Bitcoin Mixer Mixer.Money: Real Anonymity Technologies

Mixer.Money is a platform that provides anonymization of cryptocurrency transactions by mixing bitcoins, offering users various security and privacy modes. The main idea of the service is to break the link between the sender and the recipient of the transaction, hide the origin of the funds and protect the user from blockchain analysis.

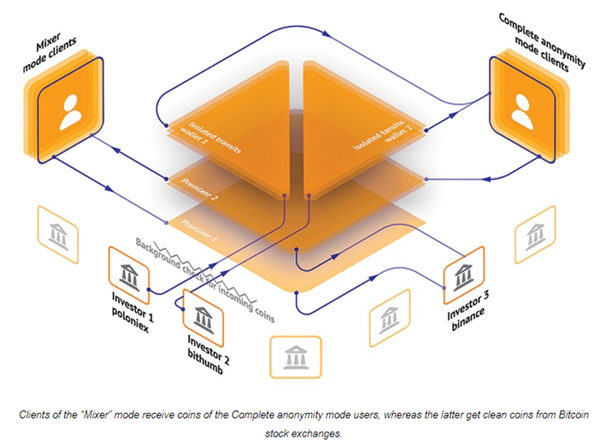

Mixer.Money has an advanced anonymization feature. There are modes available here that do not mix the assets of different clients, but provide pure bitcoins from exchanges, from trusted investor partners. Using the bitcoin.mixer 2.0 algorithm, all coins received from the bitcoin mixer have a positive history.

How Mixer.Money works

The platform uses an automatic mixing process that does not require operator intervention. The system has three operating modes, each of which is designed for specific privacy and security scenarios.

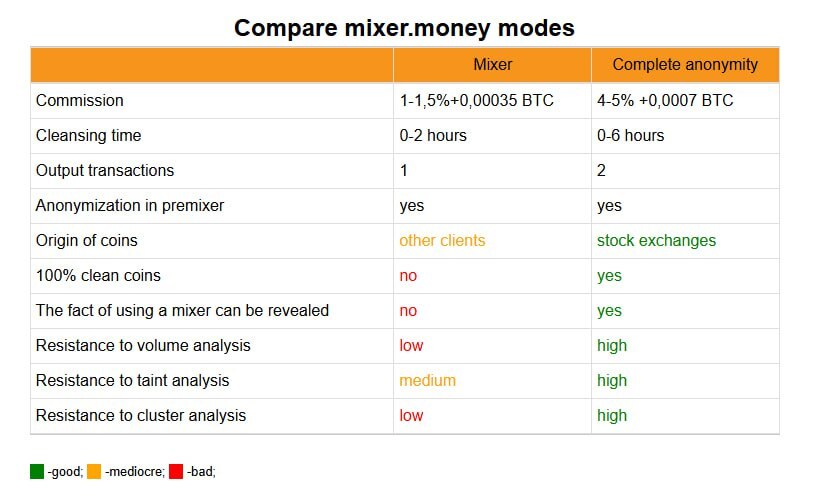

1. “Mixer” mode

This is a basic mode that provides protection against manual transaction analysis. The user sends their coins to a specially generated mixer address. After that, the coins are split into smaller parts — UTXO — and mixed with coins from other customers. Within 0-2 hours, the mixer sends these mixed coins back to the specified address. Random fees are used in the process, which makes tracking more difficult.

2. “Complete anonymity” mode

This is the most secure mode. The coins are broken up and mixed with assets received from the exchanges from the partners (that is, they are already “clean”). This allows the user to receive “clean” coins from other exchanges that are not directly linked to his source address. The time to complete this mode is up to 6 hours, and the commission is 4-5%. This scenario is great for those who value maximum privacy and are protected from the analysis of clustering schemes and taint analytics.

3. Accurate payment

This mode allows you to perform mixing with an accurate indication of the amount and the recipient’s address. After processing, the coins are split into parts, and a commission is charged to the deposit address, and a precisely defined amount is sent to the specified address.

The main mechanisms and features of the work

Ensuring confidentiality

Users’ coins end up in the pool, where they are mixed with the assets of other clients, which breaks the sender—recipient chain. As a result, analytical programs cannot link source and destination addresses.

No logs are kept in Mixer.Money and no IDs are assigned. All work data is encrypted. Each application is automatically deleted after 168 hours and it is simply impossible to find out that it was there. All communication with clients is based on a system of guarantee letters with a PGP signature. They are needed to resolve controversial issues.

Process automation

After one confirmation in the blockchain, the mixer automatically starts transactions in accordance with the selected mode, which greatly simplifies use.

Randomization of fees and time

To complicate the analysis, the service uses random commission values and variations in the sending mode, which helps to avoid pattern recognition.

The service has the ability to make deferred transactions: the generated address for sending coins for mixing is active for up to 7 days. If the platform from which the coins are sent delays the withdrawal, the address will not be lost.

Advantages of using Mixer.Money

- High level of anonymity, especially in the “Complete anonymity” and “Accurate Payment” modes.

- Fast transaction processing: up to several hours.

- No need to register or store transaction history.

- The opportunity to test the service at no cost by sending a small amount.

Result

Mixer.Money works by mixing cryptocurrencies in a pool, which creates a new chain of transactions that is disconnected from the original sender. In different modes, it uses different levels of anonymity and cost, which allows you to adapt the use to the needs of the user. The main strength of the service is automatic, fast and efficient mixing, which ensures a high level of privacy, which makes it one of the most popular solutions for protecting privacy when working with bitcoins.

Disclaimer: This is a sponsored article. The views and opinions presented in this article do not necessarily reflect the views of CoinCheckUp. The content of this article should not be considered as investment advice. Always do your own research before deciding to buy, sell or transfer any crypto assets.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Crucial Fed Rate Cut: October Probability Surges to 94%