A quick look at Honcho, a personalized AI identity platform: How to enable LLM applications to enable hyper-personalized experience?

Original article by Daniel Barabander , General Counsel & Venture Partner at Variant

Compiled by: Zen, PANews

On April 11, Beijing time, AI startup Plastic Labs announced the completion of a $5.35 million Pre-Seed round of financing, led by Variant, White Star Capital and Betaworks, with participation from Mozilla Ventures, Seed Club Ventures, Greycroft and Differential Ventures, and angel investors including Scott Moore, NiMA Asghari and Thomas Howell. At the same time, its personalized AI identity platform "Honcho" has officially opened early access.

As the project is still in its early stages, the entire crypto community knows very little about Plastic Labs. While Plastic released the above financing and product dynamics through X, Daniel Barabander, general counsel and investment partner of its main investor Variant, also made an in-depth interpretation of the project and its Honcho platform. The following is the original content:

With the rise of large-scale language model (LLM) applications, the need for software personalization has never been greater. These applications rely on natural language, which changes depending on who you are talking to - just like the way you explain a math concept to your grandparents is different from the way you explain it to your parents or children. You instinctively adjust your expression based on the audience, and LLM applications must also "understand" who they are talking to in order to provide a more effective and relevant experience. Whether it is a therapeutic assistant, a legal assistant, or a shopping companion, these applications need to truly understand their users in order to be valuable.

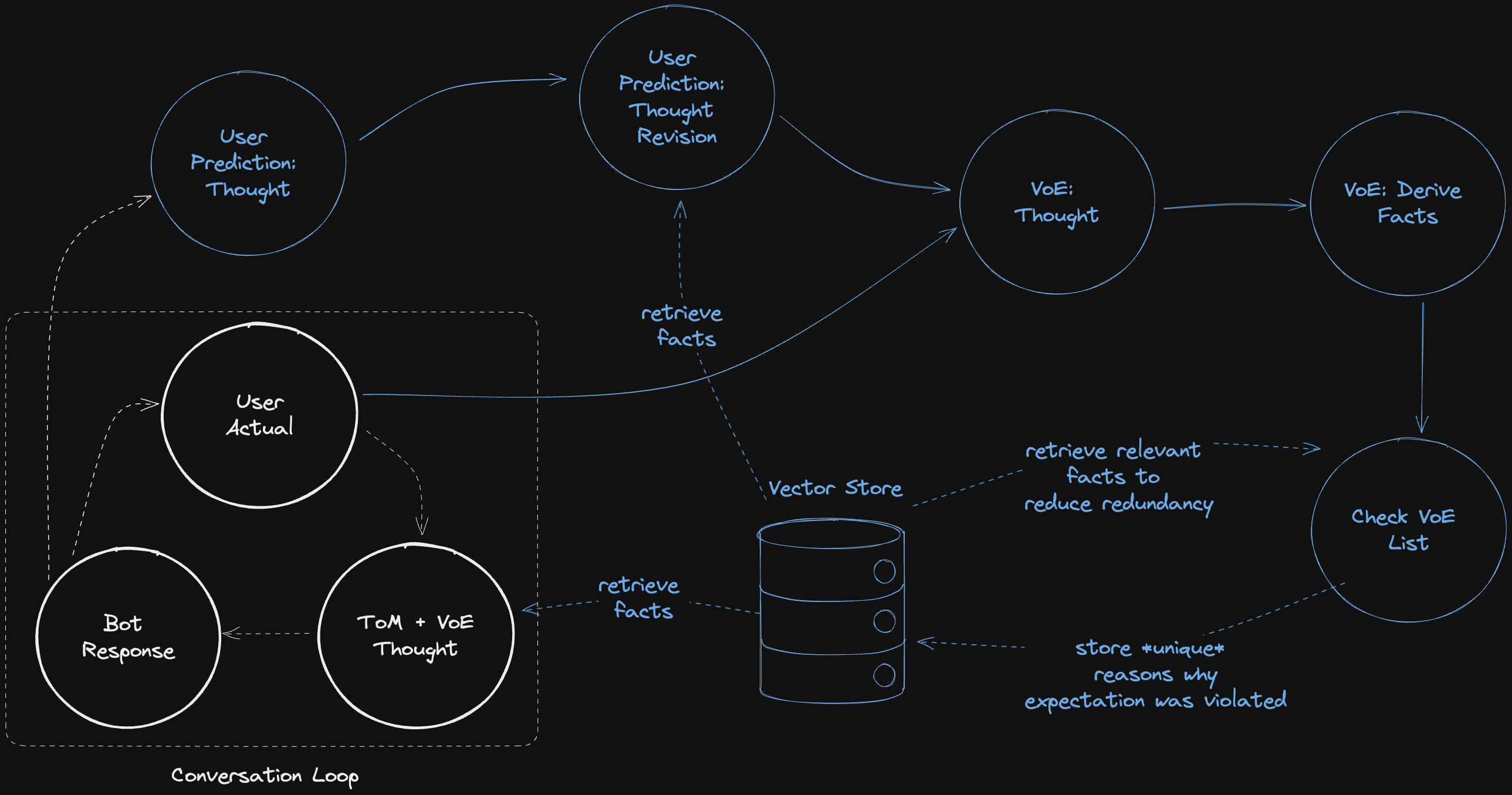

However, despite the importance of personalization, there are currently no off-the-shelf solutions available for LLM applications to call. Developers often have to build various fragmented systems to store user data (usually in the form of conversation logs) and retrieve it when needed. As a result, each team has to reinvent the wheel and build their own user state management infrastructure. Worse, methods such as storing user interactions in vector databases and performing retrieval enhancement (RAG) can only recall past conversations, but cannot truly grasp the deeper characteristics of the user's own interests, communication preferences, tone sensitivity, etc.

Plastic Labs brings Honcho, a plug-and-play platform that allows developers to easily personalize any LLM application. Developers no longer need to build user modeling from scratch. As long as they integrate Honcho, they can immediately get rich and persistent user portraits. These portraits are more detailed than traditional methods, thanks to the team's advanced technology borrowed from cognitive science; and they support natural language queries, allowing LLM to flexibly adjust its behavior based on user portraits.

By abstracting away the complexity of user state management, Honcho opens up a new level of hyper-personalized experience for LLM applications. But it is much more than that: the rich abstract user portraits generated by Honcho also pave the way for the long-elusive "shared user data layer".

Historically, shared user data layers have failed for two main reasons:

- Lack of interoperability : Traditional user data is often highly dependent on specific application scenarios and difficult to migrate across apps. For example, social platform X may be modeled based on the people you follow, but this data is of no help to your professional network on LinkedIn. Honcho captures higher-order and more general user traits that can seamlessly serve any LLM application. For example, if a tutoring app finds that you learn best by analogy, your therapy assistant can also use this insight to communicate with you more effectively, even though the two scenarios are completely different.

- Lack of immediate value : Previous sharing layers had difficulty attracting applications in the early stages because they did not bring substantial benefits to first movers, who are the key to generating valuable user data. Honcho is different: it first solves the "first-level problem" of user state management for a single application. When enough applications are connected, the network effect will naturally bring about the solution of the "second-level problem" - new applications are not only connected for personalization, but can also use existing shared user portraits from the beginning, completely eliminating the cold start pain point.

Currently, Honcho has hundreds of applications on the closed beta waiting list, covering a variety of scenarios such as addiction coaches, educational companions, reading assistants, and e-commerce tools. The team's strategy is to first focus on solving the core problem of user status management of applications, and then gradually launch a shared data layer for applications willing to participate. This layer will use cryptographic incentives: applications that access early will obtain ownership shares of this layer, thereby sharing its growth dividends; at the same time, the blockchain mechanism can also ensure that the system is decentralized and credible, eliminating the concerns of centralized institutions extracting value or developing competing products.

Variant believes that the Plastic Labs team has the skills to overcome the challenges of user modeling in LLM-driven software. When developing the personalized chat tutoring app Bloom, the team experienced first-hand the problem that the app could not truly understand students and their learning styles. Honcho was born out of this insight and is solving the pain points that every LLM app developer will face.

Vous aimerez peut-être aussi

Solo Bitcoin Miner Strikes Gold, Nets Nearly $350,000 from Single Block

FTX/Alameda redeemed $35.52 million of SOL an hour ago, possibly to pay compensation to creditors.