PANews reported on November 19th that, according to The Block, Senator Tim Scott, Chairman of the Senate Banking Committee, stated that the committee plans to vote on the Crypto Market Structure Act next month and hopes to submit the bill to the full Senate in early 2026 for President Trump to sign into law. The bill aims to clarify the regulatory boundaries between the SEC and CFTC and introduce the concept of "auxiliary assets" to define which crypto assets are not considered securities.PANews reported on November 19th that, according to The Block, Senator Tim Scott, Chairman of the Senate Banking Committee, stated that the committee plans to vote on the Crypto Market Structure Act next month and hopes to submit the bill to the full Senate in early 2026 for President Trump to sign into law. The bill aims to clarify the regulatory boundaries between the SEC and CFTC and introduce the concept of "auxiliary assets" to define which crypto assets are not considered securities.

The US Senate Banking Committee plans to vote on the crypto market architecture bill next month.

PANews reported on November 19th that, according to The Block, Senator Tim Scott, Chairman of the Senate Banking Committee, stated that the committee plans to vote on the Crypto Market Structure Act next month and hopes to submit the bill to the full Senate in early 2026 for President Trump to sign into law. The bill aims to clarify the regulatory boundaries between the SEC and CFTC and introduce the concept of "auxiliary assets" to define which crypto assets are not considered securities.

Aviso legal: Los artículos republicados en este sitio provienen de plataformas públicas y se ofrecen únicamente con fines informativos. No reflejan necesariamente la opinión de MEXC. Todos los derechos pertenecen a los autores originales. Si consideras que algún contenido infringe derechos de terceros, comunícate a la dirección service@support.mexc.com para solicitar su eliminación. MEXC no garantiza la exactitud, la integridad ni la actualidad del contenido y no se responsabiliza por acciones tomadas en función de la información proporcionada. El contenido no constituye asesoría financiera, legal ni profesional, ni debe interpretarse como recomendación o respaldo por parte de MEXC.

También te puede interesar

Web3 Infrastructure Upgrade: BNB Greenfield Boosts Data Monetization through Decentralized Storage

“If we see data as the petroleum of the digital era, then BNB Greenfield is the Saudi Aramco, providing a series of upstream services including exploration, production, refining and transportation, and downstream companies can further utilize its product for sales or reproduction.”

Compartir

PANews2023/02/10 12:00

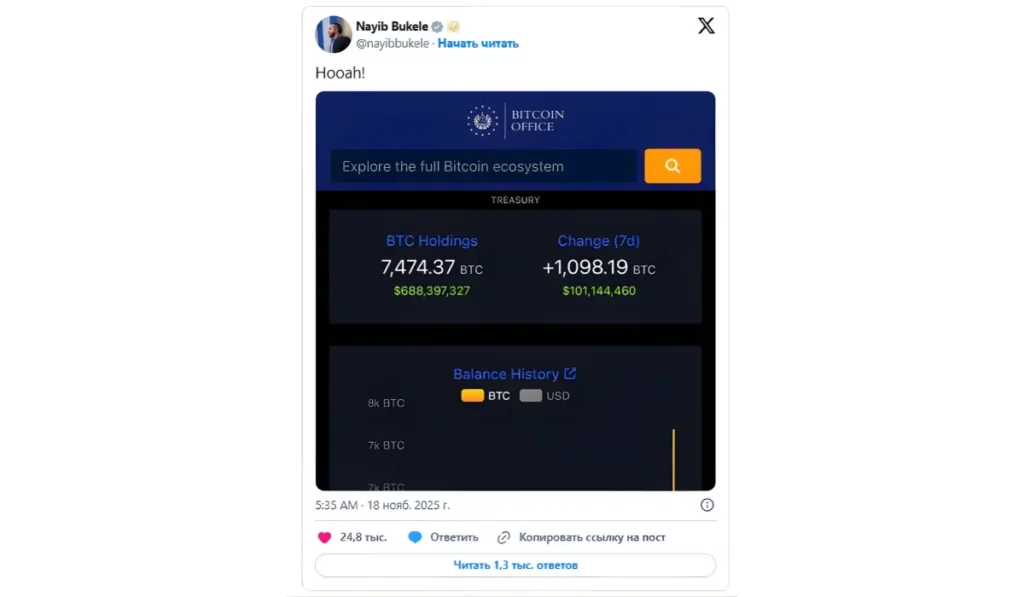

El Salvador “Buys The Dip”, Adds 1098 BTC To Growing National Bitcoin Treasury

Key Takeaways El Salvador is steadfast in maintaining its bitcoin accumulation strategy. Amid a decline that saw the apex crypto’s price drop below the $90,000 mark for the first time since April 2025, the Central American nation added 1098 BTC, worth nearly $100 million, to its coffers over the past week. On Tuesday, President Nayib... The post El Salvador “Buys The Dip”, Adds 1098 BTC To Growing National Bitcoin Treasury appeared first on BiteMyCoin.

Compartir

Bitemycoin2025/11/19 13:25

FedWatch Predicts Small Fed Rate Cut in December

The post FedWatch Predicts Small Fed Rate Cut in December appeared on BitcoinEthereumNews.com. Key Points: FedWatch data suggests possible Fed rate cut in December. Unchanged rates probability slightly higher at 51.1%. Market reactions include major crypto liquidations. BlockBeats News reports on CME’s “FedWatch” data indicating a 48.9% chance of a 25 basis point Fed rate cut in December, with 51.1% probability of rates staying unchanged. Crypto markets closely watch potential Fed moves, impacting asset volatility. $7.9 billion in liquidations reflect market reactions to macroeconomic signals. FedWatch Predicts Small Fed Rate Cut in December The CME’s FedWatch tool captures current market expectations regarding the U.S. Federal Reserve’s interest rate stance. As of mid-November, there is a nearly even split between expectations for a cut and for no change, hinting at market uncertainty. Such monetary policy speculations often precede notable shifts in financial markets, including cryptocurrencies. Leading digital assets like Bitcoin and Ethereum could witness significant price reactions depending on any Fed announcement. Market reactions remain cautious amid this uncertainty. The crypto community is focused on potential ripple effects across asset prices, highlighted by the recent major liquidation events tied to speculative positioning. Bitcoin and Ethereum: Coping with Potential Policy Shifts Did you know? In similar past cycles, crypto markets have experienced sharp volatility surges ahead of FOMC meetings, reflecting trader positioning in anticipation of outcomes. Bitcoin (BTC) currently trades at $91,457.44, with a market cap of $1.82 trillion and a dominance of 58.32%, according to CoinMarketCap as of November 19, 2025. Over the past 24 hours, BTC saw a trading volume of $86.42 billion, marking a decrease of 19.55%, with its price rising by 1.97%. However, a seven-day decline of 11.31% continues to reflect broader market nervousness. Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 04:48 UTC on November 19, 2025. Source: CoinMarketCap Analytical insights indicate the potential for financial market upheaval if the Federal…

Compartir

BitcoinEthereumNews2025/11/19 12:56