Solana Price Prediction: Could This New Crypto Presale Beat SOL’s Next Rally?

Solana has a strange way of stealing the spotlight every cycle. The price tends to move fast, and the ecosystem keeps producing energy even when broader sentiment slows down.

The chain still delivers gains and still feels like one of the strongest forces in the market. However, the idea of upward potential is not only tied to large established assets anymore.

Crypto Presale With Real Utility: Why LiquidChain Appears at the Perfect Time

A growing number of early-stage projects often reach higher multiples simply because their market caps are tiny and they have appealing narratives. A few, like LiquidChain ($LIQUID), might even outperform Solana in the next couple of years.

LiquidChain provides one execution layer that merges Bitcoin, Ethereum, and Solana liquidity into a unified environment. Users won’t need to start looking for a bridge or wrapped assets floating around with custodial risks. With the platform, there are also no multiple deploys for developers who are tired of maintaining three versions of the same application.

The project acts as a global settlement layer that sits above major blockchains and links them together. Liquidity from Bitcoin, Ethereum, and Solana is verifiably represented on Layer 3.

It has a high-performance VM inspired by Solana-class throughput, handling multi-chain operations almost instantly. It also verifies states from the three ecosystems in real-time, which is important because users finally gain cross-chain movement without wrapped tokens.

There is another part that tends to surprise people when they look deeper. The developer side has a deploy-once architecture that allows any dApp to reach all major ecosystems without starting from scratch. In practice, a single launch on LiquidChain means instant access to the entire multi-chain market.

This is one of the reasons the project attracts attention even before the mainnet goes live. The unified liquidity idea feels overdue.

The Role of $LIQUID Inside the Ecosystem

The $LIQUID token fuels the entire architecture. It handles settlement fees, governance, incentives, and cross-chain proof validation. It becomes the unit that keeps the whole system running.

As unified liquidity pools grow, the token gains more utility because every cross-chain execution flows through the Layer 3 environment. The token eventually ties together capital, developers, and applications. This is the kind of structure usually associated with high-potential early-stage assets, especially during a crypto presale.

Solana Price Prediction With Current Market Conditions

At the time of writing, Solana ($SOL) price sits near $145. That is roughly a 45% decline from the September 2025 high around $250. $SOL has pulled back along with the broader market. The market cap still sits above $75 billion, which is large enough to influence sentiment but also heavy enough to limit how quickly it can move compared to smaller assets.

The arrival of the Solana ETFs has not pushed the price upward in the immediate term. Some observers expect delayed effects as institutional inflows stabilize. The long-term reaction remains open.

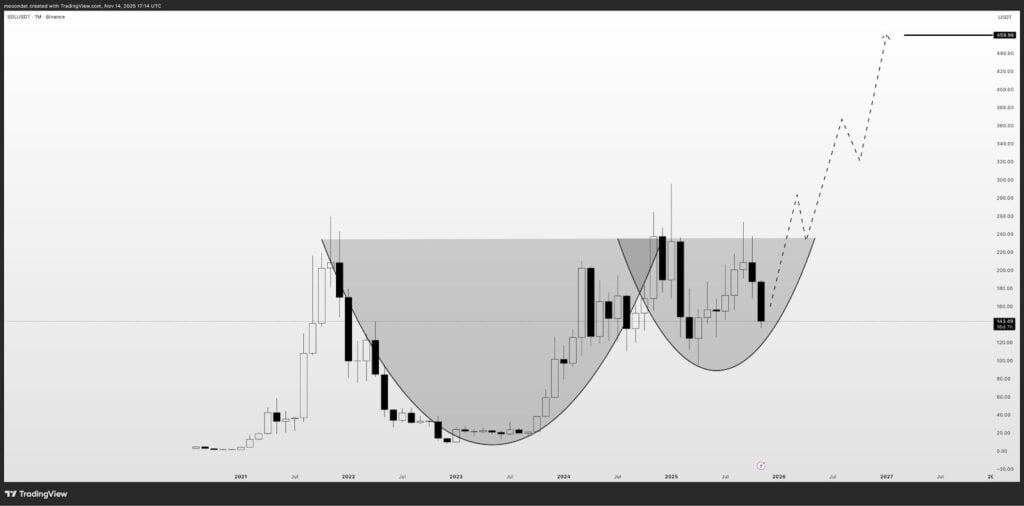

A well-known analyst, Ray, who has more than 190k followers on X, shared a simple Solana price prediction. The target sits at $500, and the analyst posted a chart showing a large cup-and-handle pattern forming on the higher timeframe.

The structure shows two rounded bottoms and a breakout zone forming around the upper range. The attached chart suggests that the pattern could eventually lift Solana into that region again.

The jump from the current $145 level to $500 represents just a little over a 3x move. That would not be unusual in a strong bull run. It might not even come quickly, considering the size of the market cap, although the pattern shows a steady upward bias.

Best Altcoin to Buy During Market Dips? LiquidChain Could Deliver More Upside Than Solana

Billions of dollars remain trapped inside separate ecosystems. LiquidChain’s unified environment gives traders, builders, and protocols something they currently do not have: free-flowing movement across chains without trust-based bridges.

Actually, the market has been hinting at this need for years. That idea alone positions it as a strong candidate for anyone watching crypto presales focused on real utility.

Solana already commands a large market cap. Growth still happens, although the pace slows as numbers rise. LiquidChain is just starting, and the low initial market cap naturally provides more room for multiples during early adoption phases.

The Layer 3 solution addresses fragmentation at a time when cross-chain DeFi becomes essential for institutions, traders, and developers. The market needs more efficient movement, fewer risks, and deeper liquidity. LiquidChain’s unified settlement layer, real-time verification, and deploy-once design feel aligned with what the market needs right now.

Another reason comes from infrastructure rotations. Infrastructure projects often outperform because they shape the environment for the rest of the cycle. LiquidChain’s crypto presale arrives at a point when cross-chain solutions finally reach mainstream interest, and the timing might help the project gain higher levels of attention.

How to Buy $LIQUID in the Early Crypto Presale

This crypto presale offers early exposure to a fast-developing cross-chain architecture. This makes $LIQUID one of the most compelling altcoins to watch this cycle. The presale for LiquidChain is active.

Buying the token starts with acquiring some crypto like ETH and USDT. A decentralized wallet like Best Wallet or MetaMask will also be needed. The project’s official website allows a connected wallet to choose an amount and complete the purchase. Card payments are also available.

Discover the future of blockchain innovation with LiquidChain:

Presale: https://liquidchain.com/

X (Twitter): https://x.com/getliquidchain

Telegram: https://t.me/liquid_chain

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Born Again’ Season 3 Way Before Season 2

Fed forecasts only one rate cut in 2026, a more conservative outlook than expected