MSTR stock vs. MSTY stock: Which offers better returns in a Bitcoin bull run?

The YieldMax MSTR Option Income Strategy ETF has grown into a $4.8 billion fund, driven by its 136% dividend yield and its connection to Strategy, the largest corporate holder of Bitcoin.

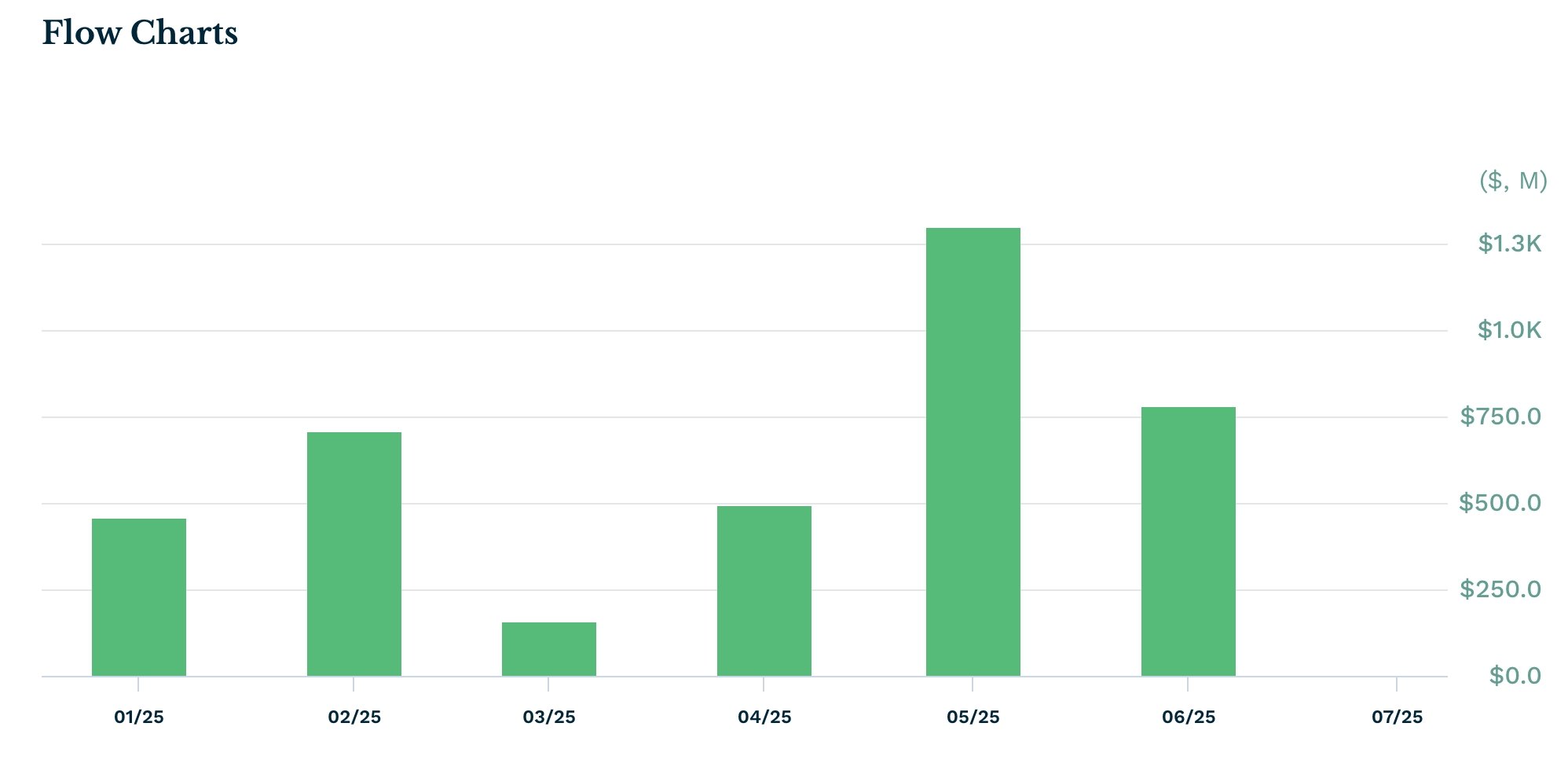

MSTY’s inflows have increased each month this year, with the net amount reaching $3.9 billion. This trajectory may continue if Bitcoin (BTC) breaks out and hits a new all-time high, as Polymarket traders expect.

Demand is also rising because Strategy’s core stock does not pay a dividend. Instead, MSTY generates its monthly distributions through a covered call strategy.

In a covered call approach, the fund invests a portion of its capital in Strategy stock and benefits as the stock rises. It then sells call options on the stock, generating premium income, which it distributes to investors.

A call option is a contract that gives the investor the right, but not the obligation, to buy an asset at a specific price within a certain time period.

If MSTR stock drops below the strike price, the option becomes worthless since the stock can be bought directly on the market. If the stock rises above the strike price, the call option is exercised. In this case, the fund retains the premium but sacrifices additional upside if the rally continues.

If the stock remains flat, the ETF still generates a return through the monthly premium. These scenarios explain why MSTY and other covered call ETFs offer high dividend yields.

MSTY has a lower total return than MSTR

The 136% dividend yield is highly enticing to many income investors. For instance, a $10,000 investment would yield a gross annual dividend payment of $13,600 if the yield remains constant.

However, a closer look reveals that MSTY’s total return has lagged behind MSTR’s. Data shows that MSTY has declined by 18% year to date, while MSTR stock is up 34%.

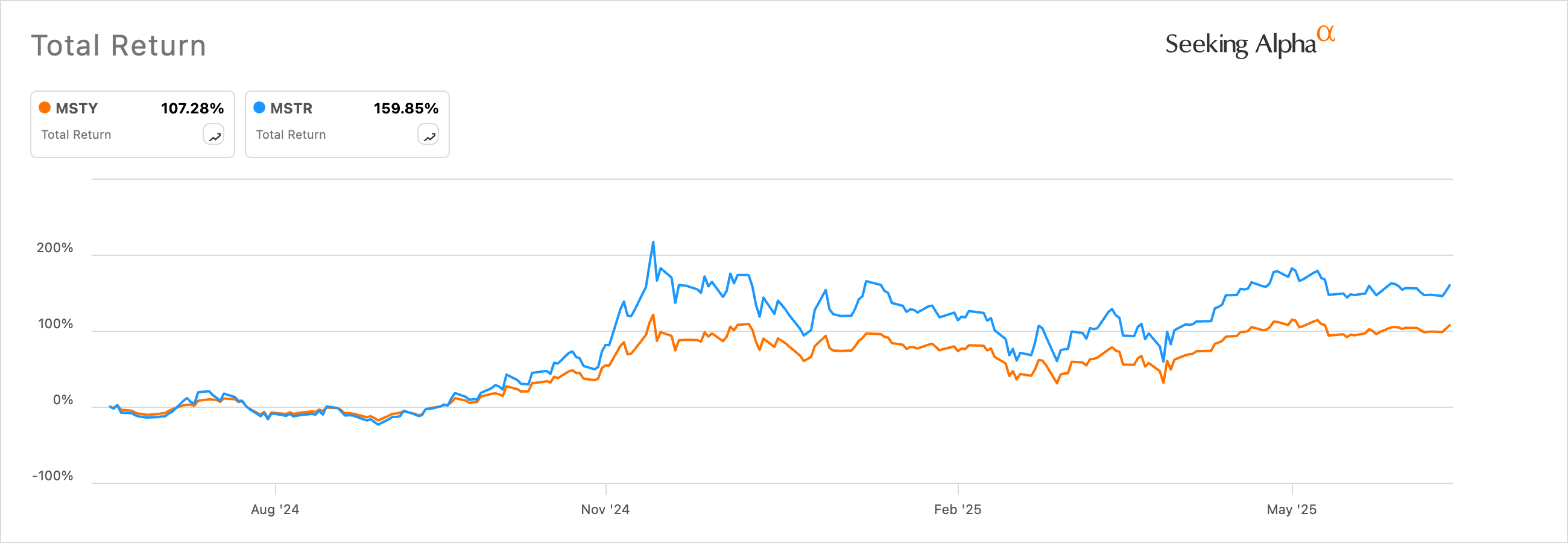

The best measure of an ETF’s performance is the total return, which includes dividends. In this case, MSTR stock has risen 34.20% this year, while MSTY has gained 29%. As shown below, MSTY’s total return over the past 12 months was 107%, compared to MSTR’s 160%.

A similar trend appears across most covered call ETFs. For example, Coinbase stock has advanced 60% in the past 12 months, while the YieldMax COIN Option Income Strategy ETF (CONY) has risen 24%. Similarly, the $40 billion JEPI ETF consistently lags behind the S&P 500 Index.

You May Also Like

XRPR and DOJE ETFs debut on American Cboe exchange

Over 60% of crypto press releases linked to high-risk or scam projects: Report