Turbo Price Prediction: TURBO Spikes 50% as Bulls Target $0.0030

Highlights:

- The Turbo price has rallied 50% to $0.0024, breaking out of a 2-month downtrend.

- The derivatives market indicates growing confidence as the open interest spikes 363%.

- Technical outlook suggests potential upside towards $0.0030 in the short term, provided the $0.0021 support level remains intact.

The Turbo price is currently trading at $0.0024, representing a 50% increase in the past 24 hours. The meme coin has broken out of the 2-month downtrend, showing intense bullish sentiment. Reinforcing the bullish grip is its daily trading volume, which has increased by 998%, indicating heightened trading activity and investor confidence.

A quick look at the derivatives statistics suggests that market conditions are improving, with rising open interest and volume indicating further bullishness. In the meantime, technical indicators also indicate the fading bearish pressure, which is why a further upside in the Turbo price is imminent.

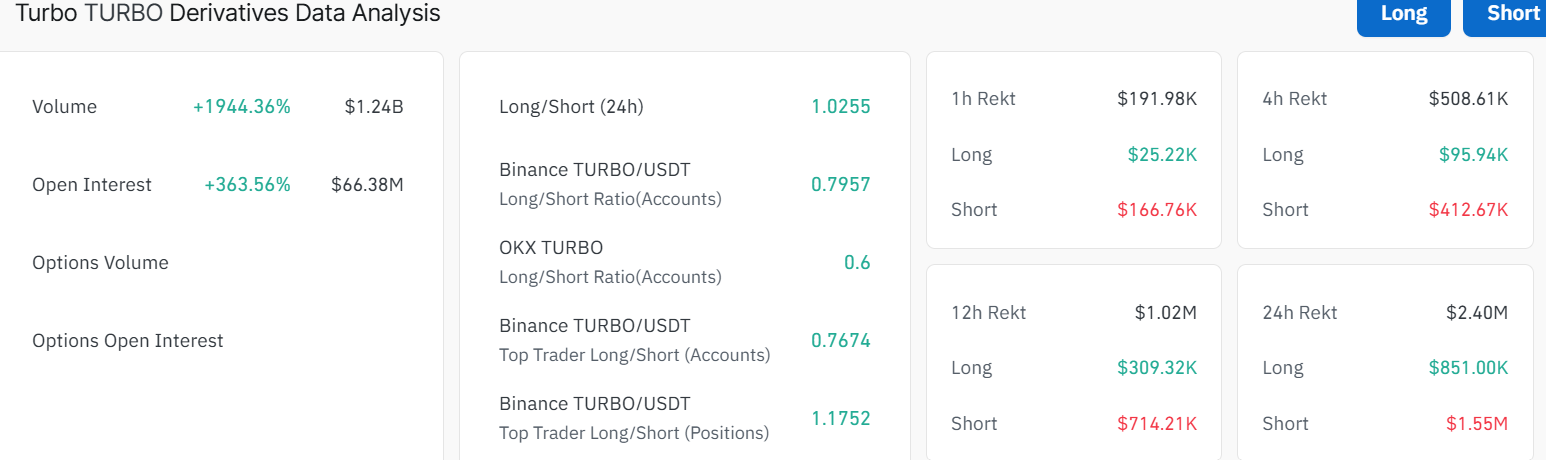

The Coinglass data shows that many traders are trading on future price changes, with the present open interest of $66.38 million, which has increased by 363% in the past 24 hours. With the recent market experience of a huge influx of overleveraged positions, new positions are more likely to emerge, causing a surge in the Turbo price.

Turbo Derivatives Data: CoinGlass

Turbo Derivatives Data: CoinGlass

Turbo has also been doing well on the long-to-short ratio. Currently at 1.0255, indicating a better-balanced market sentiment with an inclination towards long positions. In other words, the bulls are having the upper hand in the market.

Turbo Price Breaks Out of the Falling Channel, Eyes $0.0030

The TURBO chart shows a token with bullish momentum. The price recently broke out of a falling parallel pattern, bouncing strongly from the major demand zone at $0.0013. This zone previously triggered a strong rally in April. Meanwhile, the breakout is supported by the 50-day Simple Moving Average (SMA) on the 1-day chart, currently at $0.0021, which has flipped into a major support zone.

The 50-day SMA at $0.0021 is holding steady, while the 200 SMA at $0.0037 serves as a strong long-term resistance. However, with volatility kicking in, the Turbo price may surge higher to the 200-day SMA.

TURBO/USD 1-day chart: TradingView

TURBO/USD 1-day chart: TradingView

The RSI (Relative Strength Index) at 65.23 indicates intense buying pressure in the market. However, there is still room before the meme coin reaches overbought territory, cautioning of a potential pullback.

The falling channel from which the price broke out suggests buyers are streaming in, reinforced by strong volume. If the Turbo price holds above the $0.0021 support zone, there could be a push toward $0.0030, the immediate resistance. However, a drop below $0.0021 might signal a retreat to $0.0013 for support.

The Turbo price still has room to move. The 50% surge shows retail FOMO, but the chart traders should be cautious if the meme coin spikes above the 70+ region. In the short term, traders could aim for $0.0030 if the breakout holds. In the long term, the $0.0037 resistance could come into play if this trend persists. For now, cautious investors may wait for a breakout above the $0.0030. With no overbought signals yet, the TURBO rally may just be beginning.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

USD/CHF rises on US dollar rebound, weak Swiss economic data

Turkmenistan Passes Law to Regulate Crypto Market: Report