Solana poised for bull run, but new sports memecoin hints at potential 7000% rally

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Solana may rally in 30 days, but a new sports memecoin is gaining buzz for its potential 7000% breakout.

Table of Contents

- XYZ sets the G.O.A.T. standard: Early buyers positioned for monster returns

- Solana

- Conclusion

Market watchers are predicting a significant upturn for Solana in the upcoming 30 days. Simultaneously, a recently launched sports-themed meme coin is drawing attention for its potential to achieve an even more dramatic 7000% surge. This intriguing scenario is prompting investors to consider which asset might offer the most substantial gains.

XYZ sets the G.O.A.T. standard: Early buyers positioned for monster returns

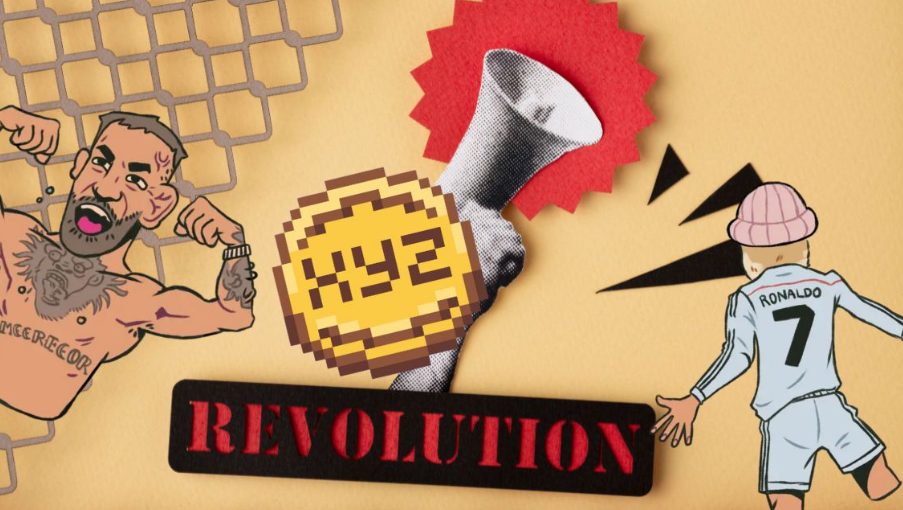

XYZVerse (XYZ) isn’t just another memecoin; it’s a movement redefining the space. By fusing the adrenaline of sports fandom with the speed of crypto innovation, XYZVerse is attracting diehard fans of football, basketball, MMA, and esports into a single, fired-up community.

With its bold “Greatest of All Time” (G.O.A.T.) vision, XYZVerse is gunning for the top and gaining recognition fast. It was recently crowned Best New Meme Project, a title that reflects growing momentum and serious investor interest.

What gives XYZ an edge? It’s not built on hype alone. With a locked-in roadmap, sports-focused branding, and a loyal community, XYZVerse is set up for long-term domination, not a flash-in-the-pan pump.

Fueled by competitive spirit, the XYZ token is built to win. This isn’t just a coin, it’s a symbol of pride for sports lovers and crypto degenerates alike, and it’s charging toward the top of the meme coin podium.

XYZ is already winning before even listing

The presale is in full swing, and XYZ is surging through its stages:

- Launch Price: $0.0001

- Current Price: $0.003333

- Next Presale Stage: $0.005

- Final Presale Price: $0.02

- Target Listing Price: $0.10

With over $14 million raised, XYZVerse could be one of the hottest presales of the year. Investors jumping in now still have time to grab tokens before prices soar, potentially unlocking up to 1,000x gains once listings go live on major CEXs and DEXs.

The presale momentum is accelerating. Every stage means higher prices, so the earlier you buy, the bigger your upside.

Join the XYZ presale now and turn spare change into generational wealth.

Solana

Over the past week, Solana (SOL) has experienced a small decline of 2.82%. This follows a month where the price dropped by 12.25% and a six-month period with an 18.46% decrease. Currently, SOL is trading between $139.87 and $167.27, showing signs of stabilization after significant fluctuations.

Technical indicators offer mixed signals for Solana’s future direction. The Relative Strength Index (RSI) is at 61.06, suggesting that the asset is approaching overbought conditions. The Stochastic oscillator reads 78.84, supporting this view. However, the Moving Average Convergence Divergence (MACD) level is positive at 0.2413, indicating potential upward momentum.

If Solana’s price breaks above the nearest resistance level of $181.47, it could target the next resistance at $208.87, implying a potential gain of about 25%. Conversely, if the price falls below the support level of $126.67, it might test the second support at $99.27, representing a decline of around 28%. These levels are crucial in determining Solana’s next move in the market.

Conclusion

While SOL is expected to surge, XYZVerse blends sports and memes, aiming for 20,000% growth through a community-driven platform that could deliver even greater returns.

To learn more about XYZVerse, visit the website, Telegram, and X.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

You May Also Like

Three dormant wallets, suspected to belong to the same entity, purchased 5,970 ETH eight hours ago.

BlackRock Increases U.S. Stock Exposure Amid AI Surge