Trading time: Global stock markets are in turmoil, and the ETH/BTC exchange rate hits a new low since February 2020

1. Market observation

Keywords: tariffs, ETH, BTC

After the Qingming Festival, the global financial market ushered in "Black Monday", and the Trump administration's tariff policy caused a huge market shock. According to the latest Forbes survey, 72% of Wall Street heavyweights expressed disappointment with the Trump team's economic strategy, with the tariff policy scoring only 1.86 points and the cryptocurrency-related policy scoring 2.00 points. The business community reacted strongly. At the Yale University CEO Summit, 44% of corporate executives said that they would collectively speak out against Trump's tariff policy when the stock market fell by 20%. Musk, who has always supported Trump, also supported the establishment of a "zero tariff" system between the United States and Europe on social media over the weekend, and it is suspected that he publicly distanced himself from the White House's trade war stance.

Panic spread in the market, and circuit breakers were triggered in many Asian markets. The Nikkei 225 Index fell by more than 8% at one point, the South Korean KOSPI Index fell by more than 5%, and the Taiwan Stock Exchange Weighted Index plummeted by more than 9%, triggering a circuit breaker. In terms of A-shares, the Shanghai Composite Index fell below 3,100 points, and more than 1,000 stocks in the market hit the limit. Risk aversion increased, and gold fell below $3,000 this morning before rebounding to above $3,050, eventually forming a trend of simultaneous rise in gold, the U.S. dollar, and U.S. bonds. It is worth noting that the People's Bank of China has increased its gold holdings for the fifth consecutive month, and stated that monetary policy tools such as reserve requirement ratio cuts and interest rate cuts have left ample room for adjustment.

The cryptocurrency market was also not spared, with Bitcoin falling 7.2% to below $78,000, and Ethereum falling 15% to below $1,550. In addition, the ETH/BTC exchange rate fell below 0.02, hitting a new low since February 2020. However, analysts hold different views on the future development of mainstream cryptocurrencies. Jamie Coutts, chief crypto analyst at Real Vision, predicts that BTC is expected to hit $132,000 this year based on the M2 money supply growth model; crypto analyst Miles Deutscher believes that the final rebound will be stronger than ever, and Bitcoin is expected to hit a new high between the third quarter of this year and the first quarter of 2026. In contrast, Andrew Kang, partner of Mechanism Capital, is pessimistic about Ethereum and predicts that ETH may return to the $1,000-1,500 range.

In terms of regulation, the SEC issued an important statement on stablecoins, clarifying that certain types of crypto assets (i.e., "Covered Stablecoins") do not fall into the category of securities, and that such stablecoins must maintain a 1:1 exchange ratio with the U.S. dollar and be backed by low-risk, high-liquidity assets. At the same time, the White House requires federal agencies to report their cryptocurrency holdings to the Secretary of the Treasury, but does not force the public disclosure of audit results.

At the macroeconomic level, Federal Reserve Chairman Powell warned that tariff policies will push up inflation and curb economic growth. Goldman Sachs lowered its forecast for US GDP growth in the fourth quarter of 2025 to 0.5%, and raised the probability of a 12-month recession from 35% to 45%. It is expected that the Federal Reserve will launch a series of interest rate cuts in June this year. If the United States avoids a recession, the Federal Reserve may cut interest rates by 25 basis points three times in a row, bringing interest rates to 3.5%-3.75%. However, if the economy falls into recession, the Federal Reserve may cut interest rates by about 200 basis points next year. Faced with downward economic pressure, Robert Kiyosaki, author of "Rich Dad Poor Dad", suggested that investors turn to hard assets such as gold, silver and Bitcoin to cope with the possible economic crisis.

2. Key data (as of 13:30 HKT on April 7)

(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars)

-

Bitcoin: $77,267.21 (-17.53% year-to-date), daily spot volume $45.352 billion

-

Ethereum: $1,537.97 (-53.78% year-to-date), with a daily spot volume of $28.761 billion

-

Fear and Corruption Index: 25 (panic)

-

Average GAS: BTC 1 sat/vB, ETH 1.7 Gwei

-

Market share: BTC 62.7%, ETH 7.6%

-

Upbit 24-hour trading volume ranking: XRP, BTC, ETH, AERGO, SOL

-

24-hour BTC long-short ratio: 0.9794

-

Sector ups and downs: The crypto market fell across the board, with the Meme sector falling 14.23% and the AI sector falling 13.52%.

-

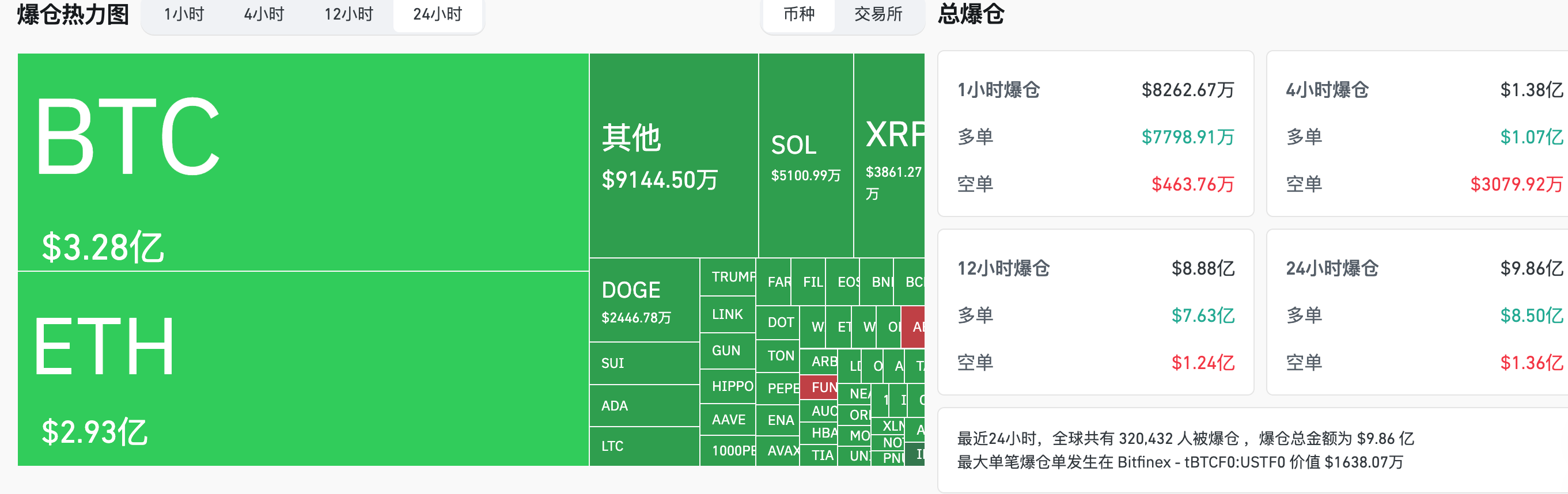

24-hour liquidation data: A total of 320,432 people were liquidated worldwide, with a total liquidation amount of US$986 million, including BTC liquidation of US$328 million and ETH liquidation of US$293 million.

-

BTC medium- and long-term trend channel : upper channel line ($84111.92), lower channel line ($82446.34)

-

ETH medium and long-term trend channel : upper channel line ($1822.26), lower channel line ($1786.17)

*Note: When the price is higher than the upper and lower edges, it is a medium- to long-term bullish trend; otherwise, it is a bearish trend. When the price passes through the cost range repeatedly within the range or in the short term, it is a bottoming or topping state.

3. ETF flows (as of April 4 EST)

-

Bitcoin ETF: -$64.88 million

-

Ethereum ETF: $2.06 million

4. Today’s Outlook

-

Jito (JTO) unlocked 11.31 million tokens, worth about $24.8 million

-

OKX will delist MAX/USDT, KISHU/USDT, 1INCH/USD and GRT/USD perpetual contracts on April 8

-

Paris Blockchain Week 2025

-

Tensor (TNSR) will unlock 126 million tokens on April 8, worth approximately $20.6 million

-

Ethereum Name Service (ENS) unlocks 1.45 million tokens worth approximately $22.7 million

-

Binance will suspend Syscoin deposits and withdrawals on April 8 to support its network upgrade

The biggest decliners in the top 500 by market value today : 0x0.ai (0x0) fell 30.20%, Safe (SAFE) fell 23.76%, Artificial Liquid Intelligence (ALI) fell 22.94%, PAAL AI (PAAL) fell 22.40%, and Berachain (BERA) fell 21.75%.

5. Hot News

-

Data: CHEEL, APT, SAGA and other tokens will usher in large-scale unlocking, among which CHEEL unlocking value is about 161 million US dollars

-

Macro Outlook of the Week: CPI will make it even more difficult for the Fed, and the US dollar index may fall into a quagmire of sharp decline

-

Aave's cumulative borrowing interest on the Ethereum network exceeds $1 billion

-

Nikkei 225 index fell 8.4%

-

Liquidation of 67,500 ETH whale positions triggers chain decline

-

U.S. federal agencies must report crypto holdings to the Treasury Secretary, but audit results may not be made public

-

Nasdaq futures fell more than 5.5%, S&P 500 futures fell more than 4.7%

-

BTC falls below $78,000, down 5.60% on the day

-

ETH falls below $1,600, down 9.45% on the day

-

U.S. Commerce Secretary Lutnick: Tariffs will take effect on April 9, no delay

-

Analyst: 91,900 BTC withdrawn from exchanges in the past month

-

Mechanism Capital partner: ETH is likely to return to $1,000-1,500 this year

-

Trump hinted that he "deliberately" caused the stock market crash and called on Americans to "remain patient"

-

Web3 social app Phaver has ceased operations, and its token price has fallen 99% since TGE

-

The world's top 500 richest people lost a record $536 billion in net worth during the U.S. stock market crash this week

-

Analyst: Bitcoin is still expected to hit new highs between the third quarter of this year and the first quarter of 2026

-

Lens Chain mainnet is now online

You May Also Like

SEC Approves Generic ETF Standards for Digital Assets Market

MemeCon 2025: A Gala Night for Web3 Culture & Creativity in Singapore