XRP Price Roars Back With 8% Surge As Franklin Templeton, Grayscale XRP ETFs List On NYSE Arca

The XRP price surged 8% over the past 24 hours to trade at $2.21 as of 3:02 a.m. EST on trading volume that surged 56% to $6.2 billion.

This comes as Grayscale and Franklin Templeton listed on Monday XRP ETFs on NYSE Arca, bringing the total Ripple token ETFs to four. The first, the Canary Capital XRP ETF, debuted on November 13, followed a week later by the Bitwise product.

Grayscale’s fund trades under the GXRP ticker and waived its standard 0.35% fee for 3 months, or until assets reach $1 billion.

Franklin Templeton launched its XRP fund under the ticker XRPZ and charges a 0.19% fee, with a full waiver on the first $5 billion in assets until May 31.

XRP Price Poised For A Sustained Recovery

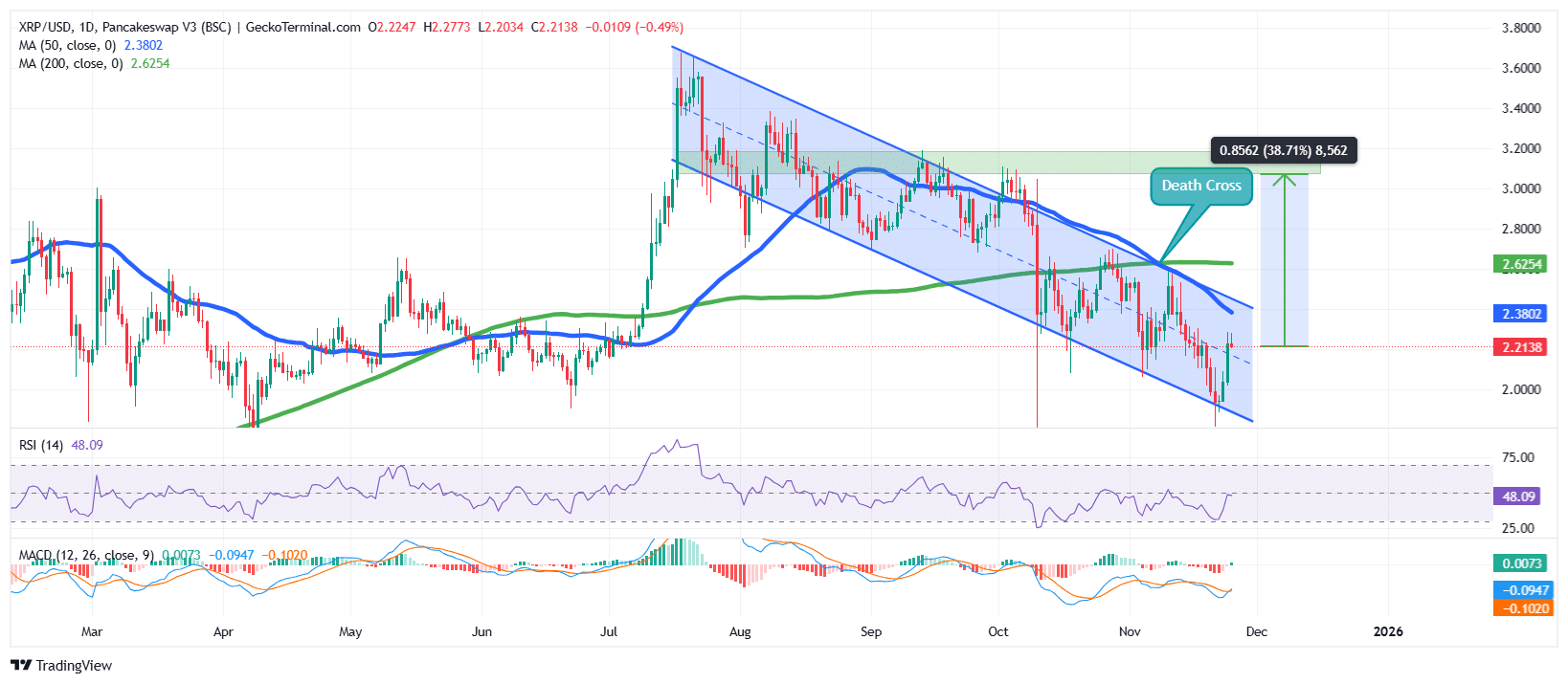

The XRP price experienced a parabolic rise in July to an all-time high (ATH) of around $3.66, after overcoming the $2.4 resistance level that had held the price for the first half of the year.

However, after hitting the long-term resistance zone and its ATH, the bears took control, pushing XRP’s price down into a well-defined falling channel.

As a result, the Ripple token price broke down below both the 50-day and 200-day Simple Moving Averages (SMAs), further fueled by a death cross that formed around $2.63 on the daily chart.

This dented hopes of a recovery, as XRP dropped to the lower boundary of the falling channel around $1.90.

However, this level has helped the bulls step in, with the price of the Ripple token now trading in the mid-range around $2.2 as it approaches the 50-day SMA ($2.38).

The Relative Strength Index (RSI) also shows that buyers are regaining control, as it is recovering from the 30-oversold region towards the 50-midline level, currently at 48.

Moreover, the Moving Average Convergence Divergence (MACD) supports the recovery attempts, as the blue MACD line has crossed above the orange signal line.

Green bars on the histogram have also begun to form above the zero line, cementing the start of a recovery narrative.

XRP/USD Chart Analysis Source: GeckoTerminal

XRP/USD Chart Analysis Source: GeckoTerminal

Ripple Token Price Could Surge 38%

According to the XRP/USD chart analysis, the XRP price is poised for a potential rebound, with the chart signaling a possible climb toward the $3.064 region, about 38% above the current price near $2.21.

After repeatedly respecting the lower boundary of its falling channel, the Ripple token is showing early signs of a momentum shift. A continuation of this bounce could carry XRP back toward the mid-channel area and eventually into the highlighted supply zone.

The first major resistance sits at the 50-day SMA around $2.38, followed by the 200-day MA near $2.63.

Improving RSI conditions and early MACD stabilization further support the likelihood of this upward rally.

Conversely, if the price gets rejected at the 50-day SMA, it could trap XRP within the falling channel, risking a drop back toward the lower support zone near $2.0 if momentum fades.

Related News:

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

Republic Europe Launches SPV for Retail Investors in Kraken