The crypto market suffered setbacks across the board, with the Meme sector leading the decline of more than 8%, and ETH falling below $4,500 at one point.

PANews reported on August 15th that according to SoSoValue data, the crypto market suffered across the board over the past 24 hours, with declines ranging from 2% to 9% due to the significantly higher-than-expected July PPI in the United States, diminished expectations for a significant interest rate cut in September, and cooling market sentiment. The meme sector saw an 8.62% drop over the past 24 hours, while within the sector, Pepe (PEPE), SPX6900 (SPX), and Fartcoin (FARTCOIN) fell 10.43%, 10.97%, and 13.52%, respectively. Furthermore, Ethereum (ETH) fell 2.43%, briefly falling below $4,500 before recovering to above $4,600. Bitcoin (BTC) fell 3.85%, falling below $119,000.

In other sectors, the CeFi sector fell 1.18% in 24 hours. Within the sector, LEO Token (LEO) was relatively strong, rising 1.57%; the Layer1 sector fell 3.25%, of which Algorand (ALGO) fell 9.86%; the PayFi sector fell 6.57%, and Velo (VELO) fell 10.55%; the DeFi sector fell 6.65%, but Saros (SAROS) and AERO (Aerodrome Finance) rose 2.19% and 2.28% respectively; the Layer2 sector fell 6.73%, and SKALE (SKL) rose 47.98% against the trend.

The crypto sector index, which reflects the historical market trends of the sector, shows that the ssiGameFi, ssiMeme, and ssiAI indices fell by 8.57%, 8.55%, and 8.35%, respectively.

Vous aimerez peut-être aussi

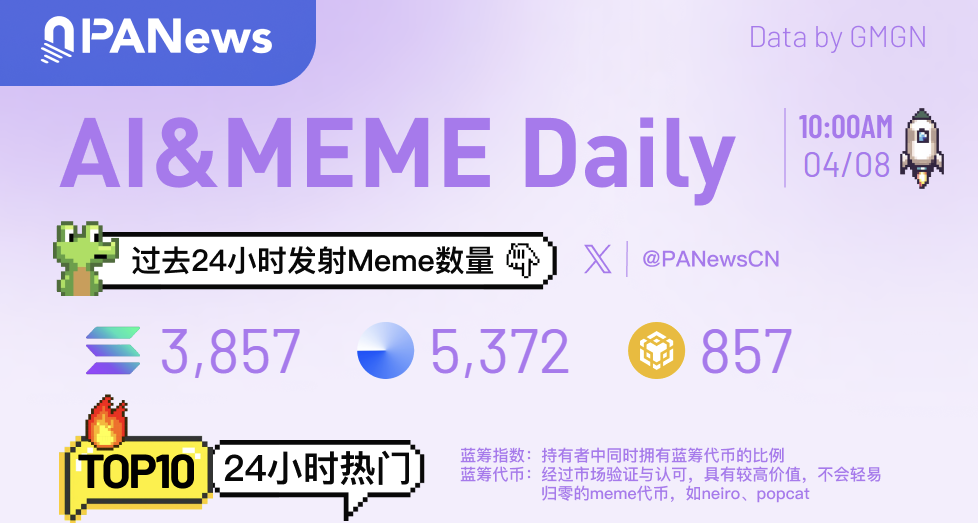

Ai&Meme Daily, a picture to understand the popular Ai&Memes in the past 24 hours (2025.4.8)

Bitcoin spot ETFs saw a net inflow of $231 million yesterday, marking the seventh consecutive day of net inflows.