Pi Network Sets February 15 Deadline for Mandatory Mainnet Node Upgrade

- Pi Network has set February 15 as the deadline for all nodes to support the first of several scheduled upgrades to remain connected to the network.

- The new Pi Node improves sync speed and the network’s stability under load, while also expanding the token capabilities.

Pi Network has set the deadline for all nodes to upgrade to the latest version as February 15 as part of its roadmap towards improving scaling, performance and stability.

“All Mainnet nodes must complete this step to remain connected to the network,” Pi Network stated in its announcement on social media.

In an accompanying announcement, the team broke down what the new Pi Node improves and why node operators must upgrade to the latest version. According to the team, Pi Nodes perform a similar role on the network as miners do on proof-of-work networks like Bitcoin. However, Pi’s consensus algorithm is based on the Stellar Consensus Protocol, which, as our detailed guide explains, is based on a federated Byzantine agreement model.

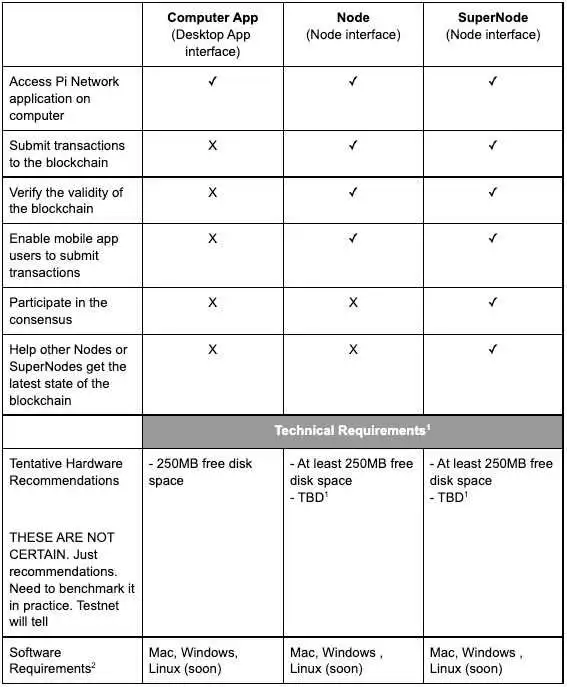

The Pi Network has prioritized its users, and anyone can install a desktop application to run a local node, unlike other networks like Bitcoin which require equipment worth tens of thousands of dollars to run.

However, this simplicity comes at a cost during the initial stage, where the node software relies on a centralized layer for “faster iterations of scenario stress testing and adaptations of the consensus algorithm to accommodate the needs of Pi Network and its global community.”

Additionally, ordinary nodes don’t participate in the consensus; they only submit transactions and verify the validity of the recorded transactions. Consensus is left to the SuperNodes.

Image Courtesy of Minepi.com.

Image Courtesy of Minepi.com.

The team says this allows the core team to quickly push protocol changes without the need for broader agreement by the validators.

As CNF has reported, the network expects its KYC validator rewards system to be released before the end of the first quarter.

Pi Browser 1.15 Launches

In a separate update, the network has revealed that version 1.5 of the Pi Browser has been released to a select group. The new update comes with system-level and technical updates that make it better suited to the upcoming upgrades.

The Browser remains one of the most important tools to Pi users, being the gateway to the network’s tools and services. These includes games, social media apps, DeFi protocols and marketplaces. It also comes with a built-in wallet interface. On top of everything, it’s still a browser that can be used for normal internet surfing.

On the price charts, PI has gained nearly 8% in the past day, trading at $0.147 at press time for a $1.32 billion market cap. Like many other tokens, the recent uptrend hasn’t been enough to erase the bearish movements of the past four weeks, where it has lost 30% of its value.

]]>추천 콘텐츠

Qatar pushes tokenization with launch of QCD money market fund

FedEx (FDX) Q1 2026 Earnings