ETF Recap: Bitcoin and Ether Funds Rebound With Big Weekly Gains

Bitcoin exchange-traded funds (ETFs) snapped early-week losses to close with a $247 million net inflow, while ether ETFs notched $327 million in gains, with both markets seeing strong institutional participation.

Bitcoin and Ether Post $247 Million and $327 Million Weekly Gains

What began as a bruising start to the week for crypto ETFs turned into a roaring comeback. Investors piled back into both bitcoin and ether funds on Thursday and Friday, erasing earlier outflows and ending the week deep in the green.

Bitcoin ETFs racked up a total $246.75 million in inflow for the week. Blackrock’s IBIT led with $188.92 million, while Bitwise’s BITB added $62.26 million. Grayscale’s Bitcoin Mini Trust brought in $30.58 million, while Vaneck’s HODL added $25.57 million.

Smaller boosts came from Grayscale’s GBTC ($3.40 million) and Franklin’s EZBC ($3.38 million). Fidelity’s FBTC (-$55.18 million), Valkyrie’s BRRR (-$6.44 million), and Ark 21Shares’ ARKB (-$5.76 million) were the only notable laggards.

Source: Sosovalue

Source: Sosovalue

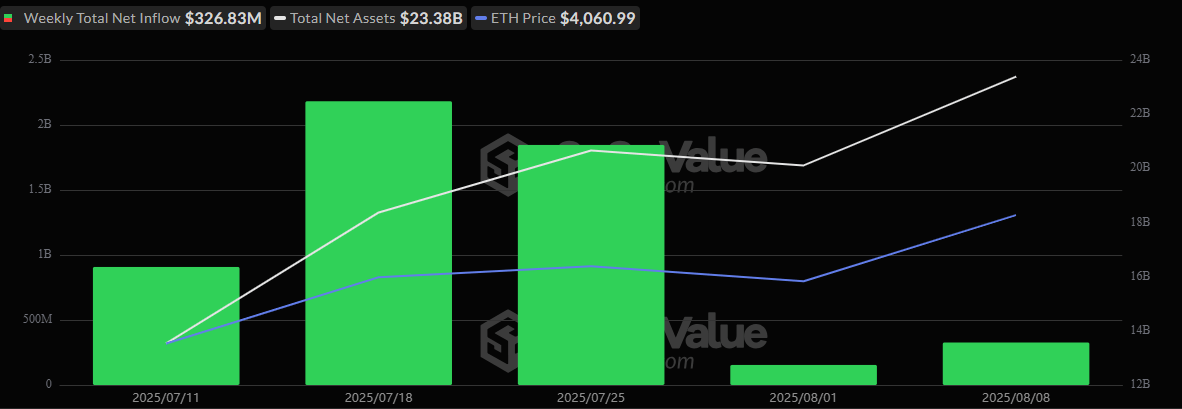

Ether ETFs closed with a $326.83 million net inflow, powered by Blackrock’s ETHA ($105.44 million) and Fidelity’s FETH ($109.05 million). Grayscale’s ETHE (+$28.86 million) and Ether Mini Trust (+$22.74 million) joined the rally.

Bitwise’s ETHW (+$32.63 million) and Vaneck’s ETHV (+$12.27 million) added more fire to the inflows while additional contributions of $5.84 million, $5.08 million, and $3.94 million were seen on Franklin’s EZET, Invesco’s QETH, and 21Shares’ CETH.

Trading volumes remained strong with $3 – $4 billion daily for BTC ETFs and $1 – $2 billion for ETH ETFs, signaling sustained investor appetite. With sentiment shifting sharply midweek, the rebound suggests institutional confidence is alive and well.

Vous aimerez peut-être aussi

The Rise of DATs: From Bitcoin Holding to Yield Management

Elon Musk accuses Apple of antitrust violations, xAI plans legal action