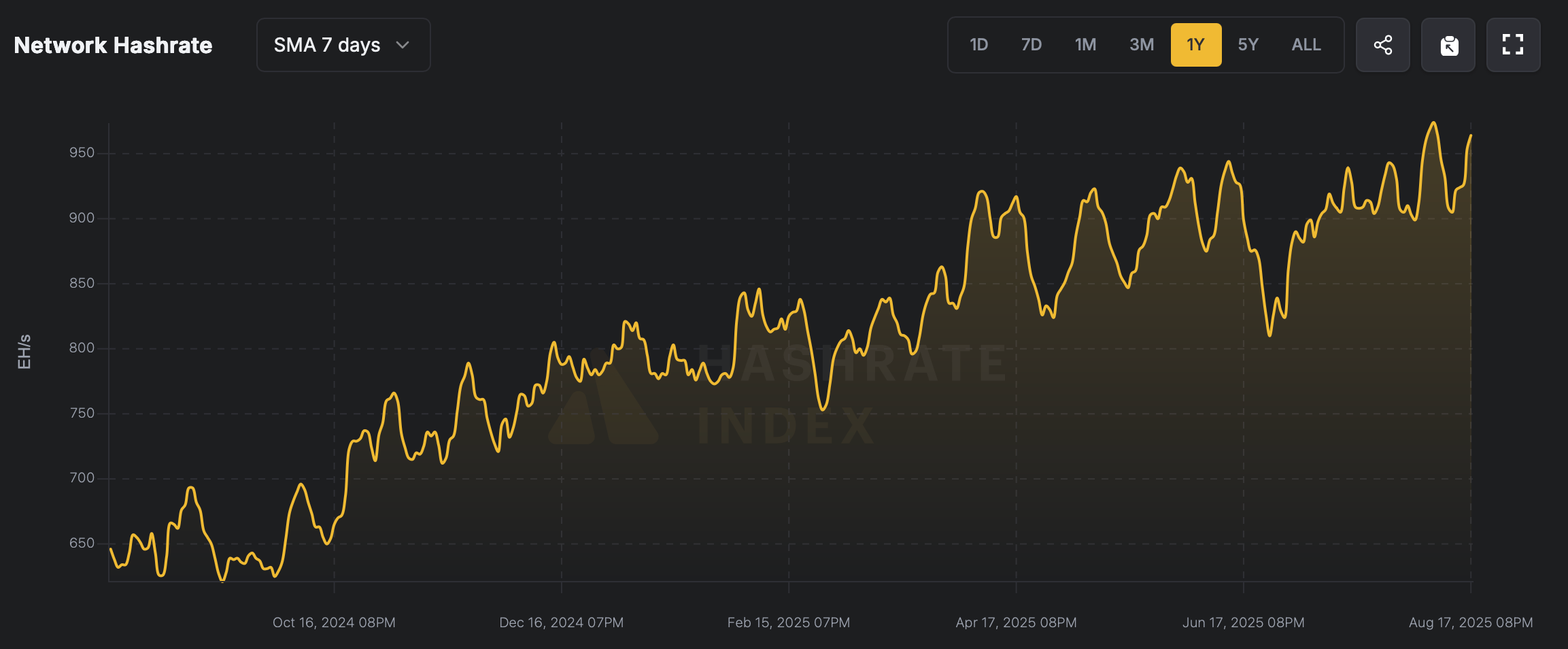

Hashrate Rebounds to 966 EH/s, Edging Within Striking Distance of a New Peak

As bitcoin holds around $116,000 mark, the network’s hashrate is steadily pushing its way back toward record-breaking territory.

Despite Revenue Loss, Bitcoin Miners Push Network Strength Back to Record-Breaking Levels

After climbing to 976 exahash per second (EH/s), the network’s computing power slid back below the 900 EH/s threshold just four days later. As of Monday, Aug. 18, 2025, the global hashrate has rebounded once more, reaching 966.08 EH/s.

Hashrate network data source: hashrateindex.com

Hashrate network data source: hashrateindex.com

This rebound comes even as falling prices have dragged down mining revenue, with hashprice slipping 7% over the past five days. On Aug. 13, the hashprice—the estimated value of one petahash per second (PH/s) of mining power per day—was $60.61.

Today, it sits at $56.37 per PH/s. Bitcoin’s price isn’t the only factor weighing on miners—transaction fees now make up less than 1% of block rewards, sitting at just 0.54% of block rewards over the last day. Moreover, the climbing hashrate has stretched block intervals, with the average time now hovering close to ten minutes.

This places the upcoming difficulty adjustment at an estimated 0.13%, though that figure could easily shift by the time the retarget date arrives on Aug. 22. With the hashrate sitting at 966 exahash per second (EH/s), the network is just 10 EH/s shy of setting a new record.

While bitcoin’s price and mining revenue have been shifting, the efficiency of the latest application-specific integrated circuit (ASIC) rigs continues to stand out.

Vous aimerez peut-être aussi

U.S. stocks closed: the three major stock indexes rose and fell, and Circle rose 34%

Bitcoin Miner TeraWulf Announces $400M Private Notes – Data Center Push, $60M Upsize Option