World Liberty Financial (WLFI) Price Prediction 2025, 2026-2030

- Bullish WLFI price prediction for 2025 is $0.1740 to $0.2585.

- World Liberty Financial (WLFI) price might reach $1 soon.

- Bearish WLFI price prediction for 2025 is $0.0715.

In this World Liberty Financial (WLFI) price prediction 2025, 2026-2030, we will analyze the price patterns of WLFI by using accurate trader-friendly technical analysis indicators and predict the future movement of the cryptocurrency.

|

TABLE OF CONTENTS

|

|

INTRODUCTION

|

|

|

WORLD LIBERTY FINANCIAL PRICE PREDICTION 2025

|

|

| WLFI PRICE PREDICTION 2026, 2027-2030 |

| CONCLUSION |

| FAQ |

World Liberty Financial (WLFI) Current Market Status

| Current Price | $0.1630 |

| 24 – Hour Price Change | 0.48% Down |

| 24 – Hour Trading Volume | $175.59M |

| Market Cap | $4.35B |

| Circulating Supply | 26.73B WLFI |

| All – Time High | $0.46 (On Sep 01, 2025) |

| All – Time Low | $0.1632 (On Sep 04, 2025) |

What is World Liberty Financial (WLFI)

| TICKER | WLFI |

| BLOCKCHAIN | Ethereum (ERC-20 standard) |

| CATEGORY | Decentralized Finance (DeFi) |

| LAUNCHED ON | July 2024 |

| UTILITIES | Governance, Lending, Borrowing, Payments, Staking |

World Liberty Financial (WLF) is a U.S.-based decentralized finance (DeFi) platform launched to provide blockchain-powered financial services such as lending, borrowing, and governance. The project introduces a governance token, WLFI, which allows holders to participate in decision-making, and a stablecoin, USD1, designed to facilitate reliable and borderless digital transactions. The platform emphasizes transparency, accessibility, and interoperability across multiple blockchains, positioning itself as an alternative to traditional financial systems.

The Trump family is closely tied to the initiative, with Donald Trump serving as “Chief Crypto Advocate” and his sons taking on ambassador roles in promoting the platform. Their involvement has drawn significant attention, both from supporters and critics. While some view WLF as a bold step toward mainstream adoption of digital finance, others raise concerns about potential conflicts of interest and the blending of private enterprise with political influence.

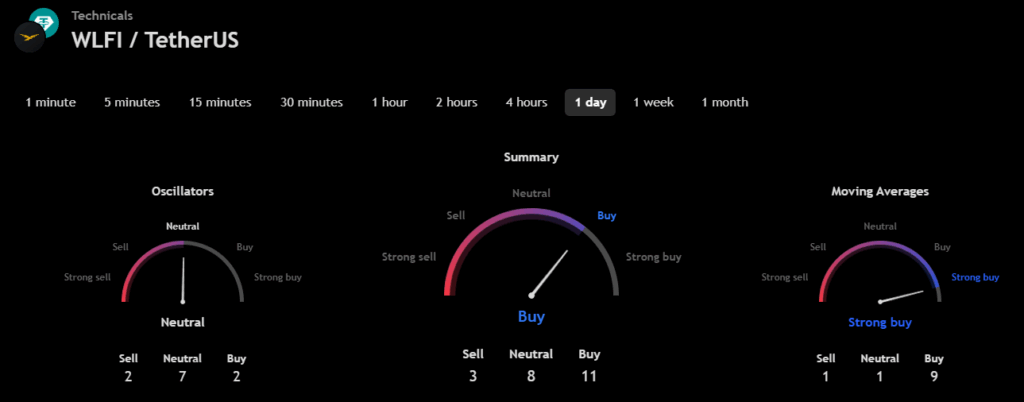

World Liberty Financial 24H Technicals

(Source: TradingView)

(Source: TradingView)

World Liberty Financial (WLFI) Price Prediction 2025

World Liberty Financial (WLFI) ranks 25th on CoinMarketCap in terms of its market capitalization. The overview of the World Liberty Financial price prediction for 2025 is explained below with a daily time frame.

In the above chart, World Liberty Financial (WLFI) laid out an Horizontal Channel pattern also known as the sideways trend. In general, the horizontal channel is formed during the price consolidation. In this pattern, the upper trendline, the line which connects the highs, and the lower trendline, the line which connects the lows, run horizontally parallel and the price action is contained within it.

A horizontal channel is often regarded as one of the suitable patterns for timing the market as the buying and selling points are in consolidation.

At the time of analysis, the price of World Liberty Financial (WLFI) was recorded at $0.1630. If the pattern trend continues, then the price of WLFI might reach the resistance levels of $0.1540 and $0.1915. If the trend reverses, then the price of WLFI may fall to the support of $0.1352 and $0.1164.

World Liberty Financial (WLFI) Resistance and Support Levels

The chart given below elucidates the possible resistance and support levels of World Liberty Financial (WLFI) in 2025.

From the above chart, we can analyze and identify the following as resistance and support levels of World Liberty Financial (WLFI) for 2025.

| Resistance Level 1 | $0.1740 |

| Resistance Level 2 | $0.2585 |

| Support Level 1 | $0.1166 |

| Support Level 2 | $0.0715 |

World Liberty Financial (WLFI) Price Prediction 2025 — RVOL, MA, and RSI

The technical analysis indicators such as Relative Volume (RVOL), Moving Average (MA), and Relative Strength Index (RSI) of World Liberty Financial (WLFI) are shown in the chart below.

From the readings on the chart above, we can make the following inferences regarding the current World Liberty Financial (WLFI) market in 2025.

| INDICATOR | PURPOSE | READING | INFERENCE |

| 50-Day Moving Average (50MA) | Nature of the current trend by comparing the average price over 50 days | 50 MA = $0.1641 Price = $0.1471 (50MA > Price) | Bearish/Downtrend |

| Relative Strength Index (RSI) | Magnitude of price change;Analyzing oversold & overbought conditions | 49.2908 <30 = Oversold 50-70 = Neutral >70 = Overbought | Nearly Oversold |

| Relative Volume (RVOL) | Asset’s trading volume in relation to its recent average volumes | Below cutoff line | Weak volume |

World Liberty Financial (WLFI) Price Prediction 2025 — ADX, RVI

In the below chart, we analyze the strength and volatility of World Liberty Financial (WLFI) using the following technical analysis indicators — Average Directional Index (ADX) and Relative Volatility Index (RVI).

From the readings on the chart above, we can make the following inferences regarding the price momentum of World Liberty Financial (WLFI).

| INDICATOR | PURPOSE | READING | INFERENCE |

| Average Directional Index (ADX) | Strength of the trend momentum | 46.4946 | Strong Trend |

| Relative Volatility Index (RVI) | Volatility over a specific period | 57.26 <50 = Low >50 = High | High Volatility |

Comparison of WLFI with BTC, ETH

Let us now compare the price movements of World Liberty Financial (WLFI) with that of Bitcoin (BTC), and Ethereum (ETH).

From the above chart, we can interpret that the price action of WLFI is similar to that of BTC and ETH. That is, when the price of BTC and ETH increases or decreases, the price of WLFI also increases or decreases, respectively.

World Liberty Financial (WLFI) Price Prediction 2026, 2027 – 2030

With the help of the aforementioned technical analysis indicators and trend patterns, let us predict the price of World Liberty Financial (WLFI) between 2026, 2027, 2028, 2029, and 2030.

| Year | Bullish Price | Bearish Price |

| World Liberty Financial (WLFI) Price Prediction 2026 | $3 | $0.1 |

| World Liberty Financial (WLFI) Price Prediction 2027 | $5 | $0.09 |

| World Liberty Financial (WLFI) Price Prediction 2028 | $7 | $0.08 |

| World Liberty Financial (WLFI) Price Prediction 2029 | $9 | $0.07 |

| World Liberty Financial (WLFI) Price Prediction 2030 | $11 | $0.06 |

Conclusion

If World Liberty Financial (WLFI) establishes itself as a good investment in 2025, this year would be favorable to the cryptocurrency. In conclusion, the bullish World Liberty Financial (WLFI) price prediction for 2025 is $0.2585. Comparatively, if unfavorable sentiment is triggered, the bearish World Liberty Financial (WLFI) price prediction for 2025 is $0.0715.

If the market momentum and investors’ sentiment positively elevate, then World Liberty Financial (WLFI) might hit $1. Furthermore, with future upgrades and advancements in the World Liberty Financial ecosystem, WLFI might surpass its current all-time high (ATH) of $0.46 and mark its new ATH.

FAQ

1. What is World Liberty Financial (WLFI)?

World Liberty Financial (WLF) is a U.S.-based decentralized finance (DeFi) platform launched to provide blockchain-powered financial services such as lending, borrowing, and governance.

2. Where can you buy World Liberty Financial (WLFI)?

Traders can trade World Liberty Financial (WLFI) on the following cryptocurrency exchanges such as Binance, Bybit, OKX, KuCoin, gate.io, MEXC, Bitget, bingX, HTX.

3. Will World Liberty Financial (WLFI) record a new ATH soon?

With the ongoing developments and upgrades within the World Liberty Financial platform, World Liberty Financial (WLFI) has a high possibility of reaching its ATH soon.

4. What is the current all-time high (ATH) of World Liberty Financial (WLFI)?

World Liberty Financial (WLFI) hit its current all-time high (ATH) of $0.46 on September 01, 2025.

5. What is the lowest price of World Liberty Financial (WLFI)?

According to CoinMarketCap, WLFI hit its all-time low (ATL) of $0.1632 on September 04, 2025.

6. Will World Liberty Financial (WLFI) hit $1?

If World Liberty Financial (WLFI) becomes one of the active cryptocurrencies that majorly maintain a bullish trend, it might rally to hit $1 soon.

7. What will be the World Liberty Financial (WLFI) price by 2026?

World Liberty Financial (WLFI) price might reach $3 by 2026.

8. What will be the World Liberty Financial (WLFI) price by 2027?

World Liberty Financial (WLFI) price might reach $5 by 2027.

9. What will be the World Liberty Financial (WLFI) price by 2028?

World Liberty Financial (WLFI) price might reach $7 by 2028.

10. What will be the World Liberty Financial (WLFI) price by 2029?

World Liberty Financial (WLFI) price might reach $9 by 2029.

Top Crypto Predictions

MANTRA (OM) Price Prediction

XDC Network (XDC) Price Prediction

Kaspa (KAS) Price Prediction

Disclaimer: The opinion expressed in this article is solely the author’s. It does not represent any investment advice. TheNewsCrypto team encourages all to do their own research before investing.

You May Also Like

The Channel Factories We’ve Been Waiting For

BitMine koopt $44 miljoen aan ETH