Canary Capital Finalizes Spot Litecoin ETF Filing with 0.95% Fee, Ticker LTCC

Key Takeaways:

- Canary Capital has filed an S-1 amendment with the U.S. SEC for its Spot Litecoin ETF, revealing the official ticker LTCC and a 0.95% annual sponsor fee.

- Bloomberg analysts say this update marks the “last step before go-time,” signaling near-term approval once the SEC resumes full operations.

- The move positions Litecoin (LTC) as the next major altcoin poised for institutional ETF access, following the success of Bitcoin and Ethereum spot products.

The most recent regulatory filing by Canary Capital is an indicator of a conclusive move to introduce the first U.S. spot Litecoin ETF. Although the government shutdown has caused the SEC reviews to slow, industry observers feel that approval may come fairly quickly as the activities resume normalcy and this may be the next stage towards altcoin acceptance.

Read More: Litecoin Whale Buys $100M LTC, DNSBTC Offers Free Cloud Mining With $60 Starting Bonus

Canary’s Updated Filing: What’s New

Final Ticker and Fee Structure

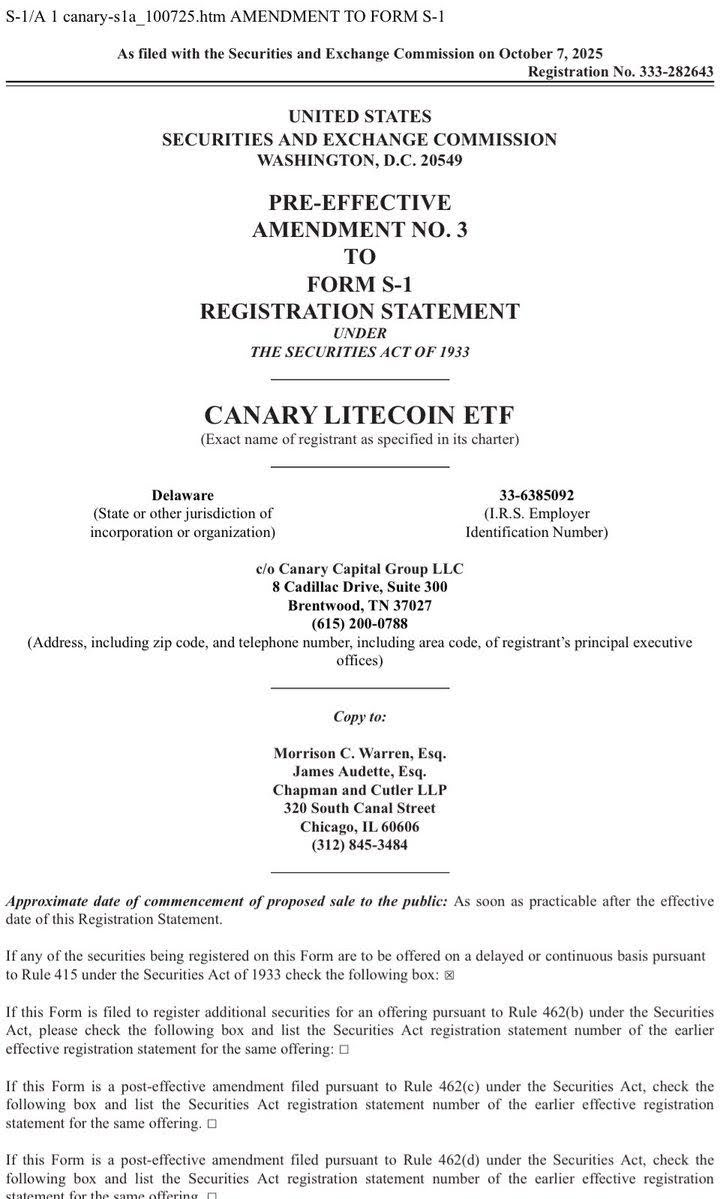

On October 7, Canary Capital submitted its amended S-1 registration statement for the Spot Litecoin ETF. The document revealed that the fund will trade under the ticker LTCC and charge investors a 0.95% sponsor fee.

The rate is higher than the 0.20–0.50% range typical for spot Bitcoin ETFs, but analysts describe it as “standard” for first-generation products in emerging sectors. The slightly elevated cost reflects the added complexity of custody, valuation, and liquidity management for altcoins like Litecoin, which do not yet have the same institutional infrastructure as Bitcoin.

Read More: SEC Pushes Final Decision on Solana ETFs to October 16 After Maximum 60-Day Extension

What the S-1 Amendment Means

An S-1 amendment typically represents the final stage before a spot ETF can launch. These filings usually disclose finalized tickers, custodians, and fees – the last technical details before SEC clearance. Bloomberg ETF analysts Eric Balchunas and James Seyffart described Canary’s move as “the goal line moment,” indicating the paperwork appears ready for approval.

Once cleared, LTCC would become the first U.S. spot ETF tracking Litecoin, a major milestone that could expand institutional access to one of the longest-standing digital assets in the market.

Market Context and Institutional Impact

Why Litecoin Matters

Often referred to as the “silver to Bitcoin’s gold,” Litecoin is one of the oldest and most decentralized cryptocurrencies. Its regulatory classification as a commodity confirmed in past CFTC statements, gives it a clearer compliance path than many newer altcoins. That clarity helps explain why Canary chose LTC as its first non-Bitcoin, non-Ethereum ETF product.

Diversified exposure to crypto has been gaining traction among institutional investors. Following record inflows in Bitcoin spot ETFs earlier this year, the market has shifted to more ordinate altcoins that have strong networks and open on-chain data. An ETF in Litecoin would enable legacy investors to be exposed to the prices without having to actually handle the asset, carry wallets or even deal with exchange risks.

Custody and Valuation

The filing by Canary describes a clear-cut framework: Canary ETF will be holding real Litecoin held in custody by regulated providers like Coinbase Custody Trust and BitGo, and daily net asset value (NAV) will be calculated using various exchanges at around 4 p.m. ET. This data aggregation ensures more accurate market representation and reduces the influence of any single exchange’s volatility.

The structure mirrors that of spot Bitcoin ETFs, which helped legitimize crypto exposure in institutional portfolios by adding traditional safeguards such as independent auditing and transparent pricing mechanisms.

Regulatory and Political Environment

SEC Delays Amid Government Shutdown

The amended filings arrive during a period of U.S. government shutdown, which has slowed the SEC’s ability to process ETF applications. Under emergency operating rules, the agency retains only essential staff, delaying reviews of non-critical items, including digital asset ETFs.

The SEC had initially faced an early-October decision deadline for Canary’s Litecoin ETF but missed it due to limited staffing. Analysts believe that once the government resumes normal operations, approvals could proceed quickly since all necessary documentation now appears complete.

A Shift in ETF Oversight

Regulatory frameworks created by the SEC in the recent time simplified the approval process of crypto ETFs through the focus on S-1 registration forms instead of the time-consuming 19b-4 rule amendments. The change can cut the waiting time by up to 240 days to a minimum of 75 days without any additional political upheavals.

Such a rush of acceleration would be crucial to Canary and other companies that are struggling to introduce altcoin ETFs. The company has also submitted preliminary applications to register XRP and Solana spot ETFs, indicating that the firm has a desire to end up as a leader in the altcoin ETF market, when regulatory circumstances are put under control.

The post Canary Capital Finalizes Spot Litecoin ETF Filing with 0.95% Fee, Ticker LTCC appeared first on CryptoNinjas.

You May Also Like

What to Expect From The Fed This Year After First Rate Cut in 2025

USD/CHF rises on US dollar rebound, weak Swiss economic data