This Week’s Biggest Altcoin Gainers Revealed as BTC Calms at $115K: Weekend Watch

Bitcoin’s price actions have calmed over the weekend as the asset has stalled around the $115,000 mark following the massive volatility experienced on Friday.

Most altcoins are also sluggish on a daily scale, which is why we will focus on their weekly performances, and OKB stands in a league of its own.

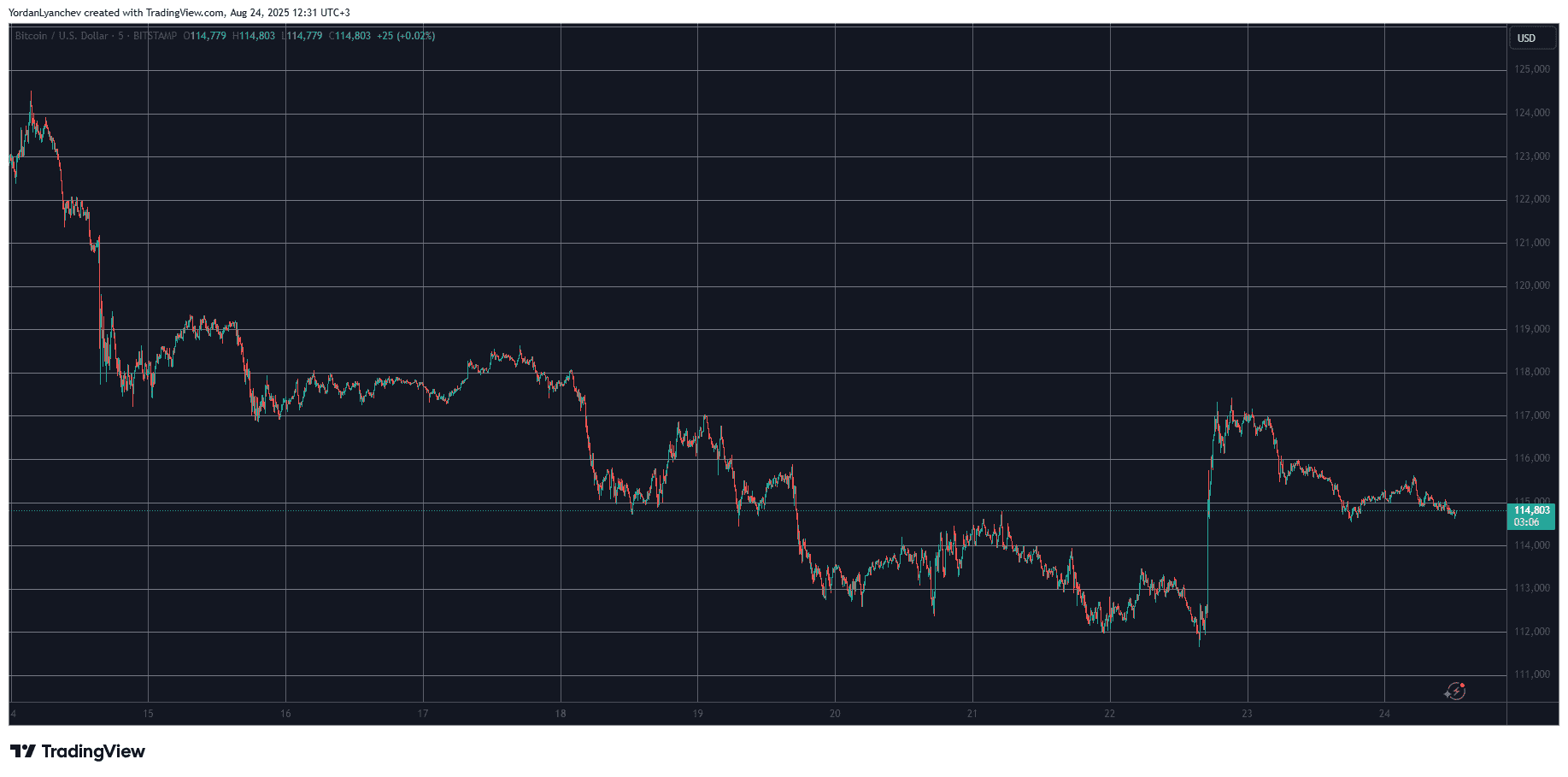

BTC Stalls at $115K

The business week didn’t go all that well for the primary cryptocurrency as its price started to lose traction from Monday. It first dipped to $115,000, and after an unsuccessful bounce, it quickly resumed its downfall with a nosedive to $113,000 by Wednesday and Thursday.

Friday was expected to be an even more volatile trading day and didn’t disappoint. At first, bitcoin dug a new local low, dropping below $112,000 for the first time since early July. However, as Jerome Powell took the stage to address the nation about the Fed’s upcoming monetary policy changes, the cryptocurrency began to recover lost ground rapidly.

Within an hour, the asset skyrocketed to over $117,000 as Powell hinted about potential rate cuts coming as soon as September.

Nevertheless, BTC’s momentum has cooled off since then, and the asset is just under $115,000 as of press time, which is essentially the same as yesterday. Its market cap has slipped below $2.290 trillion, while its dominance over the alts has taken another hit and is down to 56.3%.

BTCUSD. Source: TradingView

BTCUSD. Source: TradingView

Alts Going Wild

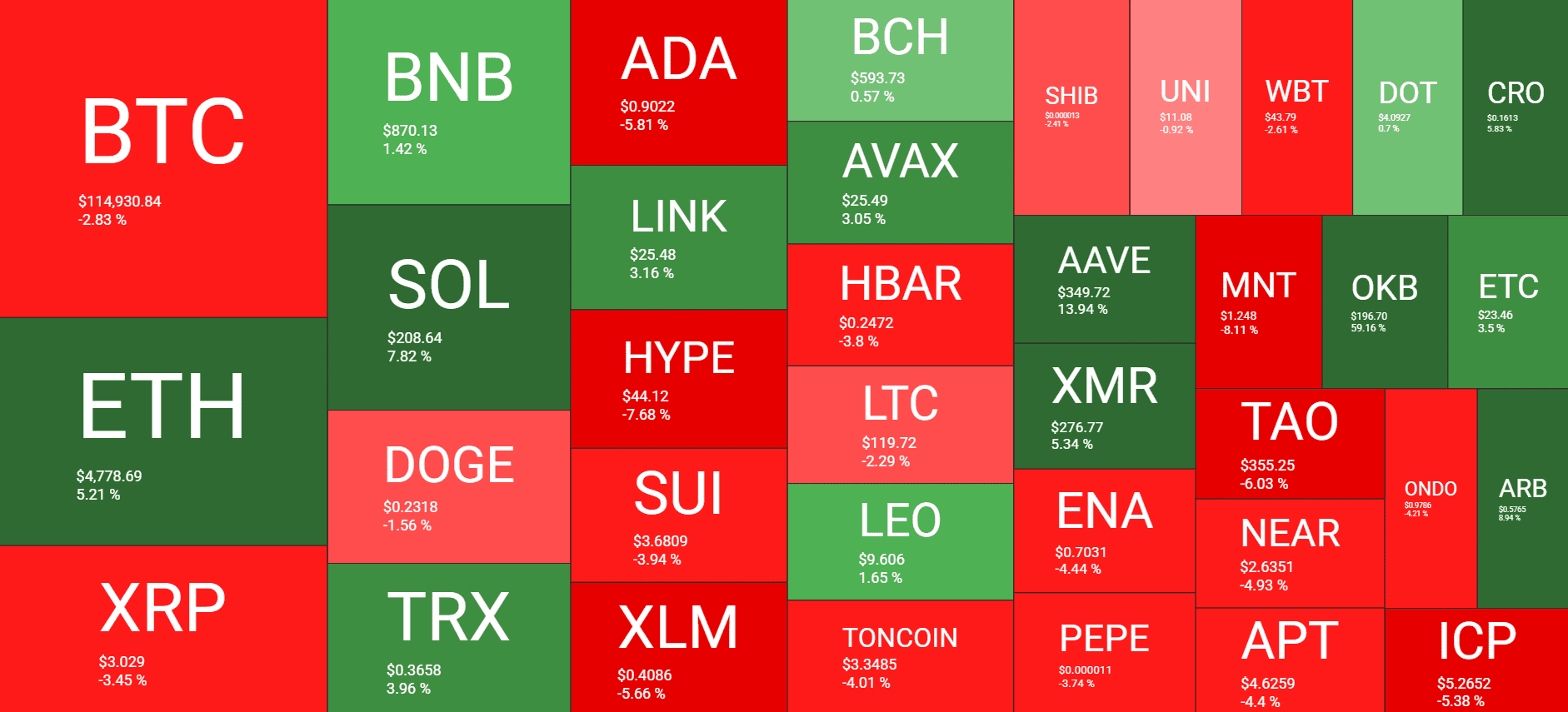

Following Powell’s speech on Friday, many altcoins produced even more impressive gains than BTC. This included ETH, which rocketed to just under $4,900 to set a new all-time high. Although it has retraced slightly since then, it’s still 5% up weekly. SOL has performed even better, gaining nearly 8% since this time last Sunday.

XMR, TRX, LINK, and AVAX have jumped by around 3-5%, while AAVE has soared by 14% weekly to $350. OKB has stolen the show as a 60% pump has driven it to almost $200 as of now.

In contrast, XRP, DOGE, HYPE, ADA, SUI, and XLM have declined by up to 7.5% in the case of Hyperliquid’s native token.

The total crypto market cap has lost over $40 billion since yesterday and is down to $4.060 trillion on CG.

Cryptocurrency Market Overview. Source: QuantifyCrypto

Cryptocurrency Market Overview. Source: QuantifyCrypto

The post This Week’s Biggest Altcoin Gainers Revealed as BTC Calms at $115K: Weekend Watch appeared first on CryptoPotato.

Vous aimerez peut-être aussi

White House adviser: Cryptocurrency bill is "very close" to passage

Contradictory Claims Surround Altcoin Said to Earn $2.79 Billion – Founder Confirms, but Problems Appear to Exist