KULR Expands Bitcoin Holdings to 1,021 BTC, Reports 291% BTC Yield

NYSE-listed firm KULR Technology Group, a sustainable energy management and a self-declared “Bitcoin First” company, has expanded its digital asset treasury with a fresh multimillion-dollar Bitcoin acquisition.

In a press release shared with CryptoNews, the firm said with additional bitcoin purchases totaling approximately $10 million, KULR now holds 1,021 BTC, valued at about $101 million.

The latest acquisitions were made at a weighted average price of $108,884 per bitcoin, including fees and expenses. This move is in line with the company’s Bitcoin Treasury Strategy, first announced on December 4, 2024, under which up to 90% of its surplus cash reserves are allocated to bitcoin.

KULR joins a growing list of companies that have added Bitcoin to their balance sheets as a treasury strategy. This includes MicroStrategy, a business intelligence firm and one of the largest corporate holders of Bitcoin.

BTC Yield Emerges as Key Performance Indicator

A core component of KULR’s strategy is its proprietary metric: BTC Yield. This figure, which reached 291.2% year to date, measures the percentage increase in the ratio of bitcoin holdings to Assumed Fully Diluted Shares Outstanding.

According to the firm it intends to reflect the effectiveness of the company’s bitcoin acquisition tactics. Complementary metrics include BTC Gain (633 BTC), BTC Dollar Gain ($70.3 million), and a multiple of Net Asset Value (mNAV) currently at 2.24.

KULR notes these metrics are designed to capture the value-accretive nature of its treasury operations, rather than serve as traditional financial indicators.

Cautions on Interpreting BTC Metrics

While BTC Yield offers insight into KULR’s Bitcoin-centric strategy, the company cautions that it should not be considered a proxy for earnings performance or liquidity. It excludes liabilities and does not reflect overall financial health.

KULR said that its stock price is influenced by a broader set of variables beyond bitcoin holdings. Investors are advised to use BTC Yield as a supplemental tool and refer to the company’s full financial statements and SEC filings for a comprehensive view of its position, says the firm.

KULR Price Action – Modest Gain

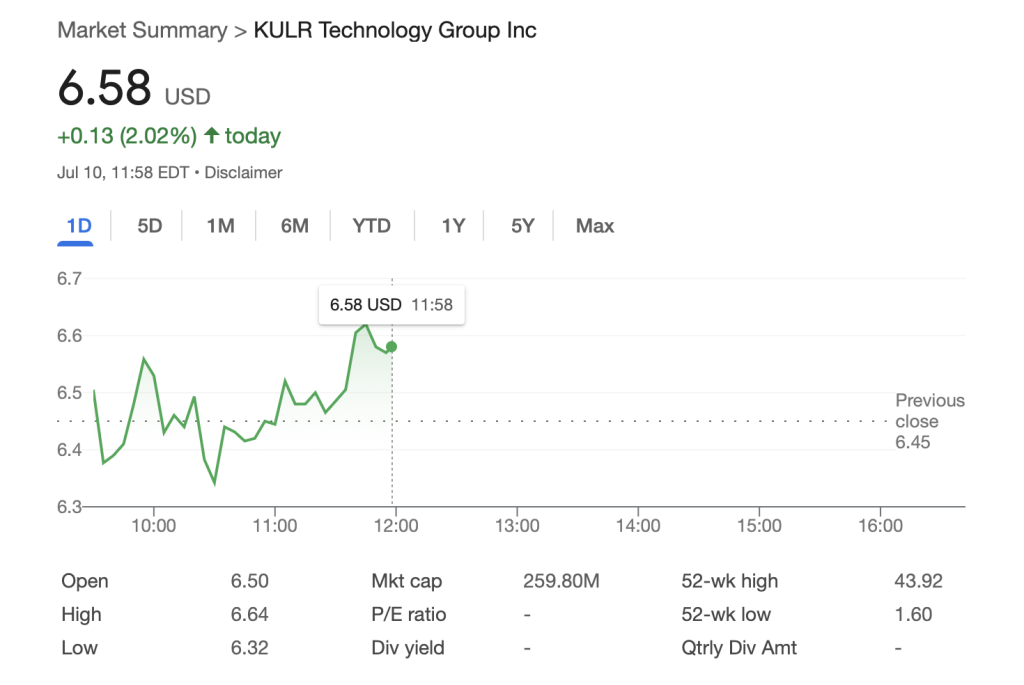

KULR Technology is trading at $6.58 today, up 2%, reflecting modest intraday gains.

KULR continues to show investor confidence, supported by its Bitcoin-driven narrative and endorsements by analysts. That said, it remains a volatile, technically uncertain stock.

KULR Boosts Mining Capacity with New Deployment in Paraguay

This month KULR said it has also deployed 3,570 Bitmain S19 XP 140T Bitcoin mining machines in Asuncion, Paraguay, raising its total mining capacity to 750 PH/s across multiple sites.

This expansion highlights KULR’s dual approach—mining Bitcoin and purchasing it on the open market—allowing the company to flexibly and efficiently grow its BTC treasury.

You May Also Like

VeChain connects to 40 blockchains with WanChain bridge

US lawmakers to discuss crypto tax policy amid push to pass three bills