SPX Price Prediction 2025: Can SPX 6900 Crypto Break Above $1 Before 2025 Ends?

The post SPX Price Prediction 2025: Can SPX 6900 Crypto Break Above $1 Before 2025 Ends? appeared first on Coinpedia Fintech News

The SPX price prediction 2025 gains attention this week as the memecoin rebounds sharply from its long-standing demand zone. With rising weekly and intraday gains, growing holder accumulation, and supportive moves in BTC and the S&P 500 index itself, traders are watching whether this momentum can fuel a stronger rally into December.

SPX Price Prediction 2025 Strengthens as Weekly Gains Lead the Meme Market

Among the top 15 memecoins by market cap, only three SPX, FART, and B are posting simultaneous positive gains on weekly and intraday timeframes, also. Notably, SPX/USD stands out with 18% weekly and 20% intraday growth, while others show only mild upside on weekly gains. This suggests investor interest is flowing into SPX 6900 crypto more.

Part of this momentum comes from broader market dynamics. Bitcoin’s rise from $80,500 to $87,000 this week has renewed risk-on appetite, creating a favorable backdrop for memecoins.

Likewise, the S&P 500 index is climbing and making price action aimed toward a potential new all-time high surpassing $6926 is indirectly elevating attention toward its parody version, SPX memecoin, reinforcing speculative enthusiasm.

Accumulation Grows as SPX Price USD Rebounds from Key Demand Zone

Another constructive signal emerges from holder trends. Holderscan data shows that since the October crash from $1.60, investors have steadily accumulated SPX. Holder count increased from 105,210 in late October to 107,910 in late November, confirming persistent demand at lower price levels. This period reflects strategic accumulation as SPX/USD traded at a discount.

Similarly, its price action aligned with this behavior. The longstanding demand zone between $0.40 and $0.58 remained active through the recent downturn, and once again acted as the base for a trend reversal.

As of writing, the SPX price today stands at $0.6436 with a market cap of $599.19 million, signaling renewed confidence from traders betting on a December breakout.

SPX Price Chart Shows Path Toward $1 and Beyond, If Momentum Sustains

Technically, the closest logical target in the near term is the $1 level, a major resistance that has capped SPX for now. Should SPX price USD close above this threshold in December, a reclaim of $1.60 becomes feasible, which would imply a potential 160% rally from current levels.

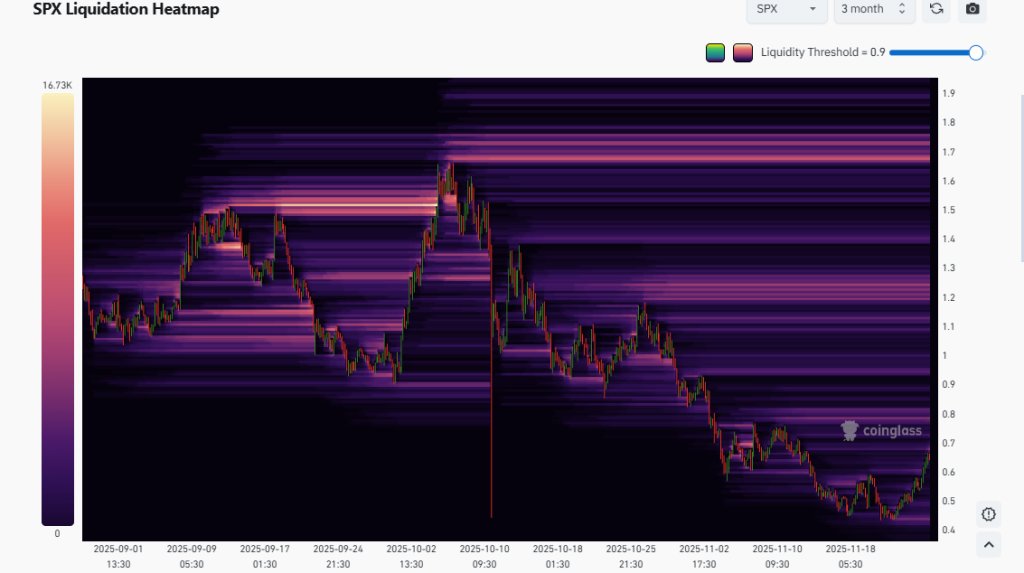

Supporting this outlook, liquidity data from Coinglass highlights strong liquidity clusters at $1.20 and $1.70, suggesting these zones may act like magnets during a bullish rally. These levels align well with current SPX price forecast expectations for a December or 2026-first-half continuation.

However, if bullish momentum fades, consolidation back toward $0.40 could persist into early 2026. Thus, the SPX price prediction 2025 ultimately depends on maintaining holder strength while avoiding liquidity traps.

With market-wide risk appetite rising faintly for now and SPX holders steadily accumulating, the SPX price prediction 2025 hinges on whether momentum can sustain above the long-protected demand zone.

You May Also Like

USD/CHF rises on US dollar rebound, weak Swiss economic data

Turkmenistan Passes Law to Regulate Crypto Market: Report