Chainlink’s LINK Hoard Blasts Past 100,000

After Chainlink’s decentralized oracle network revealed plans to create a LINK reserve, the team has now disclosed that the Chainlink Reserve added another 44,109.76 LINK, pushing its total stash past the 100,000 threshold.

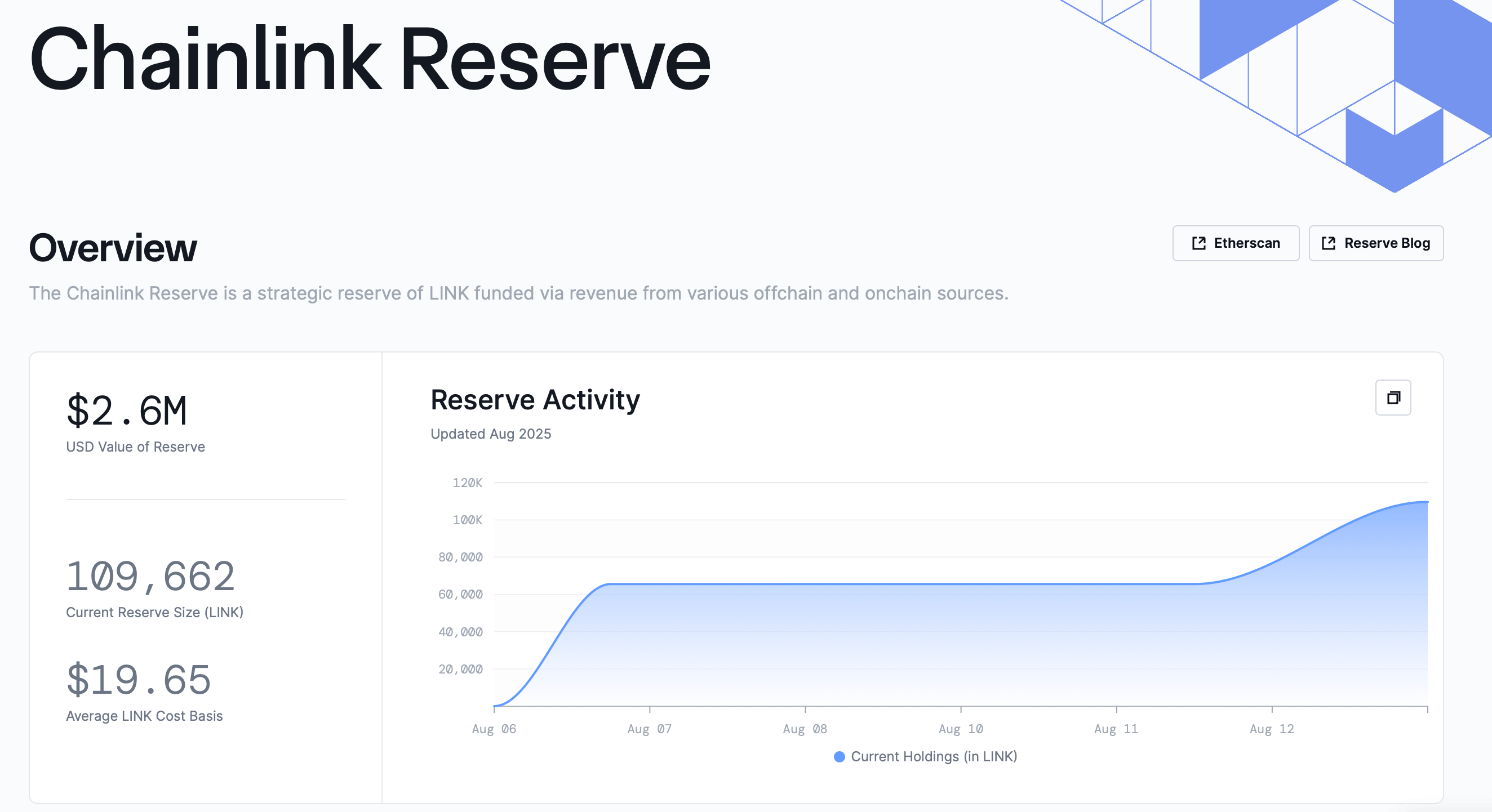

Chainlink’s Reserve Vault Hits 109K Tokens Worth $12.6M

Last week, Chainlink unveiled plans for a LINK reserve, funded by network revenue and aimed at fueling long-term expansion. The project Chainlink serves as a decentralized oracle network, built to connect blockchain smart contracts with real-world data in a secure and reliable way.

LINK, the network’s native token, powers this ecosystem. It compensates node operators for delivering data, executing computations, and safeguarding the network through staking—locking tokens as collateral to promote honest behavior. Operators who provide faulty information risk losing their staked LINK.

On Thursday, the team announced it had topped up its holdings with an additional batch of LINK. “Today, the Chainlink Reserve has accumulated 44,109.76 LINK,” Chainlink wrote on X. “As of August 14th, the Chainlink Reserve holds a total of 109,661.68364319 LINK.”

The project added:

Chainlink now joins the expanding roster of blockchain projects, digital asset firms, and publicly traded companies adding alternative assets—beyond bitcoin—to their treasury reserves. While bitcoin holdings have swelled throughout 2025, a number of organizations have been loading up on DOGE, XRP, SOL, WLFI, TRUMP, ETH, and other tokens to pad their balance sheets.

For instance, entities amassing strategic ETH reserves collectively control 3.57 million ether, valued at $16.53 billion as of today. Meanwhile, the Chainlink Reserve—worth $12.6 million—is displayed on the project’s web portal at metrics.chain.link/reserve.

Vous aimerez peut-être aussi

Coinbase user data was stolen and blackmailed for $20 million. Social attacks have become the norm

BounceBit launches high leverage contract platform BounceBit Trade