Bitcoin Hyper Could Be the Next Big Layer-2 as It Raises $23.4M in Presale

KEY POINTS:

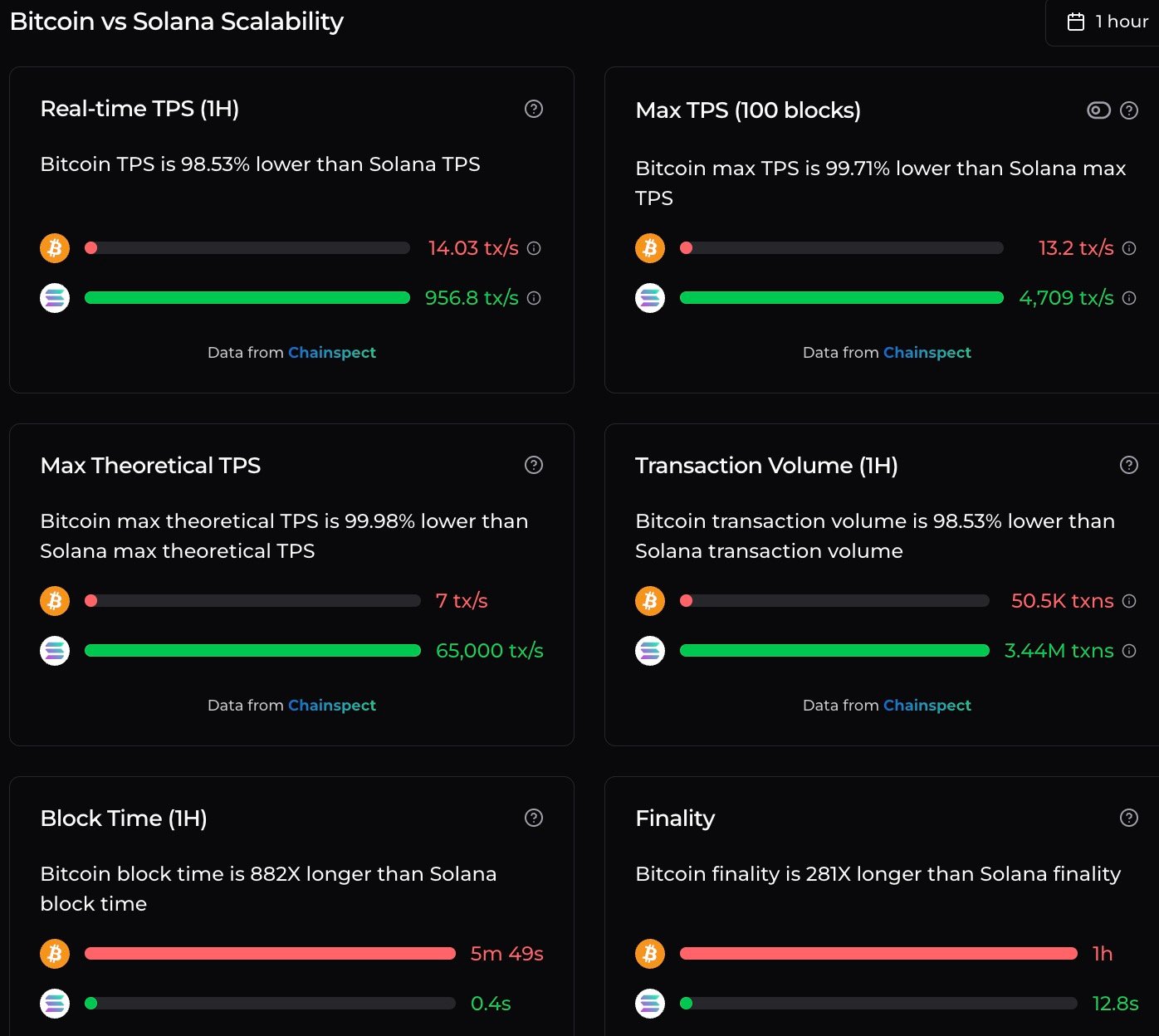

Bitcoin still handles just 14 TPS in real time, nearly 99% slower than Solana, leaving it lagging behind modern blockchain demands.

Bitcoin still handles just 14 TPS in real time, nearly 99% slower than Solana, leaving it lagging behind modern blockchain demands.

Bitcoin Hyper ($HYPER) utilizes the Solana Virtual Machine (SVM) to deliver sub-second, near-zero-fee transactions and comprehensive DeFi support for Bitcoin.

Bitcoin Hyper ($HYPER) utilizes the Solana Virtual Machine (SVM) to deliver sub-second, near-zero-fee transactions and comprehensive DeFi support for Bitcoin.

The project has already raised $23.4M in its presale, including a $28.2K whale buy, signaling strong early investor confidence.

The project has already raised $23.4M in its presale, including a $28.2K whale buy, signaling strong early investor confidence.

Early holders can earn 50% staking APY and gain priority access to airdrops, governance, and launchpad events as Bitcoin enters its Layer-2 era.

Early holders can earn 50% staking APY and gain priority access to airdrops, governance, and launchpad events as Bitcoin enters its Layer-2 era.

Slow transaction times, high fees, and limited functionality have kept $BTC from matching the speed and versatility of newer blockchains.

That’s the opportunity Bitcoin Hyper ($HYPER) is looking to seize. By combining Bitcoin’s security with Solana’s Virtual Machine (SVM) performance, Bitcoin Hyper promises near-zero-fee transactions and full support for DeFi, dApps, and even meme coins.

It’s a new Layer-2 project built to give Bitcoin the scalability and usability it’s missing. The project has already raised $23.3M in its presale, with a $28.2K whale buy occurring over the weekend. These are clear signs that investors are betting big on Bitcoin’s next evolution.

The Bitcoin Bottleneck

Bitcoin may dominate every market cap chart with ease, but beneath all that glory lies a sign of age.

The network processes roughly 14 transactions per second (TPS) in real time, compared to Solana’s 956 TPS; that’s a 98.5% gap. And when you look at theoretical capacity, the difference is outstanding: Bitcoin’s 7 TPS versus Solana’s 65K TPS.

Source: Chainspect

This lag is about usability as much as it is about speed. Solana has handled 3.44M transactions per hour, while Bitcoin has just 50.5K. Yet, Bitcoin’s block time is 882 times longer, at almost 6 minutes, compared to Solana’s, which is every 0.4 seconds. It’s clear how Bitcoin is built for security and decentralization, but it can’t keep pace with the demands of modern on-chain life.

So despite being the most recognized digital asset on earth, Bitcoin remains a store of value, not a functional base layer for payments, DeFi, or dApps. Builders have flocked to Ethereum, Solana, and Avalanche, leaving Bitcoin’s chain largely static… It’s a vault, not a playground.

Bitcoin Hyper ($HYPER) presents a bold proposition: to provide Bitcoin with a modern execution layer without compromising its foundation.

Bitcoin Hyper – Bringing Speed, DeFi, and Culture to Bitcoin

Bitcoin Hyper isn’t another Bitcoin sidechain; it’s a true Layer-2, purpose-built to make Bitcoin fast, cheap, and versatile. It mirrors Bitcoin’s security but runs on the SVM, the same engine powering one of the world’s fastest blockchains.

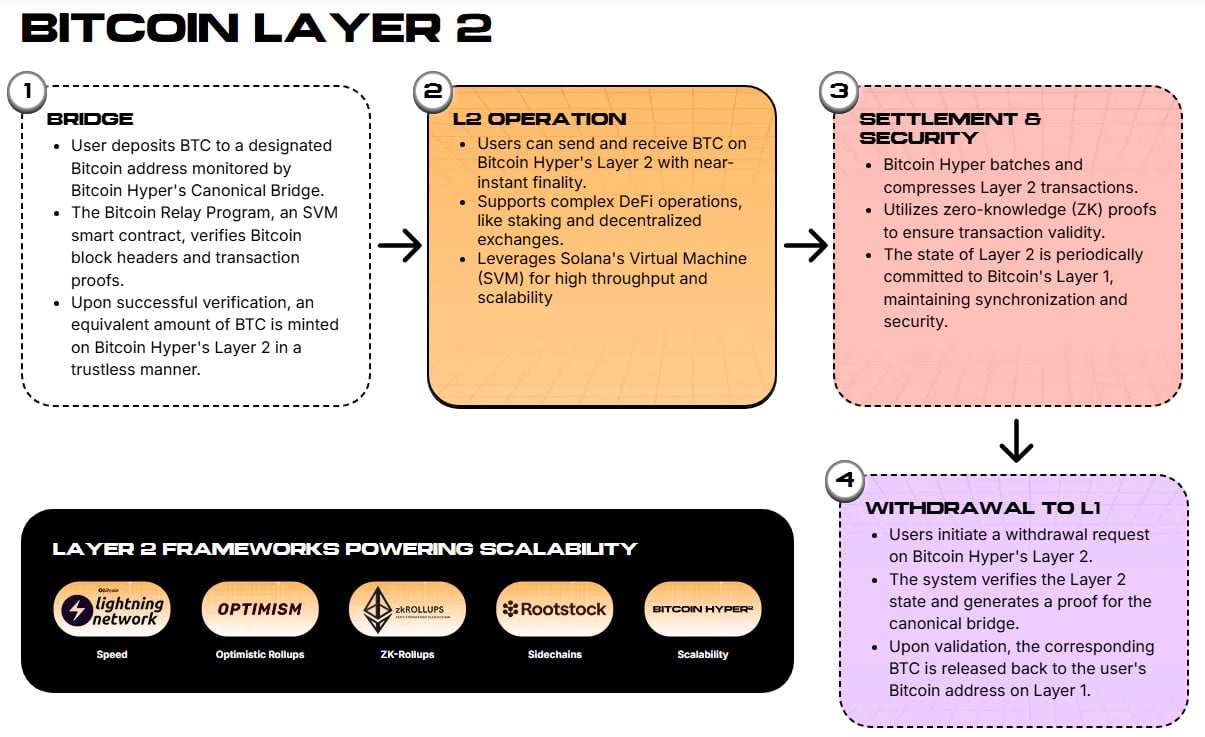

Here’s how it works:

- Bridge in: You lock your $BTC on-chain, and a smart contract verifies the deposit directly from Bitcoin blocks. Once confirmed, the same amount is minted on the Bitcoin Hyper Layer-2 – completely trustless.

- Transact: You can now send, stake, or trade $BTC instantly with sub-second speed and near-zero fees.

- Settle securely: Every batch of transactions is validated using zero-knowledge (ZK) proofs and regularly committed back to Bitcoin’s main chain.

- Bridge Out: Want Your $BTC Back? Withdraw anytime. Every step is transparent, traceable, and cryptographically verified.

This process turns slow-moving Bitcoin into a high-speed, cross-chain asset that can finally interact with the broader DeFi world. Builders can launch dApps, NFTs, and meme coins directly on a Bitcoin-secured network. Traders get cheap, instant payments. Holders can earn yield without leaving Bitcoin.

Everything in this ecosystem runs on $HYPER, the token used for transaction fees, staking, governance, and early-access launches. Thanks to the SVM Foundation, Bitcoin Hyper is natively interoperable with Solana, allowing developers to port existing Solana projects to Bitcoin Hyper with minimal friction.

Looking for a more comprehensive overview? Read our What is Bitcoin Hyper guide.

Bitcoin Hyper’s $23.4M Presale Highlights Growing Demand

Momentum around Bitcoin Hyper ($HYPER) has accelerated fast. The project has already raised over $23.4M in its presale, with tokens now priced at $0.013105. Investors are betting on a real technological leap for Bitcoin’s scalability.

Early participants can stake their tokens for a 50% APY, gaining priority access to airdrops, governance decisions, and future launchpad events within the Hyper ecosystem. A notable $28.2K whale buy on Saturday underlines growing interest, suggesting that confidence in Bitcoin’s Layer-2 future is building.

Learn how to buy Bitcoin Hyper in our step-by-step guide.

Funds from the presale are directed toward expanding developer tooling, building cross-chain bridges, and ensuring deep liquidity ahead of mainnet launch.

With scalability already proven on SVM-based networks, the next phase focuses on user adoption, including integrated wallets and application support designed to make Hyper accessible from day one.

The next presale price tier is expected to increase soon, tightening the entry window for early adopters. For those looking to back Bitcoin’s next major upgrade, Bitcoin Hyper’s presale may be one of the few remaining opportunities to enter at the ground floor.

Join the Bitcoin Hyper presale today and secure your spot in Bitcoin’s next evolution.

You May Also Like

South Korea Launches Innovative Stablecoin Initiative

Vitalik Buterin Questions the Continued Relevance of Ethereum’s Layer 2 Solutions