From $2,265 to $47 Million: 2012 Bitcoin Stash Jumps Back Into Action

This weekend, with bitcoin trading 4.2% higher than last week, a quartet of long-forgotten wallets from June and July 2012 sprang to life, shifting 400 BTC valued at $47.45 million — their first move in more than 13 years.

Vintage Bitcoin Revival: 400 Coins From 2012 Reemerge

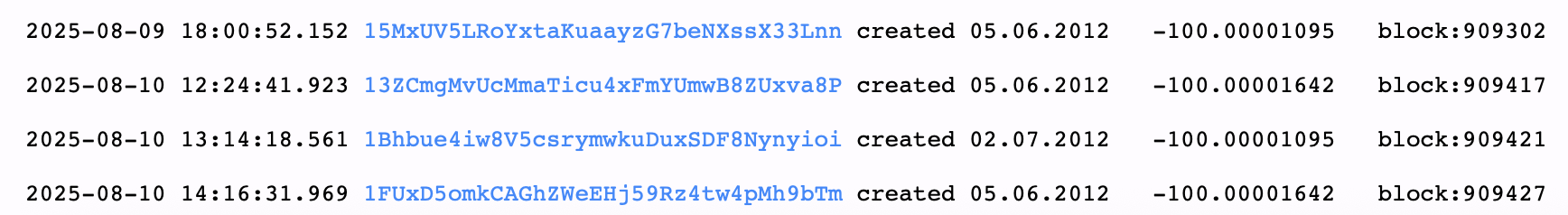

Although August hasn’t yet matched July’s streak of activity, a steady stream of dormant wallets has been stirring. Just three days ago, Bitcoin.com News reported on the movement of 3,000 BTC from 30 separate 2015 wallets — each sending coins for the first time since their creation. This weekend, btcparser.com data shows that, between blocks 909302 and 909427, four Pay-to-Public-Key-Hash (P2PKH) wallets from 2012 released 400 BTC back into circulation.

Each wallet moved exactly 100 BTC to its own unique Pay-to-Witness-Public-Key-Hash (P2WPKH) address, where the coins remain as of press time. In simple terms, P2PKH wallets 1, 2, 3, and 4 handed their bitcoin over to newer P2WPKH addresses 1, 2, 3, and 4. The bitcoin cash ( BCH) tied to the BTC moved this weekend still sits untouched, valued at over $229,000 in the original wallets 1, 2, 3, and 4.

Three of the wallets were created on June 5, 2012, while the fourth appeared on July 2, 2012. Back then, the 300 BTC from June 5 was worth about $1,602, and the 100 BTC from July 2 was valued at roughly $663 — putting the original stash at just $2,265 for the whole lot. If sold today, the 400 coins would deliver the owner an eye-watering 20,949,877% gain.

Wallets from 2010 through 2012 are a rare sight in motion, but with prices at all-time highs, a steady flow of long-dormant BTC has been migrating into fresh addresses and active circulation. As noted in previous sleeping bitcoin reports, many of these awakenings appear to be simple transfers into newer address formats or for consolidation, rather than outright sales.

Vous aimerez peut-être aussi

BTCS Inc., a listed company, spent $8.23 million to increase its holdings by 2,731 ETH

Indian court declines bail for suspect in $228m crypto fraud