MSTR Stock Plunges 17% as Strategy Reports $12.4B Bitcoin Loss in Q4 2025

Michael Saylor‘s Strategy Inc. posted a staggering $12.4 billion net loss for the fourth quarter of 2025, driven almost entirely by unrealized losses on its bitcoin treasury as crypto prices tumbled.

The company disclosed Wednesday that it now holds 713,502 bitcoins acquired at a total cost of $54.26 billion, representing an average purchase price of $76,052 per coin. Despite the paper losses, Strategy added 41,002 bitcoins in January 2026 alone, signaling no retreat from its core accumulation strategy.

The quarterly bloodbath on the income statement reflects Strategy’s adoption of fair value accounting in January 2025, which forces bitcoin’s price fluctuations to flow directly through financial results each period. This marks a dramatic shift from the previous cost-less-impairment model that only recognized downward moves.

Strategy’s stock (MSTR) mirrored the pain, plunging 17.12% to close at $106.99 on Wednesday before sliding further to $103.14 in after-hours trading—a combined drop of over 20% as investors digested both the quarterly loss and continued bitcoin weakness. Analysts have started slashing price targets amid the double whammy of accounting losses and persistent market volatility.

Strategy’s stock (MSTR) plunged 17.12% to $106.99 | Source: Yahoo Finance

Saylor, the company’s Executive Chairman, maintained his long-term conviction stating: “Strategy has built a digital fortress anchored by 713,502 bitcoins and our shift to Digital Credit, which aligns with our indefinite bitcoin horizon.” The holdings carried a market value of $59.75 billion as of February 1st based on a bitcoin price of $83,740—a valuation that looked increasingly disconnected from reality as prices cratered below $63,000 just days later.

STRC Preferred Stock Scales to $3.4 Billion with 11.25% Yield

Strategy expanded its flagship Digital Credit instrument throughout the quarter despite the market turbulence. The STRC (Stretch) preferred stock, which features a variable dividend rate, grew to an aggregate stated amount of $3.4 billion. The current annualized dividend sits at 11.25%, adjusted monthly through a formula designed to anchor the trading price near its $100 par value.

Since launching the instrument, Strategy has paid out $413 million in cumulative distributions to STRC shareholders, representing a blended annual yield of 9.6%. All 2025 distributions qualified as non-taxable return of capital for U.S. tax purposes, a benefit Strategy expects to continue for the foreseeable future—potentially ten years or more—given the company projects zero accumulated earnings for tax calculations.

Throughout 2025, Strategy completed five initial public offerings across different classes of preferred stock, pulling in $5.5 billion in gross proceeds. The company also built what it calls a “USD Reserve” totaling $2.25 billion—enough to cover 2.5 years of dividend obligations and debt interest payments. Chief Financial Officer Andrew Kang emphasized that “Strategy’s capital structure is stronger and more resilient today than ever before,” pointing to how the cash buffer reinforces creditworthiness even as mark-to-market losses pile up.

Bitcoin Plummets Below $63,000 as $2.11 Billion in Leveraged Positions Evaporate

Wednesday’s trading session turned into a bloodbath for crypto markets, compounding Strategy’s problems. Bitcoin BTC $63 614 24h volatility: 13.0% Market cap: $1.27 T Vol. 24h: $139.78 B tumbled from near $73,3400 to an intraday low of $62,345—the weakest level since November 2025. The hourly chart shows relentless selling that shattered every intermediate support level, with prices shedding over $25,000 from the three-month highs. The daily decline topped 12.80%, trapping countless investors in underwater positions and triggering cascading liquidations across derivatives markets.

Bitcoin crash from $73,3400 to $62,345 | Source: TradingView

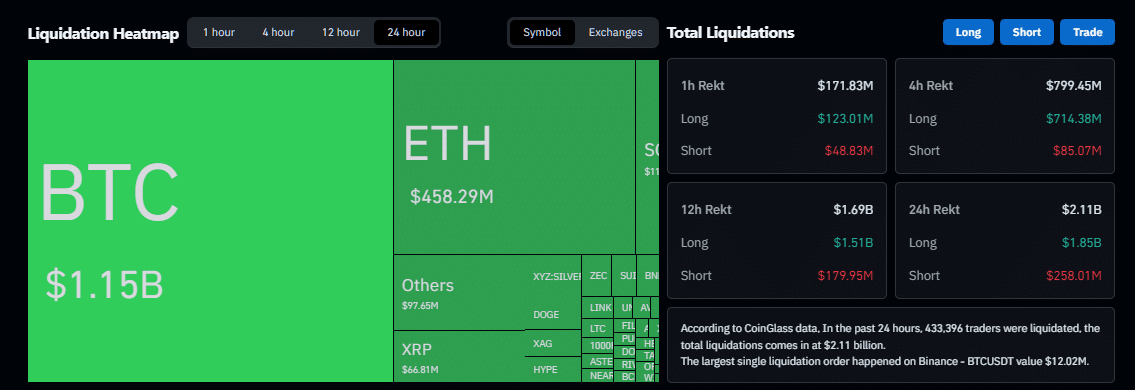

According to CoinGlass data, 433,413 traders got liquidated across all cryptocurrencies over the past 24 hours, wiping out $2.11 billion worth of positions. Bitcoin alone accounted for $1.15 billion in forced liquidations as of this writing,

Liquidation heatmap and total liquidations as of February 5, 2026 | Source: CoinGlass

The post MSTR Stock Plunges 17% as Strategy Reports $12.4B Bitcoin Loss in Q4 2025 appeared first on Coinspeaker.

추천 콘텐츠

$683M to Nscale for 60,000 GPUs by 2026

Gold continues to hit new highs. How to invest in gold in the crypto market?