OCC confirms banks’ authority to hold crypto to pay digital-asset network fees

The Office of the Comptroller of the Currency (OCC) issued new policy guidance on Tuesday, confirming that banks can hold cryptocurrencies to pay fees on the blockchain network. The U.S. banking regulator also maintained that the network fees are incurred to facilitate permissible activities.

The OCC said in an interpretive letter that a national bank may hold digital assets as principal necessary for testing permissible crypto-asset-related platforms. According to the report, the initiative can either be internally developed or acquired from a third party.

OCC allows banks to use digital assets to test crypto-related platforms

Similar to blockchain networks, banks will also need to have specific tokens on their balance sheets to use as a fee for transactions. The Interpretive Letter No. 1186 detailed that activities allowed under the Guiding and Establishing National Innovation for U.S. Stablecoins Act will require banks to pay network fees as an agent for the customer or as part of their custody operations.

Adam Cohen, the OCC’s senior deputy comptroller, chief counsel, argued that the initiative enables a national bank to expand its pre-existing permissible activities. He also acknowledged that banks won’t have to depend on operational risks associated with acquiring digital assets from a third party.

The banking regulator took a more cautious approach to crypto during the Biden administration. The OCC required financial institutions to receive approval from the agency before engaging in most digital asset-related activities.

Under the Biden administration, other banking regulators, including the FDIC, have prevented financial institutions from participating in crypto-related activities. The agency cited crypto assets as too risky, including engagement with permissionless blockchain networks like Ethereum, and the public, on which activities can be censored by human administrators.

The recent pro-crypto Trump administration has caused a tidal shift in the crypto industry this year by dismantling such policies. The OCC reversed Biden’s previous policy in March, which required national banks to gain regulator approval before engaging in crypto activity. The agency, under Trump appointee Jonathan Gould, has also allowed financial institutions to custody digital assets for their customers and engage in stablecoin-related activities.

Other U.S. banking regulators, including the Federal Reserve and the Federal Deposit Insurance Corp., as well as the broader Treasury Department, revealed initiatives to write new regulations governing stablecoin issuers and activity. The new regulations will be based on the recently established GENIUS Act requirements; however, those rules haven’t yet been set in place for approval.

Crypto firms file for a national trust bank charter

Apart from national banks, the digital asset exchange platform Crypto.com applied to the OCC in late October for a national trust bank charter. The firm said the initiative aims to expand its federally supervised crypto-custody services for institutions.

The crypto firm stated that the filing is part of its regulated, security-first approach for large customers, including ETF sponsors, corporates, and advisers. The OCC regards a national trust bank as a limited-purpose national bank it supervises for trust company powers. Crypto.com co-founder and CEO Kris Marszalek acknowledged that building the product and service portfolio through regulated and secure offerings has been the firm’s focus since its launch.

According to OCC’s digital-assets licensing portal, Coinbase also filed in October to establish Coinbase National Trust Company, headquartered in New York. USDC issuer Circle also filed in late June to launch First National Digital Currenty Bank, N.A., to bring its stablecoin reserves oversight and institutional custody under an OCC charter.

Join a premium crypto trading community free for 30 days - normally $100/mo.

También te puede interesar

Web3 Infrastructure Upgrade: BNB Greenfield Boosts Data Monetization through Decentralized Storage

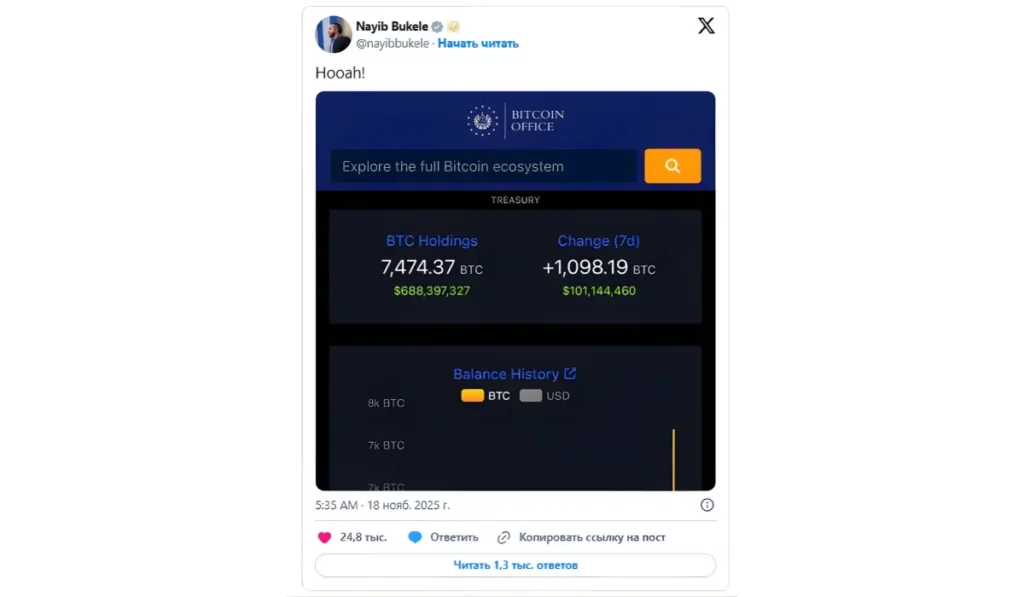

El Salvador “Buys The Dip”, Adds 1098 BTC To Growing National Bitcoin Treasury