Is BTC stockpiling the next big equity trade? Smarter Web Company and peers test the limits of mNAV premiums

U.K-listed The Smarter Web Company completed a £8.1 million capital raise shortly after its BTC crosses over 2,050. Can BTC accumulation push stock prices up?

- U.K-listed The Smarter Web Company’s stock has surged 208% in the past month following mass BTC acquisitions.

- The company recently purchase 225 BTC, boosting its total holdings to 2,050 BTC. Echoing a wider trend of companies updating their BTC holdings in an attempt to boost stock prices.

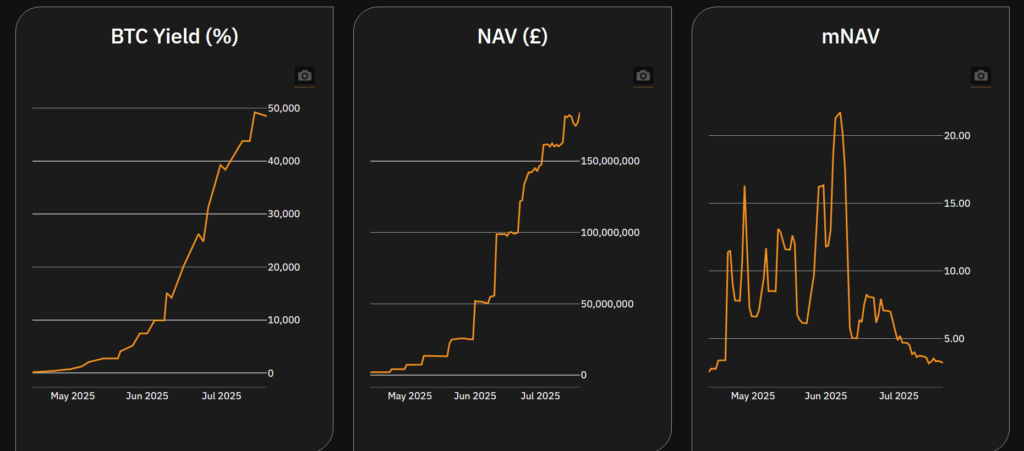

- As of August 4, company holds a total of 2,050 BTC in its reserves, meanwhile its share price is trading at £230.75. According to the company’s official website, Smarter Web Company has a market Net Asset Value of 3.22, down from a high of nearly 20 in June.

According to a recent press release, the total offering would generate capital worth £8.1 million ($10.75 million) for the company. The funding round for The Smarter Web Company offered shares priced at £2.05 per stock. The newly issued shares are expected to be available for trading on August 7, 2025.

Data from Google Finance shows that the stock has been surging as high as 208.094% in the past month as it continues to bump up its crypto reserves by buying more BTC (BTC). In early July, its holdings stood at 543.52 BTC and jumped to 2,050 BTC by the end of the month. This four-fold BTC holdings boost translated into a 200% share jump on the stock market.

The same thing happened in June when the SWC stock reached its peak price at £500. June was the month the company managed to reach 500 BTC for the first time since it established its BTC treasury stockpiling strategy in April 2025.

The impact of BTC stockpiling on stock value

On 28 April 2025, The Smarter Web Company unveiled its “10‑Year Plan” and Bitcoin Treasury strategy. The company had previously held BTC internally. However this marked the first time the firm declared its commitment to stockpiling BTC and announcing its purchases to the public.

Unfortunately for the firm, the shift to a BTC company was not immediately recognized as a positive sign among investors in the market. On April 28, its share was still stuck at the 52‑week low of £3.125, its market cap still stood at £5.1 million. Though at the time, the first BTC purchase made by the company still stood at a measly 2.3 BTC in reserves.

It wasn’t until early June did the market cap of Smarter Web Company multiply from just £5 million to £150 million in just two months time. In fact, its stock price spiked; hitting a £500 high from its previous low that barely reached £0.05. This marked a more than 1,000% jump for its stock price two months after the BTC strategy was announced.

As of August 4, company holds a total of 2,050 BTC in its reserves, meanwhile its share price is trading at £230.75. According to the company’s official website, Smarter Web Company has a market Net Asset Value of 3.22. This means that means investors are paying £3.22 in stock value for every £1 of treasury value held in Bitcoin and cash.

Michael Saylor’s Strategy, the company that many have cited as the inspiration for spawning dozens of BTC-focused companies in its wake, has a mNAV of 1.65, which means its share value is trading at a 1.65 ratio compared to its Bitcoin reserve.

How does Smarter Web Company compare to other BTC-focused companies?

The Smarter Web Company is not an isolated case. Many companies in the past few days have announced the formation of a BTC treasury strategy. This is usually followed by announcements issued on an almost daily-to-weekly basis about recent BTC purchases and updates of its total holdings.

On June 30, struggling Spanish coffee chain, Vanadi Coffee saw its stock surge by 242% following the approval of its new strategy to start acquiring more BTC on its balance sheet. Today, its stock received a slight boost to its value after its announced a recent 7 BTC purchase, which raised its holdings to 85 BTC.

Despite holding a meager BTC trove, compared to the likes of MicroStrategy which currently holds 628,791 BTC, the news of a 7 BTC purchase was enough to raise its stock price by 0.73% on the market.

On the other hand, the same thing has yet to happen to Valereum; another publicly-listed U.K. company that has established a Bitcoin treasury on August 1. Much like Smarter Web Company’s Bitcoin beginnings, its stock appeared to dip slightly by 4.35% in the past day compared to the previous trading day. At the time, its stock is currently trading at 0.033 euro.

Today, its stock price has remained at 0.03 euro. However, this could change as the company has not announced any BTC purchasing activity.

According to data from Bitcoin Treasuries, there are 287 entities holding Bitcoin, this includes institutions, and state governments. In the past 30 days, this number has seen an increase of 22 entities, reflecting a continued growth of firms that hold BTC in their balance sheets.

You May Also Like

PEPE GAMES and REDBIT officially launch exclusive customized game REDBIT ROLL and introduce token destruction mechanism

Social gaming platform STAN completes $8.5 million in funding, with participation from Google and others