Bitcoin Price Prediction: Novogratz Sees $200K if Trump’s Fed Pick Turns Dovish

The post Bitcoin Price Prediction: Novogratz Sees $200K if Trump’s Fed Pick Turns Dovish appeared first on Coinpedia Fintech News

The crypto market is watching closely as changes loom at the U.S. Federal Reserve.

Jerome Powell’s term as Fed chair ends soon, and the choice of his successor could reshape financial markets. For Bitcoin and the wider crypto industry, the decision may be a powerful catalyst for the next cycle. Let’s dive in to understand.

Novogratz Predicts a Crypto Surge

In an interview with Kyle Chase, Galaxy Digital CEO Mike Novogratz suggests that Bitcoin could surge if the next U.S. Federal Reserve chair after Jerome Powell adopts a highly dovish stance.

“I think that that’s the biggest potential bull catalyst for Bitcoin and the rest of crypto. Feds cutting when they shouldn’t be. And you put in a massive dove” he says.

According to Novogratz, if Trump appoints a chair who pushes aggressive rate cuts, both Bitcoin and gold could skyrocket, creating what he called a “blow-off top.”

Could Bitcoin Reach $200K?

Novogratz believes it could create an unexpected “oh shit moment,” sending Gold and Bitcoin skyrocketing.

“Can Bitcoin get to $200K? Of course it could…Because it becomes a whole new conversation if that happens, he said. He also pointed out that markets often don’t price in extreme moves until they happen.

“Do I want it to happen? No. Why? Because I love America,” he added. He believes that such a scenario would be very harmful for the U.S. economy, and he believes there’s a real risk that the Federal Reserve could lose its independence.

Trump’s Fed Pick: Who Are The Finalists?

Reports suggest that President Trump is considering three finalists for the role of Fed chair: White House economic adviser Kevin Hassett, Fed Governor Christopher Waller, and former Fed Governor Kevin Warsh.

Fed’s Dovish Shift Could Weigh on U.S. Dollar

There are also concerns that the U.S. dollar could face near-term pressure if President Trump influences the Federal Reserve to take an excessively dovish approach.

The Fed recently delivered its first rate cut since December and is expected to ease the borrowing costs gradually in the coming months. Experts warn that the outlook could shift once Powell’s term ends in May, potentially changing the central ban’s stance.

Novogratz also reflected on the long-awaited arrival of institutional investors into crypto, noting that what he called “the herd” has finally arrived, starting with ETFs and major players like BlackRock.

He also highlighted that the recent laws, like the Genius Act and a potential market structure bill, could provide the regulatory clarity needed for broader adoption.

You May Also Like

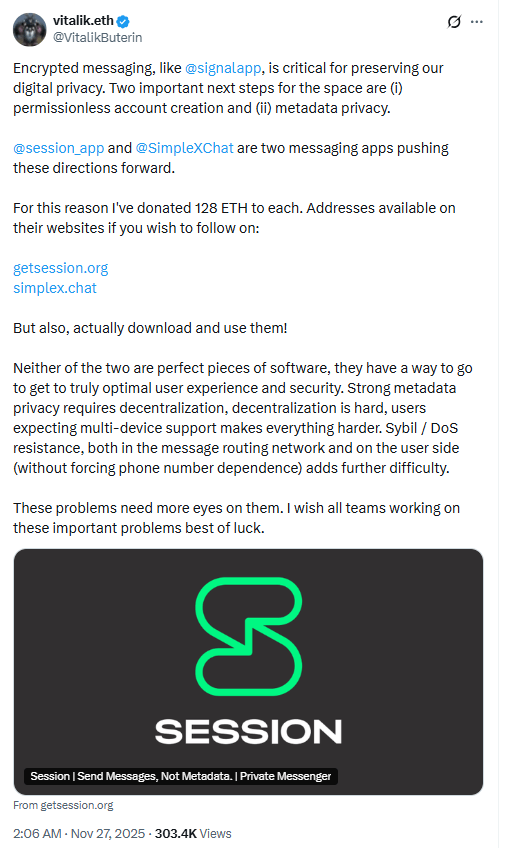

Ethereum’s Vitalik Buterin Funds Two Projects Driving Digital Privacy