Bitcoin mining hashrate hits record in October, profits lag

Bitcoin reached a record in computing power, but rising block difficulty continues to hurt miners’ profits.

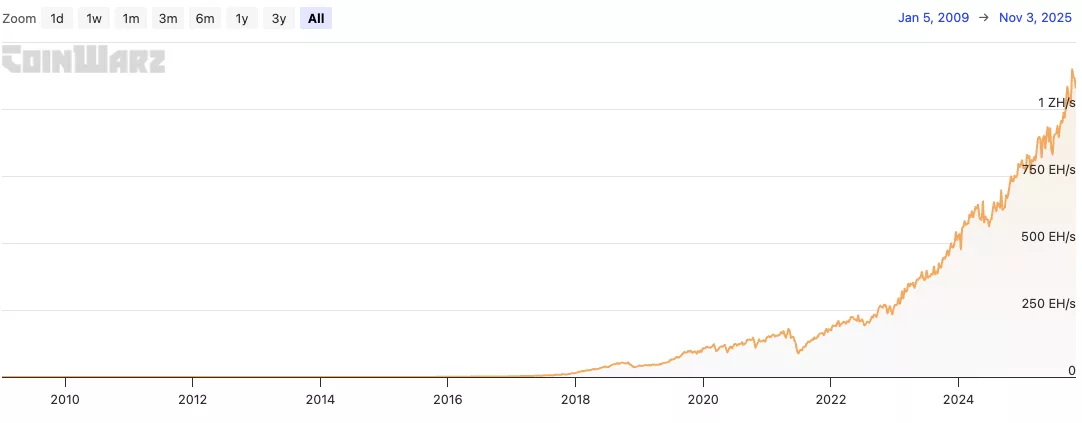

- Bitcoin mining hashrate reached a record 1.13 Zh/s in October.

- Geographically, this expansion was driven by Kazakhstan and the Middle East

- Still, mining profitability fell 7% due to increasing block difficulty

Bitcoin miners found themselves under pressure from all sides in October. The sector posted a record 1.13 Zh/s hashrate in October, which indicates increased participation in Bitcoin mining. Still, increased mining difficulty, rising energy prices, and record $19B in liquidations cut into miners’ profits.

Hashrate refers to the amount of computational power that participates in Bitcoin mining. This is crucial for decentralization and security, as a high hashrate makes attacks against the network more difficult. However, the metric does not automatically translate into more mining profits.

Notably, daily revenue per exahash per second (EH/s) dropped 7% compared to September, from $52,000 to $48,000. What is more, the declining Bitcoin price cut into miners’ rewards, with the hashprice falling nearly 12% month-to-date.

Bitcoin miners struggle to stay afloat

Falling Bitcoin prices also coincided with a rise in energy costs. The increase in oil and gas prices affected miners not tied to the electrical grid. In some regions, especially in Europe and the U.S., miners also had to deal with power curtailment. For this reason, the hashrate will likely fall in the near future.

También te puede interesar

Crypto Executives Advocate for U.S. Strategic Bitcoin Reserve Legislation

Shiba Inu (SHIB) Hype Is Fading Fast As MUTM at $0.035 Steps into the Limelight As The Best Crypto To Buy Now