a member of the FOMC, who said that the weakness of the labour market currently outweighs the risks of inflation.

It is worth noting that bitcoin is trading at $92,665, according to TradingView at the time of writing.

Daily chart of BTC/USDT on Binance. Source: TradingView.

Daily chart of BTC/USDT on Binance. Source: TradingView.

Earlier, we wrote about how the Fed’s decision could affect the movement of the bitcoin price. Read more in a separate article:

You May Also Like

ZEC Surges Toward $480 Resistance, Is a $520 Breakout Next?

Venezuela’s Growing USDT Reliance May Aid Sanctions Evasion Amid US Tensions, TRM Report Suggests