Charles Schwab confirms plans to launch a spot Bitcoin ETF and enable direct crypto trading by mid-2026. The move follows a shift in regulatory sentiment after the launch of Litecoin and Solana ETFs. Bitcoin ETFs continue to face heavy outflows, with $558.44M outflows on Friday, as market uncertainty deepens. Charles Schwab will officially enter the spot Bitcoin ETF market, with CEO Rick Wurster confirming the launch during an investor call. The $13 trillion asset manager aims to rival BlackRock’s iShares Bitcoin Trust (IBIT) by integrating spot cryptocurrency trading directly into its brokerage platform by the first half of 2026. The rollout will offer Schwab clients in-platform access to Bitcoin (BTC) and Ethereum (ETH), eliminating the need for cryptocurrency exchanges and the complexities of managing assets across crypto wallets. Schwab’s decision follo…Read The Full Article Charles Schwab Set to Launch Spot Bitcoin ETF and Crypto Trading by 2026 On Coin Edition. Charles Schwab confirms plans to launch a spot Bitcoin ETF and enable direct crypto trading by mid-2026. The move follows a shift in regulatory sentiment after the launch of Litecoin and Solana ETFs. Bitcoin ETFs continue to face heavy outflows, with $558.44M outflows on Friday, as market uncertainty deepens. Charles Schwab will officially enter the spot Bitcoin ETF market, with CEO Rick Wurster confirming the launch during an investor call. The $13 trillion asset manager aims to rival BlackRock’s iShares Bitcoin Trust (IBIT) by integrating spot cryptocurrency trading directly into its brokerage platform by the first half of 2026. The rollout will offer Schwab clients in-platform access to Bitcoin (BTC) and Ethereum (ETH), eliminating the need for cryptocurrency exchanges and the complexities of managing assets across crypto wallets. Schwab’s decision follo…Read The Full Article Charles Schwab Set to Launch Spot Bitcoin ETF and Crypto Trading by 2026 On Coin Edition.

Charles Schwab Set to Launch Spot Bitcoin ETF and Crypto Trading by 2026

- Charles Schwab confirms plans to launch a spot Bitcoin ETF and enable direct crypto trading by mid-2026.

- The move follows a shift in regulatory sentiment after the launch of Litecoin and Solana ETFs.

- Bitcoin ETFs continue to face heavy outflows, with $558.44M outflows on Friday, as market uncertainty deepens.

Charles Schwab will officially enter the spot Bitcoin ETF market, with CEO Rick Wurster confirming the launch during an investor call. The $13 trillion asset manager aims to rival BlackRock’s iShares Bitcoin Trust (IBIT) by integrating spot cryptocurrency trading directly into its brokerage platform by the first half of 2026.

The rollout will offer Schwab clients in-platform access to Bitcoin (BTC) and Ethereum (ETH), eliminating the need for cryptocurrency exchanges and the complexities of managing assets across crypto wallets.

Schwab’s decision follo…

Read The Full Article Charles Schwab Set to Launch Spot Bitcoin ETF and Crypto Trading by 2026 On Coin Edition.

Aviso legal: Los artículos republicados en este sitio provienen de plataformas públicas y se ofrecen únicamente con fines informativos. No reflejan necesariamente la opinión de MEXC. Todos los derechos pertenecen a los autores originales. Si consideras que algún contenido infringe derechos de terceros, comunícate a la dirección service@support.mexc.com para solicitar su eliminación. MEXC no garantiza la exactitud, la integridad ni la actualidad del contenido y no se responsabiliza por acciones tomadas en función de la información proporcionada. El contenido no constituye asesoría financiera, legal ni profesional, ni debe interpretarse como recomendación o respaldo por parte de MEXC.

También te puede interesar

Crypto News: JPMorgan IBIT Exposure Up 64% as Ethereum Allocation Shrinks

JPMorgan increases Bitcoin ETF exposure by 64%, holding 5.28M shares, while its Ethereum allocation drops to just 66 shares. JPMorgan Chase has sharply increased its exposure to Bitcoin through BlackRock’s Bitcoin ETF. Meanwhile, its Ethereum holdings have shrunk. The latest SEC filing shows a 64% rise in Bitcoin ETF shares. This change reflects a […] The post Crypto News: JPMorgan IBIT Exposure Up 64% as Ethereum Allocation Shrinks appeared first on Live Bitcoin News.

Compartir

LiveBitcoinNews2025/11/08 19:15

EUR/CHF slides as Euro struggles post-inflation data

The post EUR/CHF slides as Euro struggles post-inflation data appeared on BitcoinEthereumNews.com. EUR/CHF weakens for a second straight session as the euro struggles to recover post-Eurozone inflation data. Eurozone core inflation steady at 2.3%, headline CPI eases to 2.0% in August. SNB maintains a flexible policy outlook ahead of its September 25 decision, with no immediate need for easing. The Euro (EUR) trades under pressure against the Swiss Franc (CHF) on Wednesday, with EUR/CHF extending losses for the second straight session as the common currency struggles to gain traction following Eurozone inflation data. At the time of writing, the cross is trading around 0.9320 during the American session. The latest inflation data from Eurostat showed that Eurozone price growth remained broadly stable in August, reinforcing the European Central Bank’s (ECB) cautious stance on monetary policy. The Core Harmonized Index of Consumer Prices (HICP), which excludes volatile items such as food and energy, rose 2.3% YoY, in line with both forecasts and the previous month’s reading. On a monthly basis, core inflation increased by 0.3%, unchanged from July, highlighting persistent underlying price pressures in the bloc. Meanwhile, headline inflation eased to 2.0% YoY in August, down from 2.1% in July and slightly below expectations. On a monthly basis, prices rose just 0.1%, missing forecasts for a 0.2% increase and decelerating from July’s 0.2% rise. The inflation release follows last week’s ECB policy decision, where the central bank kept all three key interest rates unchanged and signaled that policy is likely at its terminal level. While officials acknowledged progress in bringing inflation down, they reiterated a cautious, data-dependent approach going forward, emphasizing the need to maintain restrictive conditions for an extended period to ensure price stability. On the Swiss side, disinflation appears to be deepening. The Producer and Import Price Index dropped 0.6% in August, marking a sharp 1.8% annual decline. Broader inflation remains…

Compartir

BitcoinEthereumNews2025/09/18 03:08

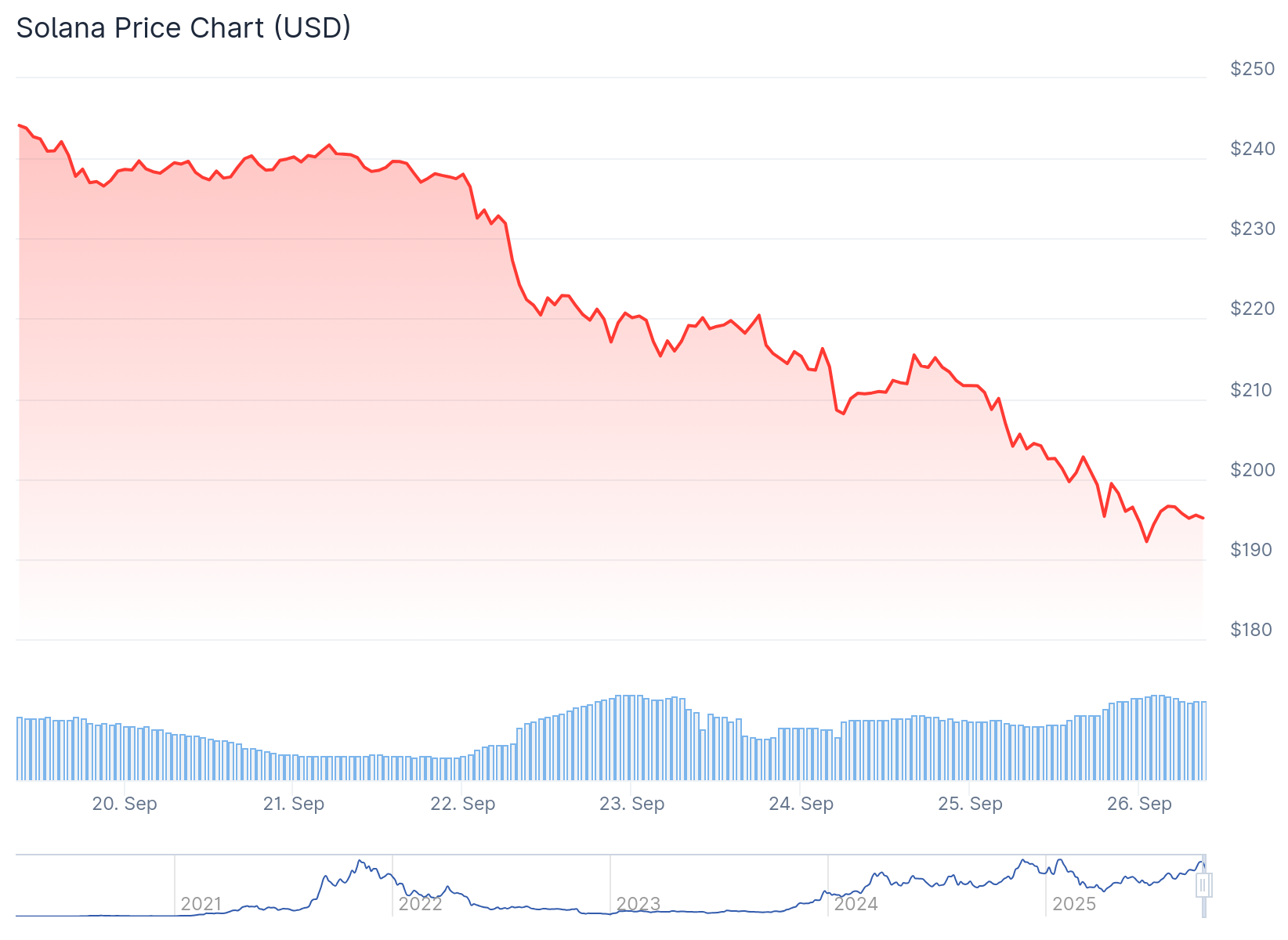

Solana (SOL) Price: Drops Below $200 Ahead of October ETF Decision Deadline

TLDR Solana (SOL) dropped to $192 on Thursday, falling below the $200 mark and erasing a recent rally to $253 Grayscale’s spot SOL ETF faces its first approval deadline on October 10, with five more applications pending through October 2025 Institutions hold less than 1% of SOL’s supply compared to 16% of Bitcoin and 7% [...] The post Solana (SOL) Price: Drops Below $200 Ahead of October ETF Decision Deadline appeared first on CoinCentral.

Compartir

Coincentral2025/09/26 15:47